:: ::  |

| Autor |

Poruka |

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

World markets struggle to come back

NEW YORK (CNNMoney) -- World markets attempted to come back Tuesday, a day after Wall Street's worst session in more than 2-1/2 years.

In afternoon trading, European markets were mixed, seesawing between gains and steep declines. Asian markets picked themselves off the mat, finishing off their lows of the day. U.S. stock futures -- for the time being -- signaled a higher open for Wall Street.

In Europe, Britain's FTSE 100 (FTSE100) was just above breakeven after being down more than 5% earlier. France's CAC 40 (CAC40) climbed 0.6%, having dropped as much as 4.6% earlier. Germany's DAX (DAX) lost 1.5% after an earlier descent of 7%. .

Tokyo's Nikkei (N225) index ended down 153 points, or 1.7%, to 8.944.48, after being off as much as 4.8% earlier in the session. It was the first time since mid-March that the Nikkei sank below 9,000.

In Hong Kong, the Hang Seng (HSI) finished more than 5% lower in a late sell-off. The index had come most of the way back from an earlier down 7% drubbing. Shanghai's composite index finished barely lower.

Australia's All Ordinaries index (ASX) ended nearly 1% higher after being down 5% earlier.

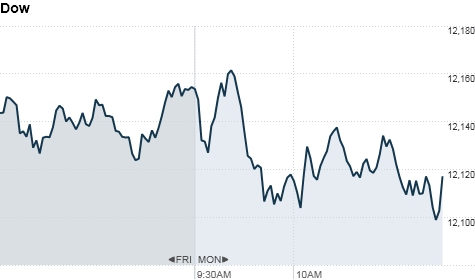

U.S. stock futures were slightly higher as a turbulent overnight period came closer to an end. The S&P 500 (SPX), Nasdaq Composite (COMP) and Dow Jones industrial average (INDU) futures were all up more than 2.5% earlier, but then promptly turned negative before rebounding. Futures indicate the possible direction of the market when it opens at 9:30 a.m. ET.

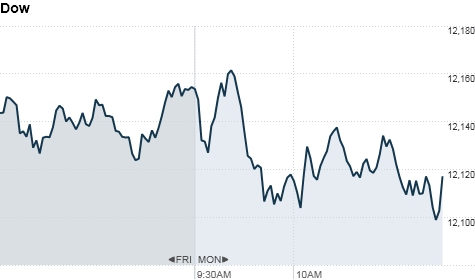

The moves followed a day in which the three major U.S. stock indexes sank between 5% and 7% each -- pushing the Dow (INDU) below 11,000 for the first time since last November. The drops followed Standard & Poor's Friday downgrade of the United States' credit rating.

The ripple effects of S&P's downgrade are only starting to be felt.

The credit agency downgraded mortgage giants Fannie Mae and Freddie Mac on Monday, as well as dozens of U.S. cities, insurance companies, and other entities with financial ties to the U.S.' credit rating. More downgrades are expected through the week.

By CNNMoney Staff

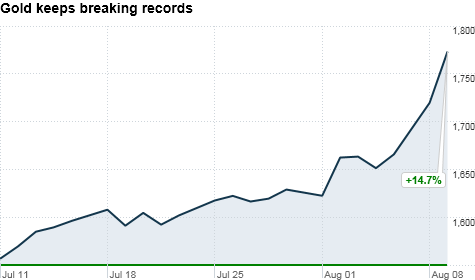

Investors flee to gold

NEW YORK (CNNMoney) -- Stock-shocked investors are fleeing to gold, pushing the precious metal to new heights.

Gold reached a new intraday high of $1,782.50 per ounce in electronic trading before backing down to $1,746.20. That's an increase of $33, or about 2%, compared to its Monday close. On Monday, gold broke $1,700 for the first time.

The current flight to gold has been by a nasty stock market plunge. On Monday, the Dow Jones industrial average plummeted 624 points, or about 5.5%, and the Nasdaq and S&P 500 dropped nearly 7%. It was the worst day on Wall Street since the 2008 fiscal crisis.

The rise in gold and the plunge in stocks are the result of Standard & Poor's downgrade of U.S. debt on Friday from AAA to AA+. This has undermined faith in the United States and the contagion has spread to markets around the globe.

"Against this backdrop, together with strong Asian gold demand and continued purchasing by central banks, gold continues to demonstrate its attributes as a hedge against credit risk, currency and inflation/deflation risk," wrote Marcus Grubb, managing director of investment at the World Gold Council, in an e-mail to CNNMoney.

Jono Remington-Hobbs, precious metals analyst for Fastmarkets Limited in London, said that gold has been on a 10-year boom. It has recently become more valuable as other safe havens, such as the Swiss franc and Japanese yen, lost their luster.

The key to gold, he said, is that it's a strong asset now, just like it was a strong asset 2,000 years ago.

"An ounce of gold would have bought you a great suit then; it would buy you a great suit now," said Remington-Hobbs.

While the economic malaise has been a boon for gold, which is up 15% over the last month, it has had the opposite effect on oil, whose price has plunged more than 16% over the last month.

S&P worst case scenario could happen

But oil rebounded Tuesday after tumbling below the $80-a-barrel mark, rising 26 cents to $81.57 a barrel. Just two weeks ago, oil was flirting with $100 per barrel.

Gold is also still far from its true peak, when adjusted for inflation. The metal hit its real record on Jan. 21, 1980, when it rose to $825.50 an ounce. Adjusted for inflation to 2011 dollars, that translates to an all-time record of $2,261.33 an ounce.

By Aaron Smith

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

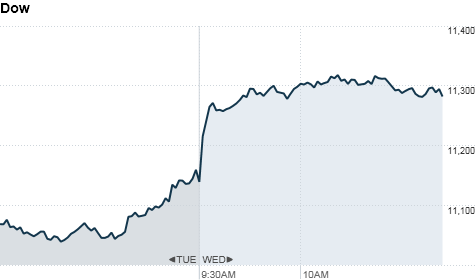

Stocks rebound from 3-day sell-off

NEW YORK (CNNMoney) -- Stocks rebounded Wednesday, as concerns over Europe's debt crisis eased and investors geared up for President Obama's highly-anticipated jobs speech later in the week.

The Dow Jones industrial average (INDU) rose 147 points, or 1.3%, the S&P 500 (SPX) added 19 points, or 1.6%, and the Nasdaq Composite (COMP) jumped 39 points, or 1.6%.

All three indexes had fallen more than 4% over the past three trading days amid fears about Europe's money troubles and a stalling economic recovery in the United States.

Wednesday's renewed optimism came on the back of solid gains in stock markets around the world, after a German court ruling rejected lawsuits intended to block Germany's involvement in providing other eurozone members with bailout packages.

"The court ruling confirms [German Chancellor] Angela Merkel's ability to help bail out Europe's troubled areas, and that provides a great amount of confidence that we will see some sort of solution in Europe soon enough," said Brian Battle, director with Performance Trust Capital Partners.

Big hedge funds are getting slaughtered

But the court's decision also said that the German parliament must have a greater say in the decisions, which could make slow the process.

Investors are also preparing for President Obama to unveil a new $300 billion jobs proposal Thursday evening aimed at stimulating the stagnant labor market.

While details of the plan are limited ahead of the speech, Battle said investors will be listening for measures that haven't been "pre-announced."

"There are a number of things investors are already anticipating, and they're hoping that the president will also have some sort of a surprise -- maybe more tax cuts or help for homeowners -- but it's hard to say," Battle said.

Jobs are clearly on investors' minds, especially following last week's dismal government report that showed zero job growth in August -- stoking fears of another recession.

U.S. stocks fell Tuesday, extending last week's losses, as the long-running debt crisis weighed on investor sentiment.

Economy: It's been a rough few weeks for investors as stocks have been quick to react to a series of mixed economic reports. That's resulted in a roller coaster ride that doesn't seem to be ending anytime soon. "Investors will be reacting to every headline, day by day," Battle said.

The Federal Reserve will release its September Beige Book at 2 p.m. ET. The report offers a localized and anecdotal account of economic conditions in the United States.

Investors are starting to get a little nervous ahead of the Federal Reserve's two-day meeting in two weeks, with some market participants beginning to think that the central bank could announce new steps to stimulate the economy.

Companies: Shares of Yahoo (YHOO, Fortune 500) jumped rose more than 3%, after the company announced that CEO Carol Bartz was fired late Tuesday. Tim Morse, the company's chief financial officer, was named as Yahoo's interim CEO.

Also late Tuesday, Bank of America (BAC, Fortune 500) announced plans to reshape its management team by letting go of Joe Price, the president of consumer and small-business banking, and Sallie Krawcheck, president of wealth and investment management. Bank of America shares rose more than 4%.

Brace for profit forecasts to be reeled in

Other financial stocks also moved higher in morning trading, with shares of Citigroup (C, Fortune 500) and JPMorgan (JPM, Fortune 500) up nearly 3%. Goldman Sachs' (GS, Fortune 500) stock edged up 2%.

After the closing bell, homebuilder Hovnanian Enterprises (HOV) will release its corporate results.

Currencies and commodities: The dollar was down against the euro, the Japanese yen and the British pound.

Oil for October delivery gained $2.56, or nearly 3%, to $88.58 a barrel.

Gold futures for December delivery fell $63, or 3.4%, to $1,810.30 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury edged lower, with the yield rising to 2.06%.

Worried bonds are no longer safe?

On Tuesday the 10-year yield hit record lows of 1.91% in overnight trading, as investors plowed into Treasuries amid fears about a slowing U.S. economy and a deepening European debt crisis.

Is the euro doomed?

World markets: European stocks were higher in afternoon trading. Britain's FTSE (UKX) 100 rose 2.6%, the DAX (DAX) in Germany gained 3.6% and France's CAC 40 (CAC40) jumped 3.1%.

Asian markets ended the session higher. The Shanghai Composite (SHCOMP) ended the day up 1.8%, the Hang Seng in Hong Kong (HSI) added 1.7% and Japan's Nikkei (N225) rose 2%.

By Hibah Yousuf

Social Security pays millions to dead people

NEW YORK (CNNMoney) -- While many Americans worry that the Social Security Administration won't have enough money left to pay their benefits when they retire, the agency is doling out millions of dollars to people who aren't even alive.

The Social Security inspector general estimates that the agency has made $40.3 million in erroneous payments to deceased beneficiaries -- even though the administration had already recorded their deaths in its records. The estimate is based on a sample tested during its most recent audit in January 2008, the watchdog agency said.

One man told CNNMoney that he notified Social Security four years ago that his mother had passed away, but he still can't get the agency to stop sending her checks every month.

Dennis Marvin, a Cleveland-based financial advisor, said several of his clients have grown frustrated by how long it took them to convince Social Security to stop sending payments to deceased family members.

Hey Social Security, I'm not dead!

"My clients are very concerned about whether Social Security is going to be there for them -- there's a tremendous lack of confidence in the system," said Marvin. "The fact that some of the benefits they could get are being taken away because they are being spent on the deceased just adds fuel to the fire."

Typically, family members or funeral directors notify the Social Security Administration of a person's date of death. The deceased's identifying information, including their Social Security number, date of birth and date of death, is then added to the agency's Death Master File, a database that contains 87 million death records.

People who fail to report this information and continue to receive payments risk fraud charges and will be forced to repay the money.

California resident Rand Washburn, for example, was charged by the San Diego County district attorney with cashing in on more than $300,000 in Social Security checks that were sent to his mother for about 15 years after she died. After burying her body in the backyard, he failed to report her death to authorities, according to the DA's office. Washburn pled guilty to felony grand theft.

Debt after death: Banks chase down mourners

Even in cases where the Social Security Administration has received notification of a death and adds the data to its master file, it has continued to make erroneous payments.

The inspector general estimates that as of January 2008, nearly 2,000 deceased beneficiaries were receiving benefits for months or even years after the agency had been notified of their deaths. If those payments were not stopped, the SSA likely dished out another $7 million in additional payments over the course of 2008, the inspector general estimated.

The Social Security Administration did not return calls or e-mails requesting comment on these errors or what it has done to reduce erroneous payments.

In its report, the inspector general estimated that the Social Security Administration could save about $152 million in unnecessary costs this year if it does a better job identifying who is actually owed money and who is not.

In addition to paying deceased beneficiaries, the inspector general's review found that the agency overpaid about $313 million to 89,300 beneficiaries and improperly paid about $7.3 million to 11,912 non-beneficiaries.

The audit also found that of the approximately 2.8 million death reports the Social Security Administration receives per year, about 14,000 -- or one in every 200 deaths -- are incorrectly entered into its Death Master File.

These million-dollar mistakes come at a time when millions of elderly and unemployed Americans are relying heavily on Social Security's disability program to get by.

Why entitlement spending must be reined in

"Any threat to a person receiving his or her [Social Security] benefits would add another level of worry to the already shaken sector of senior citizens," said Gail Cunningham, a spokeswoman for the National Foundation for Credit Counseling, a nonprofit organization representing credit counselors.

About 21 million Americans expect to depend on Social Security in retirement as their main source of income, according to the Transamerica Center for Retirement Studies. In 2011, 55 million Americans will receive monthly benefits from Social Security adding up to $727 billion in benefits, according to SSA.

By Blake Ellis

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

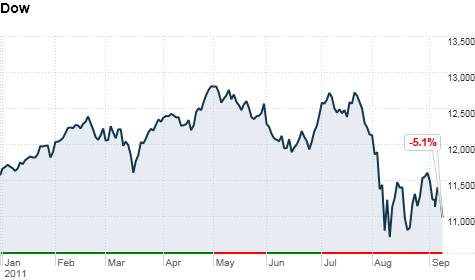

Stocks: All eyes on Greece and inflation

NEW YORK (CNNMoney) -- Next week all eyes will be on inflation and Greece.

Markets dropped sharply Friday as rumors of a possible Greek default circled the globe. The default could come as early as this weekend. Whether or not something happens in Greece will largely rule market sentiment as the market opens in New York Monday.

"I think if we don't hear anything on Greece, there could be a relief rally on Monday," says Sam Ginzburg, head of capital markets at First New York.

Investors sold stocks Friday in fear that Athens may not get its next installment of bailout money from the European Union, International Monetary Fund and European Central Bank and that the bankruptcy could come to light over the weekend.

Europe's debt crisis: 5 things you need to know

Meanwhile investors continue to cling to any reading on the fragile state of the economy. On Thursday, the Commerce Department will release the consumer price index, the government's main inflation gauge.

The CPI index will be the final reading on inflation ahead of the two-day meeting of the Federal Reserve beginning September 20. Investors are betting that if the U.S. economy shows evidence of deflation, the Fed may be more willing to take steps to shore up the economy.

Investors could bid up stock prices if they expect the Fed to introduce another round of bond buying, or so-called QE3, after the meeting. According to minutes from the previous Fed meeting, the three so-called inflation doves dissented against Fed intervention because the U.S. economy showed signs of a healthy rate of inflation.

"The market wants to handicap every event so they might take any indication of deflation or no inflation as a sign that dissent within the Fed won't be significant," says Clark Yingst, chief market analyst at Joseph Gunnar.

Stocks ended sharply lower Friday, as bad news out of Europe kept piling up. The day's steep losses pushed all three indexes to end in the red for the week. The Dow declined more than 2%, the S&P fell 1.7% and the Nasdaq slipped 0.5%.The sell-off triggered the sixth weekly decline in seven weeks for the Dow and S&P 500.

On the docket

One thing investors should bet on: continued volatility. "The market is in a really binary situation. Investors think the world is going to get better or worse," says Ginzburg. "Macro factors and psychology are the most important factors for investors right now and are more important than the fundamentals of any one company."

Monday: Investors will anxiously await Bank of America (BAC, Fortune 500) CEO Brian Moynihan's 9 a.m. presentation at the Barclays investors conference in New York for any insights into the bank's plans.

Tuesday: A report on August's import and export prices is due in the morning.

Big-box retailer Best Buy (BBY, Fortune 500) will report quarterly earnings before the opening bell.

Wednesday: The Producer Price Index, a measure of wholesale inflation, is due out from the Commerce Department ahead of the opening bell. The index is expected to have stayed the same in August after rising 0.2% in July. The so-called core PPI, which strips out volatile food and energy prices, is expected to have risen 0.2% after increasing 0.4% the previous month.

Economists expect the Commerce Department to report that retail sales rose 0.2% in August after a 0.5% rise the previous month, according to consensus estimates gathered by Briefing.com. Sales excluding volatile autos are expected to have ticked up 0.3%.

No 'F' in VIX. It measures volatility, not fear.

The July reading on business inventories, due from the government later in the morning, is likely to show an increase of 0.5%.

Thursday: The U.S. consumer price index is expected to show that prices rose 0.2% in August, after rising 0.5% the previous month. Economists expect consumer prices excluding food and energy to inch up 0.2%, matching July's uptick.

The government's weekly report on initial claims for jobless benefits is expected to drop to 410,000, from 414,000 the previous week.

The Empire Manufacturing survey is also due before the start of trading. The regional reading on manufacturing is forecast to have risen to negative 4 in September from negative 7.7 in August, according to consensus estimates from Briefing.com.

Government data on industrial production and capacity utilization for August are also due before the market opens.

Also out at 10 a.m. ET in the morning is the Philadelphia Fed index for September, a regional reading on manufacturing. The index is forecast to fall to negative 10, up from negative 30.7 the previous month.

BlackBerry maker Research in Motion is scheduled to report earnings after the markets close.

Friday: Shortly after the opening bell, the University of Michigan will put out its initial reading on consumer sentiment in September. Economists expect the figure to move slightly higher to 56.3 up from 55.7.

By Maureen Farrell

Europe's debt crisis: 5 things you need to know

NEW YORK (CNNMoney) -- It's been about 18 months since the sovereign debt crisis in Europe began attracting attention in global financial circles.

In that time, the crisis has grown into the biggest challenge the European Union has faced since the adoption of the euro as its single currency 12 years ago.

Greece, Portugal and Ireland are on life support. Italy and Spain are exhibiting worrying symptoms. Germany and France, the healthy ones, are suffering from a global economic malaise.

As the situation appears to be coming to a head, again, here are five key issues to keep an eye on.

Stability fund's instability

In July, European political leaders announced a set of proposals to address the crisis, including a second bailout for Greece, which was teetering on the verge of default.

The centerpiece of the July 21 agreement was the proposed expansion of the European Financial Stability Fund. The fund was set up last year to facilitate low-cost loans for struggling EU members including Portugal and Ireland.

Under the proposed changes, the fund would be able to buy government bonds directly from banks and investors. Importantly, it would be able to do this for nations that do not already have bailout loans, such as Spain and Italy.

The goal is to contain the crisis by limiting volatility in the sovereign debt markets, where nervous investors have driven borrowing costs for several struggling EU nations to record highs.

That would take some pressure off the European Central Bank, which has been buying government bonds as part of an emergency program.

But many analysts say there is not enough money in the 440 billion euro stability fund to be effective if Italy and Spain need to be rescued.

Europe's controversial bond-buying program

Over the next few weeks, the proposals will go before Parliaments in several eurozone nations, including some where voters are suffering from so-called bailout fatigue. The bailout and stability fund expansion would also need approval from the 17 nations that use the euro as their currency.

From Greece to Italy

In addition to expanding the stability fund, eurozone governments must unanimously approve Greece's 109 billion euro package of low-cost loans.

The agreement has already shown signs of cracking.

Finland and Greece reached a controversial agreement in August for Athens to provide cash collateral against loans from Helsinki.

The move resonated with other eurozone nations that have relatively health economies, including Austria and Belgium, which also called for collateral.

Eurozone officials have chafed at the bilateral agreements, since they mean Greece would have to put up cash in order to get cash. Jean Claude Junker, president of the Eurogroup, said finance ministers are working on an alternative plan, but the situation remains murky.

At the same time, Greece has struggled to implement harsh austerity measures aimed at reining in budget deficits and meeting conditions for its bailout loans.

As Greece goes, so goes Italy?

Meanwhile, investors have also been growing worried about Italy.

The third-largest economy in Europe, Italy is considered too big to fail. While the nation has a relatively small budget deficit, Italy has debts equal to nearly 120% of its gross domestic product.

At the same time, Italy's decade-long economic slump is not expected to end anytime soon, making it difficult for the nation to pay off its debts.

Italy has been struggling to impose austerity measures aimed at reducing its debt burden. But the process has been hampered by political infighting and public backlash.

Yet the Italian Senate voted Wednesday to approve a set of reforms, including a controversial value added tax on purchases.

The belt-tightening measures will be voted on by Italy's lower chamber later this week.

Banks under pressure

Investors are afraid big European banks, which hold billions of euros in sovereign debt on their books, may be forced to take painful writedowns if governments cannot repay their debts.

Société Générale (SCGLF), one of the oldest banks in France, has been at the forefront of investors' worried minds. The company's stock price has plunged to its lowest level since early 2009, when the financial crisis was in full swing.

Some analysts say even German banks, such as Deutsche Bank (DB), would not be immune if the sovereign debt crisis spirals out of control.

"Who says that German banks, just because they are big, and just because they are domiciled in Euroland's largest and most stable economy, are safe?" asked Carl Weinberg, chief economist at High Frequency Economics.

The troubles in the banking sector have raised concerns that Europe could suffer a credit squeeze similar to the one that crippled global credit markets in 2008.

While there have been some indirect signs that European banks are having trouble obtaining short-term dollar loans, the traditional indicators of stress in the banking system are not yet flashing red.

8 banks fail Europe stress tests

EU officials maintain that stress tests conducted in July prove that European banks have sufficient capital.

And there is always the ECB, which has already provided some relatively small loans to European banks. But given the challenging stock market and concerns about a pullback in interbank lending, banks in Europe appear to have few options to raise capital.

This dynamic has fueled fears that there could be a run on a major European bank if investors and depositors start to pull money out in a panic. In that case, governments may be forced to step in and take over.

But it's not clear whether policymakers have the political will, and the cash, to bailout a major bank.

Economy in the dumps

In the second quarter, overall economic activity among the 17 nations that use the euro grew only 0.2% compared with the first quarter, according to Eurostat.

Germany, the region's economic powerhouse, reported a paltry 0.1% increase in second-quarter gross domestic product, compared with a more robust 1.3% in the first quarter. But economists say Germany is still on track for modest growth in 2011.

The German economy is heavily dependent on exports and has benefited from rapid growth in emerging nations such as China.

Thanks a lot, Europe

As activity cools in those markets, the outlook for Germany has dimmed. The slowdown raises troubling questions about the long-term outlook for the eurozone.

Economists say the weaker members of the eurozone will not be able to repay their debts and live without bailouts until economic activity resumes in a big way.

Weighing a eurozone break-up

The crisis has brought to light problems that many analysts say will require a fundamental change in the way the European Union operates.

The eurozone nations have enjoyed the benefits of a shared currency and uniform monetary policy since about 1999. However, aside from certain unenforced budget targets, the group has never had a common approach to fiscal policy.

Is the euro doomed?

The lack of coordination has resulted in a situation where stronger members of the union are now being forced to help support less competitive members that have spent beyond their means.

If they don't, many analysts say the union could break up, with one or more nations abandoning the euro.

European leaders have said repeatedly that they will do whatever it takes to preserve the euro, arguing that greater economic integration is the key to doing so.

Volcker: 'Economy is not behaving appropriately.'

Last month, French President Nicolas Sarkozy and German Chancellor Angela Merkel met in Paris to discuss, among other things, a proposed "golden rule" to require all euro area nations to commit to balanced budgets.

The goal, they said, is to promote greater "convergence" among the policies of the core members of the EU, such as France and Germany, with those of the more troubled nations on the union's periphery.

The leaders also discussed greater coordination on corporate tax rates and the creation of a so-called financial transaction tax.

But officials have so far stopped short of explicitly calling for a uniform fiscal authority.

Investors have been calling for the creation of a so-called Eurobond, which would be backed by all 17 euro area nations. Issuing a common form of debt would ease borrowing costs for the weaker members of the union.

But it would result in higher rates for more credit-worthy nations, which are opposed to the idea.

By Ben Rooney

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

Euro markets higher as investors cheer debt sales

NEW YORK (CNNMoney) -- World markets were mostly higher Tuesday as some hope for resolving Greece's crisis overshadowed Standard & Poor's downgrade of Italy.

The DAX (DAX) in Frankfurt led the gains with a rise of 2%, as the FTSE 100 (UKX) in London added 1.3% and the CAC 40 (CAC40) in Paris gained 1.2%.

Asian markets were mixed at their close. The Hang Seng (HSI) in Hong Kong edged up 0.5% but the Nikkei (N225) in Tokyo fell 1.6%.

Discussions to provide additional bailout funds for debt-riden Greece were set to resume Tuesday. On Monday, Greek finance minister Evangelos Venizelos said talks to help Greece avoid default were "productive and substantive."

The boost in European markets also came from "much better than expected" bond auction results in Greece and Spain which are "helping to bolster sentiment," said Joel Kruger, technical currency strategist at FXCM.

Greece and Spain are members of the so-called PIIGS nations, a status that they share with fiscally troubled Italy, Ireland and Portugal. Investors are showing confidence because the better-than-expected performance of Greek and Spanish bond auctions outweighs the impact of S&P's downgrade of Italy, at least for now, said Kruger.

But he doesn't expect the bond auction to prop up the rally for long, referring it to as "short-term news that provides a sort of prop in the market."

"There continues to be a major problem trying to resolves the European debt crisis," said Kruger. "Any rally will be short lived."

S&P cut Italy's sovereign credit rating late Monday, blaming the nation's weakening economic growth and political uncertainty for its financial instability. S&P lowered the rating to A from A+, and kept its outlook negative for the country.

Europe's debt crisis: 5 things you need to know

The success of the Greek bond auction came as a surprise to some traders, considering that the Greeks are trying to get more bailout funds to prop up their weak economy and many fear that the country could default on its debt payments within a month.

A default would undermine the European banking industry, which already suffered the recent downgrade of two French banks, Societe Generale and Credit Agricole. If that triggers a wave of European debt defaults and a recession, than it could spread to the U.S. economy, which is already at risk of a double-dip recession.

By Aaron Smith

Stocks edge higher at the open

NEW YORK (CNNMoney) -- U.S. stocks edged higher at Tuesday's open, amid some modest optimism about Greece's bailout moving forward, and as a two-day Federal Reserve meeting gets underway.

The Dow Jones industrial average (INDU) rose 17 points, or 0.2%, while the S&P 500 (SPX) and the Nasdaq Composite (COMP) were little changed.

Greece's debt crisis remains the market's guiding force, with default concerns and bailout hopes keeping investors on their toes.

The Greek finance ministry said talks on Monday with officials from the European Commission, the International Monetary Fund and the European Central Bank were "productive and substantive."

"I think they will reach some sort of agreement," said Peter Cardillo, chief market economist at Rockwell Global Capital. "Some of the fears out there -- obviously the fears do exist -- but I think basically investors are looking for reasons to think that Greece is not going to default."

But lingering uncertainty over the future of the debt-stricken nation put an end to the market's 5-day winning streak on Monday.

Adding to eurozone worries, Standard & Poor's Ratings Services cut Italy's sovereign credit rating late Monday. The credit ratings agency said the nation's weakening economic growth and political uncertainty have dented its financial stability. S&P now rates Italy's credit at A, down from A+, and kept its outlook on the country as negative.

Economy: The Federal Reserve begins its two-day policy setting meeting, with a decision expected Wednesday afternoon.

The Federal Open Market Committee has expanded the length of its meeting to two days from one -- a move that investors have taken as a sign that the Fed will announce new actions to spur the economy.

In addition to watching Greece, investors are waiting for "the FOMC announcement tomorrow, which will likely means some stimulus: Operation Twist is what they are calling it," Cardillo said.

In another dour read for the struggling housing market, housing starts in August came in at a seasonally adjusted annual rate of 571,000 -- lower than the 590,000 economists were expecting. Meanwhile, permits came in at a seasonally adjusted annual rate of 620,000, better than the 585,000 economists were expecting.

Europe's debt crisis: 5 things you need to know

World markets: European stocks were higher in midday trading, boosted by some well-received debt sales in troubled European nations.

Britain's FTSE 100 (UKX) added 1.1%, the DAX (DAX) in Germany gained 1.9% and France's CAC 40 (CAC40) moved up 0.75%.

Asian markets ended mixed. The Shanghai Composite (SHCOMP) edged up 0.4% and the Hang Seng (HSI) in Hong Kong added 0.5%, while Japan's Nikkei (N225) lost 1.6%.

Companies: Tech companies Adobe Systems (ADBE) and Oracle (ORCL, Fortune 500) report quarterly results after the bell.

Packaged food company ConAgra Foods (CAG, Fortune 500) withdrew its bid for cereal maker Ralcorp Holdings (RAH) and reported earnings that fell short of forecasts. Shares of ConAgra rose 0.7%, while shares of Ralcorp edged 0.9% lower.

Currencies and commodities: The dollar edged down slightly against the euro, the British pound and the Japanese yen.

Oil for October delivery, whose contract expires Tuesday, gained 70 cents to $86.40 a barrel. The most active contract is November, which rose 83 cents to $86.64.

Gold futures for December delivery added $3.70 to $1,782.50 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury dipped slightly, pushing the yield up to 1.95% from 1.94% late Monday.

By CNNMoney staff

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

Can the Federal Reserve get banks lending?

NEW YORK (CNNMoney) -- The Federal Reserve wants consumers to apply for more mortgages and businesses to take out more loans, in order to boost the sluggish U.S. economy.

At least, that's the thinking behind Operation Twist, a policy announced by the Fed Wednesday that's meant to drive down long-term interest rates, thereby making it cheaper to borrow.

But will it really work? Industry experts have their reservations.

"Interest rates will come down, but the effect won't be what the Fed has envisioned," said Mike Fratantoni, vice president of research for the Mortgage Bankers Association.

One reason: Mortgage rates are already at record lows. While that helps some homeowners refinance their existing mortgages, it has done little to boost new home sales so far.

That's because credit standards are still tight, and even so, consumers don't want them.

"Low rates can only do so much," said Greg McBride, senior financial analyst with Bankrate.com. "Operation Twist will not prompt banks to make loans they're not comfortable making. It won't prompt people to buy houses if they're worried about a job loss, and it won't help homeowners refinance mortgages if they're already unable to qualify."

Even at record low rates around 4%, demand for new mortgages recently fell to a 15-year low, according to the Mortgage Bankers Association -- not surprising considering Main Street is still being hit by high unemployment.

Low rates have at least led to an inflow of applications for refinanced mortgages, which gives a slight boost to the economy. The Congressional Budget Office estimates that for each 1,000 homeowners who refinance, 38 fewer homeowners default.

Federal Reserve launches Operation Twist

But here's the catch: that option is only available to homeowners with pristine credit ratings and steady income, leaving out the roughly 22% of homeowners who are currently underwater in their mortgages, not to mention those struggling with unemployment.

"About a quarter of homeowners cannot even take advantage of what the Fed just did," said Frank Sorrentino, CEO of North Jersey Community Bank. "And the others who qualify for refinancing, probably already did so."

As for business loans, uncertainty about the economy continues to take its toll.

"Most corporations are already sitting on piles of cash," said Mike Schenk, vice president of economics for the Credit Union National Association. "And those that aren't, will find it difficult to sell internally the idea of investing more in an environment where demand just isn't there."

Experts also point out that Operation Twist could have the unintended consequence of hurting bank bottom lines.

Banks typically make money by taking in deposits at one rate, and lending out money at a higher rate. They take their profit from the difference between those two rates.

But if Operation Twist succeeds in lowering long-term rates, banks will have much narrower margins to work with. Long-dated loans are considered riskier, and if they offer low yields in return, why would a bank bother to lend?

"Our income is going to be under pressure as time goes on and it's going to be difficult to maintain the profitability that we had," Sorrentino said.

Banks: Not too big to flail

He points out that smaller banks don't have as many alternate lines of business to fall back on as the giant multinationals, like investment banking for example.

He expects Operation Twist will hit the small community banks hardest, forcing some to cut back on hiring or even lay off workers.

"Smaller banks especially are going to have a very difficult time making long-dated loans at these very low interest rates," he said. "The risk is just too much."

By Annalyn Censky @CNNMoney

Stocks stumble at the open

NEW YORK (CNNMoney) -- U.S. stocks stumbled at the open Friday, extending Thursday's 3% slide, as fears that the global economy is teetering toward another recession continued to grip the market.

The Dow Jones industrial average (INDU) dropped 62 points, or 0.6%, the S&P 500 (SPX) fell 5 points, or 0.4%, and the Nasdaq (COMP) lost 5 points, or 0.2%.

This week has been brutal for stocks, with investors losing faith in the economy and political leaders around the world. The Dow is on track for its worst weekly performance since October 2008.

G-20 finance ministers attempted to inject some confidence with a commitment to "a strong and coordinated international response to address the renewed challenges facing the global economy," highlighting the European debt crisis.

Gathering at the annual International Monetary Fund and World Bank meetings in Washington D.C., the group said that by its next meeting in October, the eurozone will have implemented actions to expand the bailout fund for Europe's debt-laden countries "to maximize its impact in order to address contagion."

Global economy alarm bells ring

But traders have heard enough talk, said Michael Hewson, analyst at CMC Markets in London.

"The market is sick of the same, old empty rhetoric," he said. "What we need to see now are deeds."

And to add fresh salt to the wounds, Deutsche Bank warned, in an interview with Reuters, that European banks could take bigger writedowns than expected on Greek debt.

It also didn't help that Moody's downgraded the credit ratings of eight Greek banks by two notches, sending them further into junk territory.

As investors remain jittery over the fate of Europe, fear continued to drive the world markets lower.

Britain's FTSE 100 (UKX) fell 0.8%, the DAX (DAX) in Germany dropped 1.8%, and France's CAC 40 (CAC40) shed 1.3%.

Asian markets ended in the red. The Shanghai Composite (SHCOMP) fell 0.4%, the Hang Seng (HSI) in Hong Kong tumbled 1.4% and Japan's Nikkei (N225) sank more than 2%.

Stocks in the United States, Europe and Asia are coming off a dramatic sell-off Thursday

Companies: Shares of Hewlett-Packard (HPQ, Fortune 500) edged lower a day after the company's board ousted CEO Leo Apotheker after just 11 months.

Investors will also closely watch financial stocks. Shares of Morgan Stanley (MS, Fortune 500) and Citigroup (C, Fortune 500), which have been hit hard over the last few days due to concerns about U.S. exposure to Greek debt, rose slightly in early trading.

Bank of America's (BAC, Fortune 500) stock was also rose, but is near $6 per share, a level not seen since March 2009.

Shares of KB Home (KBH) gained after the homebuilder reported a narrower than expected loss for the third quarter.

Run for cover. Copper prices are getting killed.

Currencies and commodities: The dollar fell against the euro, the Japanese yen and the British pound.

Commodities continued to slide. Oil for November delivery fell $1.30 to $79.21 a barrel. Gold futures for December delivery lost $56.60 to $1,685.10 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose slightly, pushing the yield down to 1.71% from 1.72% late Thursday. Earlier, the benchmark yield hit a fresh record low of 1.671%.

Economy: No major economic reports are scheduled for release Friday.

By CNNMoney staff

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

European optimism boosts stocks

NEW YORK (CNNMoney) -- U.S. stocks rallied at Tuesday's open as investors grew more optimistic about Europe's debt crisis being resolved.

The Dow Jones industrial average (INDU) rallied 212 points, or 1.9%, shortly after the opening bell. The S&P 500 (SPX) added 20 points, or 1.7%. The tech-heavy Nasdaq (COMP) gained 39 points, or 1.5%.

The plan would allow troubled banks to swap bad debt for bonds backed by the European Investment Bank.

But doubts remain that the action, should it occur, would bring the crisis to a complete resolution given the continent's extremely heavy debt burden.

Europe's debt crisis: 5 things you need to know

Still, even the hint of a resolution was enough to boost world markets, and U.S. financial stocks for a second day. Shares of JPMorgan Chase (JPM, Fortune 500), Bank of America (BAC, Fortune 500), Wells Fargo (WFC, Fortune 500), and Goldman Sachs (GS, Fortune 500) were all higher ahead of the opening bell.

Gold and silver prices also rebounded, bolstering shares ofIshares Silver Trust (SLV) and Spdr Gold Trust (GLD), as well as gold and silver miners, including Silver Wheaton (SLW), BHP Billiton (BHP) and Freeport-McMoran (FCX, Fortune 500).

Gold prices jumped 4.8% to $1,683 an ounce, while silver rallied nearly 11% to $33.20 an ounce.

Economy: Home prices across 20 major U.S. cities rose 0.9% in July from a month earlier, according to the S&P/Case-Shiller index. But prices were still 4.1% lower than 12 months earlier.

At 10 a.m. ET, the Conference Board will release its July consumer confidence index, which is forecast to increase to 46.6 in September from 44.5 in August.

Companies: Shares of Walgreen (WAG, Fortune 500) rallied in early trading after the drugstore chain reported better-than-expected profit and sales.

World markets: European stocks rose in afternoon trading. The DAX (DAX) in Germany surged 4.3%. Britain's FTSE 100 (UKX) jumped 3% and France's CAC 40 (CAC40) rallied 3.8%.

Asian markets ended higher. The Shanghai Composite (SHCOMP) added 0.9%, the Hang Seng (HSI) in Hong Kong gained 4.2%, and Japan's Nikkei (N225) ended the day up 2.82%,

Currencies and commodities: The dollar lost strength against the euro and British pound, but gained ground against the Japanese yen.

Oil for November delivery gained $2.51 to $82.75 a barrel.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 1.97% from 1.81% late Monday.

By CNNMoney staff

Euro stability fund on the line

NEW YORK (CNNMoney) -- As sovereign debt and banking problems continue to swirl in Europe, investors are looking to key votes this week in several euro area capitals on a plan to create some stability.

European leaders agreed in July to overhaul the framework of the European Financial Stability Facility, which was set up in the wake of the 2008 crisis.

The goal is to calm sovereign debt markets by empowering the fund to buy bonds issued by distressed euro area governments directly from investors.

It would be able to do this for nations that do not have an existing bailout program, such as Italy and Spain. Both nations are struggling with unsustainable levels of debt and dim economic prospects.

In addition, the enhanced fund would be able to provide lines of credit to European nations that need to recapitalize troubled banks.

Currently, the €440 billion fund is only able to buy bonds issued by Ireland and Portugal -- the two countries that have already received bailout money from the fund.

The proposed reforms must be approved by the individual governments of all 17 nations that use the euro.

Greek default: What it would mean

So far, only six countries have ratified the changes, including France, Italy, Spain, Ireland, Luxembourg and Belgium.

This week, the stability fund overhaul will be voted on in Slovenia, Finland, Germany and Austria.

The idea of providing more financial support for euro area nations that overspent is deeply unpopular among voters in northern Europe.

Support from Germany, already the biggest backer of the stability fund, is crucial for the proposed reforms. The lower house of the German Parliament, the Bundestag, will vote on the measure Thursday.

"With no major data due this week the spotlight will be on the vote in the Bundestag," said Nick Stamenkovic, a market strategist at Ria Capital Markets.

Despite the political obstacles, many analysts expect the reforms to pass, and European leaders have pledged to implement the measures by mid-October.

But the bigger question, many experts say, is how effective the stability fund will be, even with its new powers.

G20 pledges support, but investors want action

In particular, investors are concerned that there may not be enough money in the fund if Spain or Italy -- the third largest economy in Europe -- need to be rescued.

"Given the need to create a buffer to potentially support Spain and Italy if they lose market access, the capacity of the EFSF will likely need to be tripled or even quadrupled," economists at JPMorgan Securities wrote in a report.

Alternatively, policy makers and investors have been discussing ways to enhance the fund's capacity without raising the price tag.

Olli Rehn, the top economic and monetary official at the European Commission, said Saturday that policymakers are considering ways to leverage the fund, although he stressed that the first step is to proceed with the proposed changes.

"We are contemplating the possibility of leveraging the EFSF resources to have more firepower and thus have a stronger financial firewall to support our member states that are doing the right thing," Rehn said.

By Ben Rooney @CNNMoney

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

Junk bonds get crushed in market chaos

NEW YORK (CNNMoney) -- Investors became so nervous in the past two months that they're not willing to gamble on risky junk bonds anymore -- despite the lucrative promise of high yields.

The junk, or high-yield, bond market has tumbled along with the stock market, which suffered its worst performance in three years.. Traders say it's eerily reminiscent of the months leading up to Lehman Brothers' bankruptcy in 2008.

In a world where it's remarkably difficult to find yield with 10-year U.S. government Treasuries yielding less than 2%, investors are still fearful of the risk associated with high returns.

"When its fear vs. greed, the fear factor is very much winning out," said Andrew Jessop, vice president and high-yield portfolio manager at PIMCO.

Euro stability fund is a mirage

Before August, the high-yield market was soaring, and investors were on pace to generate annualized returns of roughly 11%. But shortly after the stock market started gyrating wildly in August, investors sold off even the safest of the junk bonds, which are those rated BB. These BB bonds are down roughly 5%, and the CCC bonds are down 13% for the year.

The sell-off in junk bonds moved more swiftly Friday, the last trading day of the third quarter. Traders said many hedge funds that have fared poorly in the past few months were rapidly selling out of positions in junk bonds.

Many lower-performing hedge funds fear that investors will soon ask for redemptions in the next few weeks. Hedge funds are selling off positions to store up cash to give it back to investors.

Some companies with risky bonds have been especially hard hit. Among the most battered companies: home builder Hovnanian Enterprises (HOV), ATP Oil and Gas (ATPG), Bank of America (BAC, Fortune 500), and Wynn Resorts (WYNN).

"There's been a bloodbath in the [high-yield] market," said Peter Plaut, senior vice president of fixed income at MF Global. "For a lot of the companies, there's no rationale for the sell-off."

Bond prices have dropped sharply because investors are fearful that some risky companies could default or even go bankrupt. But several hedge fund managers said banks are also less willing to take the other side of risky trades.

"Banks are being more conservative about allocating capital to risk," said James Keenan, head of leverage finance at BlackRock. Since the 2008 financial crisis, many large institutions have functioned less as so-called market markers.

Greece: This cannot end well

Meanwhile, trouble could be coming for companies that haven't refinanced debt and have bonds that mature in the next year. "The high-yield refinancing market is closed for all practical purposes," said Oleg Melentyev, head of high yield strategy at Bank of America.

That could mean an uptick in bankruptcies for shaky companies with 2012 maturities if things don't turn around. Eastman Kodak (EK, Fortune 500), for example, has reportedly hired a law firm to help it restructure. But the troubled photography company has denied that it plans to file for bankruptcy.

Still, fewer companies are expected to file for bankruptcy than in 2008 because many proactively refinanced while it was possible.

The number and size of high-yield bonds issued in the first nine months of 2011 was up 43% from the same period in 2010 and hit the highest level since 2007, according to data provider Dealogic. Only 12% of these junk bonds were issued in the third quarter.

What's driving the mass exodus from junk bonds is largely the looming questions over how the European Union will handle a potential default in Greece and what other problems might arise if Greece does renege on its debt.

"You can see a path where if things are handled poorly then you have a replay of 2008," said Melentyev.

By Maureen Farrell

Stocks turn higher on manufacturing surprise

NEW YORK (CNNMoney) -- U.S. stocks erased early losses and turned higher Monday, on the first trading day of the fourth quarter, as investors welcomed a better-than-expected reading on U.S. manufacturing activity.

The Dow Jones industrial average (INDU) rose 51 points, or 0.5%, the S&P 500 (SPX) added 6 points, or 0.6% and the Nasdaq composite (COMP) edged up 11 points, or 0.5%.

But the gains were only modest as investors remain primarily focused on Europe's debt crisis, as Greece attempts to deal with its deficit problems. Greece has slashed spending, reduced wages and raised taxes in an attempt to bring its debt under control.

But even still, the debt-ridden nation will miss key deficit targets for this year and next, according to the draft budget announced by the Greek cabinet late Sunday.

There isn't a whole lot of optimism that Greece will pull though. Almost all of the 22 economists surveyed by CNNMoney believe Greece will default on its debt by the end of next year.

Europe's debt crisis: Complete coverage

Stocks are coming off an ugly day and an ugly quarter. Stocks were hammered Friday, with all three major stock indices shaving more than 2%, as investors worries about the debt crisis in Europe and the outlook for global economic growth continue to mount.

The losses capped the biggest quarterly drop for the S&P 500 and the Nasdaq since the fourth quarter of 2008.

In addition to fretting over the sovereign debt crisis in Europe, investors are anxious about slowing economic activity in the United States and around the world.

The Federal Reserve and the International Monetary Fund have both warned of increasing risks to the global economic recovery.

World markets: European stocks were sharply lower in afternoon trading. Britain's FTSE 100 (UKX) fell 1.9%, the DAX (DAX) in Germany tumbled 3% and France's CAC 40 (CAC40) dropped 2.4%.

Asian markets also ended lower. The Hang Seng (HSI) in Hong Kong plunged 4.4%, while Japan's Nikkei (N225) shed 1.8%. Shanghai (SHCOMP) is closed this week for holiday.

Economy: The Institute for Supply Management's September manufacturing index rose to 51.6, from a last month's reading of 50.6. The figure was above economists' forecasts for 50.5. Any reading above 50 indicates expansion; the sector has now expanded for 26 straight months.

A report from the Commerce Department showed that construction spending jumped 1.4% in August, after falling 1.3% the prior month. Economists were expecting construction spending to slip 0.5% during the month.

Major auto manufacturers will also report auto sales for September throughout the day.

GM (GM, Fortune 500) said sales rose 19.8% during the month, above analyst expectations.

Companies: Share of Yahoo (YHOO, Fortune 500) rose after the company announced an content alliance with ABC News, owned by Disney (DIS, Fortune 500). On Friday, Jack Ma, the CEO of Chinese Internet conglomerate Alibaba Group, said that his company would be "interested" in buying all of struggling online media firm Yahoo.

Junk bonds get crushed in market chaos

Shares of Eastman Kodak (EK, Fortune 500) surged more than 30% Monday, after plunging almost 60% Friday. Rumors swirled that the camera maker had hired a law firm for advice on a major restructuring or bankruptcy filing. The company later denied that it is planning bankruptcy moves.

Apple's new CEO, Tim Cook, will take the stage at the Town Hall auditorium on Apple's (AAPL, Fortune 500) Cupertino, Calif., campus Tuesday to unveil the new iteration of the iPhone. Rumors are swirling over whether there will be one new iPhone or two.

Currencies and commodities: The dollar rose against the euro and the British pound, but lost ground against the Japanese yen.

Oil for November delivery lost $2 to $77.20 a barrel.

Gold futures for December delivery rose $35.20 to $1,657.40 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury edged up, pushing the yield down to 1.87% from 1.92% late Friday.

By CNNMoney staff

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

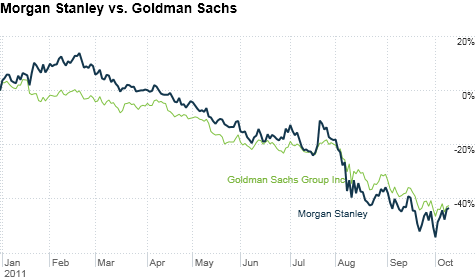

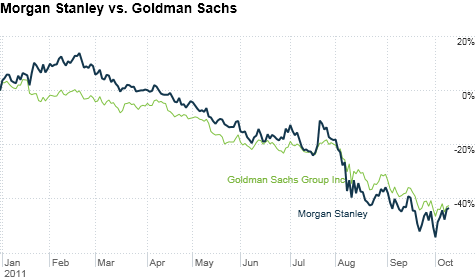

Earnings: Banks bracing for pain

NEW YORK (CNNMoney) -- August and September's see-sawing stock market may have induced nausea among equity investors, but for Wall Street's major investment banks, this volatility has most likely taken a huge toll on revenues and profits.

As banks' third quarter earnings season kicks off Thursday with JPMorgan Chase (JPM, Fortune 500), investors are bracing to see how much damage was wrought by the expected steep drop in investment banking and trading revenue.

Investment banking and trading revenue has taken a big hit from a slowdown in merger and acquisition activity, initial public offerings and corporate debt deals.

On top of that, analysts expect the six major banks with investment banking and trading floors -- JPMorgan Chase, Morgan Stanley (MS, Fortune 500), Bank of America (BAC, Fortune 500), Citigroup (C, Fortune 500), Goldman Sachs (GS, Fortune 500) and Wells Fargo (WFC, Fortune 500) -- to announce new layoffs, in addition to the thousands they've already disclosed.

So far this year, Bank of America said it would cut 30,000 jobs and Goldman announced 1,000 layoffs. To a lesser extent, Morgan Stanley said it would cut 300 'underperfoming financial advisors.' The other big banks have thus far avoided any big layoff announcements.

"The best way to cut costs is to cut people," said Paul Miller, a banking analysts at FBR. "There's been no lending and no trading and not a lot of people are being utilized."

Morgan Stanley and Goldman Sachs are expected to see the sharpest fall-off in revenue, since investment banking and trading make up the bulk of their overall revenue. For JPMorgan, Citigroup, Bank of America and Wells Fargo, these divisions account for roughly one-third of total revenue.

JPMorgan CEO Jamie Dimon already forewarned analysts that the firm's third-quarter investment banking revenue would be cut roughly in half to $1 billion from $1.9 billion. Dimon also estimated that the firm's fixed income trading would be cut by one-third.

However, JPMorgan is also known for making lemonade out of earnings' lemons by offering foreboding forecasts. "JPMorgan lowers the bar and beats it," said Miller.

Still for JPMorgan, its investment banking division accounted for only about 7% of its overall revenue in the second quarter. By contrast, Goldman Sachs' $1.4 billion of investment banking revenue made up 24% of its overall revenue. And for Morgan Stanley, its $1.7 billion in investment banking revenue accounted for 18%.

The current valuations of bank stocks may be the one bright spot for investors. They've dropped so far, that some investors and analysts question how much lower they can go, potentially making them an attractive 'buy' option.

Bank of America's stock is down 52% so far this year. Shares of Goldman Sachs, Morgan Stanley and Citigroup have fallen 42%, 43%, and 44% respectively. And Wells Fargo and JPMorgan Chase have seen 24% and 15% declines so far this year.

"Investor sentiment has turned so negative that we could have surprise upsides," said Jeff Harte, banking analyst at Sandler O'Neill.

I ditched my big bank!

Furthermore, overall lending volumes are expected to be trending higher, giving a boost to Citigroup, Bank of America, JPMorgan Chase and Wells Fargo.

But the elephant in the room remains Greece and Europe. Investors want to know just how much exposure these banks, particularly Goldman Sachs and Morgan Stanley, have to Greece and European sovereign debt.

Analysts aren't expecting CEOs to offer too much granularity on that exposure during conference calls but investors will be grasping onto any hints, both good and bad.

By Maureen Farrell

Financial stocks lead early advance

NEW YORK (CNNMoney) -- U.S. stocks edged higher at the open Wednesday, as investors await the latest plan for European bank recapitalization and sort through Slovakian politics.

The Dow Jones industrial average (INDU) rose 64 points, or 0.6%, the S&P 500 (SPX) added 8 points, or 0.7%, and the Nasdaq composite (COMP) gained 21 points, or 0.8%.

Financial stocks were among the leading gainers, with JPMorgan Chase (JPM, Fortune 500), Bank of America (BAC, Fortune 500), Citigroup (C, Fortune 500) and Wells Fargo (WFC, Fortune 500) up between 1% and 3%.

"Market sentiment is improving. Expectations are that we will get some resolution in Europe," said Peter Cardillo, chief market economist at Rockwell Global Capital.

Investors tuned into comments from the president of the European Commission, Jose Manuel Barroso, who is expected to will lay out his plan for European bank recapitalization.

Every development overseas is getting investors' front-and-center attention. More than 80% of the experts surveyed by CNNMoney agree that debt problems overseas are the most challenging hurdle for stocks, which have been struggling to claw back from lowest levels of the year hit earlier this month.

U.S. stocks ended mixed Tuesday, with the technology sector rally bucking a broader decline, as investors watched the unfolding drama in Europe.

Investors had been awaiting the outcome of Slovakian parliament's vote to overhaul the European Financial Stability Fund (EFSF) -- essentially a bailout fund for the region's most troubled nations. But, shortly after U.S. markets closed Tuesday, Slovakia voted the measure down.

Europe bank rescue is not enough

The proposed bailout needs to be ratified by all 17 eurozone nations, and Slovakia was the last country to vote. The development is a bit of a setback for European leaders that are struggling to deal with the continent's growing debt crisis. However, Tuesday's "no" vote does not necessarily mean that the plan to expand the EFSF is dead.

Actually, investors expect that in its second round of voting with a new government in place, Slovakia will manage to pass the bailout. "In a second round of voting, they will probably pass the EFSF here," said Cardillo.

Meanwhile, on the domestic front, the U.S. Senate failed to approve President Obama's jobs bill. The 50-49 vote in favor of the measure fell short of the 60 senators needed to advance the $447 billion dollar plan.

Companies: In addition to watching the debt drama unfold across the Atlantic, investors will be tuning in for the latest round of company earnings, Cardillo said.

Shares of Alcoa (AA, Fortune 500) slid after the aluminum producer reported quarterly income that fell short of analysts' expectations, but the company brought in more revenue than anticipated.

PepsiCo (PEP, Fortune 500)'s stock rose after the company reported stronger revenue Wednesday on global snack and beverage volume. PepsiCo also saw gains from its the acquisition of Wimm-Bill-Dann, a Russian dairy and juice company.

Overall, S&P 500 company earnings are expected to have climbed almost 13% in the third quarter of 2011, according to earnings tracker Thomson Reuters. Revenue of the companies in the benchmark index are expected to have risen 10%.

Meanwhile, shares of Liz Claiborne (LIZ) surged almost 18%, after the company announced it is selling several of its brands for $328 million. J.C. Penney (JCP, Fortune 500) is buying the company's namesake Liz Claiborne brand as well as the Monet brand. Liz Claiborne also sold its Dana Buchman brand to Kohl's (KSS, Fortune 500).

Economy: The latest minutes from the Federal Open Market Committee's meeting will be released at 2 p.m. ET.

World markets: European stocks rose in afternoon trading. Britain's FTSE 100 (UKX) ticket up 0.8%, the DAX (DAX) in Germany gained 1.9% and France's CAC 40 (CAC40) added 1.8%.

Asian markets ended mixed. The Shanghai Composite (SHCOMP) jumped 3% and the Hang Seng (HSI) in Hong Kong added 1%, while Japan's Nikkei (N225) slipped 0.4%.

Currencies and commodities: The dollar lost ground against the euro and the British pound, but rose versus the Japanese yen.

Oil for November delivery gained 14 cents to $85.95 a barrel.

Gold futures for December delivery rose $24.90 to $1,685.90 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 2.22%.

By CNNMoney Staff

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

Stocks: Investors on edge over Europe, earnings

NEW YORK (CNNMoney) -- U.S. stocks opened lower Monday as investors remain worried about Europe's debt crisis, while digesting mixed earnings reports from Citigroup and Wells Fargo.

The Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) stocks all declined after of the opening bell.

Before the opening bell, Citigroup (C, Fortune 500) reported earnings per share and revenue that beat expectations, while Wells Fargo (WFC, Fortune 500) posted earnings and revenue that fell short of forecasts.

Meeting in Paris over the weekend, finance ministers from the world's largest economies pledged to take "all necessary actions" to stabilize global financial markets and ensure that banks are well capitalized. (G-20 finance chiefs back Europe bank rescue)

Officials promised to have a comprehensive plan to secure the banking system and resolve Europe's sovereign debt problems in place by next Sunday, when the European Council meets in Brussels.

The announcement initially sent European stocks higher early Monday, but as traders geared up for the opening bell in New York, European indexes and U.S. stock futures turned lower.

"There's a bit of uncertainty and that uncertainty is creating volatility," said Anthony Conroy, head trader at BNY ConvergEx Group.

He added, many traders are skeptical that Europe can put a comprehensive debt plan in place by next weekend. "They've been working on it for two years, and to set a deadline for one week is a bit aggressive," he said.

While key hurdles remain for the eurozone, investors have been clinging to any positive economic data they can get lately. Last week, they temporarily shrugged off eurozone jitters and a drop in profit at JPMorgan Chase.

The Dow and Nasdaq rallied Friday, after a government report showed a jump in retail sales. That moved both indexes into positive territory for the year. The S&P came close.

But with looming uncertainty over Europe's debt crisis and several large U.S. banks expected to report paltry earnings this week, some investors wonder whether last week's rally will be sustainable.

'I have the best job in America'

Economy: The Empire State Manufacturing survey was released before the start of trading, showing that business conditions remained negative at 8.5. That's little changed from negative 8.8 in September. The survey came in worse than expected, since it was forecast to have improved slightly to negative 4 in October, according to consensus estimates from Briefing.com.

A separate report showed that industrial production edged up 0.2% in September, after rising the same amount in the previous month, matching the forecast from Briefing.com.

Companies: Shares of Hasbro (HAS) fell after the toymaker's profit fell short of estimates.

IBM (IBM, Fortune 500) will report its quarterly results after the market close.

Pipeline operator Kinder Morgan (KMI, Fortune 500) announced Sunday that it is acquiring rival El Paso (EPB) for $38 billion in cash, stock and assumed debt.

The acquisition is the second-largest M&A deal announced this year, just behind the $39 billion AT&T (T, Fortune 500) purchase of T-Mobile. (Merger Sunday: Kinder Morgan buying El Paso)

Oil producer BP (BP) announced Monday that it reached an agreement with Anadarko Petroleum (ADC) to settle all claims between the companies related to the Deepwater Horizon accident. (Anadarko to pay BP $4 billion)

As part of the settlement, Anadarko will pay BP $4 billion in a single cash payment and both parties have agreed to mutual releases of claims against each other. BP shares were up 3.4% and Anadarko shares were up 3.9% in premarket trading.

World markets: European stocks were lower in afternoon trading. Britain's FTSE 100 (UKX) slipped 0.1%, the DAX (DAX) in Germany lost nearly 1% and France's CAC 40 (CAC40) were down slightly.

Asian markets finished with gains. The Shanghai Composite (SHCOMP) added 0.4%, the Hang Seng (HSI) in Hong Kong surged 2% and Japan's Nikkei (N225) ended 1.5% higher.

Currencies and commodities: The dollar rose against the euro and the British pound slipped slightly against the Japanese yen.

Oil for November delivery lost 30 cents to $86.50 a barrel.

Gold futures for December delivery added $2.50 to $1,685.50 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 2.22% from 2.23% late Friday.

By CNNMoney staff

Taxes you'll still pay under Cain's 9-9-9 plan

NEW YORK (CNNMoney) -- Herman Cain's tax proposals have rocketed him to the top of the pack in the fight for the Republican presidential nomination.

But while his now-famous 9-9-9 tax plan would scrap the current tax structure in favor of a more simplified system, $90 billion in various federal taxes and fees would still be left intact.

That includes excise taxes on things like gas and alcohol, tobacco and firearms, airline tickets and phone service.

The revenues these taxes generate are no small sum -- equal to nearly half the money now collected in corporate income taxes.

That's one way Cain claims his "9-9-9" tax plan -- consisting of a 9% flat income tax, a 9% corporate income tax and a 9% national sales tax -- would raise just as much money as the current combination of income, corporate and payroll taxes.

Cain's tax plan: More than 9-9-9

Here's a list of taxes and fees you'll still be paying under Cain's proposal, and how much was collected under each in the fiscal year ending Sept. 30, 2010.

Gasoline taxes: The 18.4 cents per gallon contributed about $35 billion to the highway trust fund, the largest amount collected by any of the taxes that Cain's plan would leave in place.

The gas tax had been set to expire on Oct. 1 before Congress approved a six-month extension in the middle of last month. Some Tea Party activists had advocated letting it expire.

But some business groups, including the U.S. Chamber of Commerce and Dan Akerson, the CEO of General Motors (GM, Fortune 500), have advocated for a higher gas tax, both as a source of funding for highway repairs and a way to get Americans to consider buying higher-mileage cars the automakers will soon be required to produce.

Airline taxes and fees: Passengers now pay a 7.5% excise tax on flights, while the airlines pay a variety of fuel taxes. Those taxes and some ticket fees together raise about $13 billion a year that goes to the FAA.

In addition, passengers pay a variety of other fees that raise about $3.4 billion for the Department of Homeland Security. Together with the excise taxes, all these charges can add about $60 to the cost of a $240 domestic airline ticket, according to the Air Transport Association, the industry's trade group.

When a deadlock in Congress temporarily ended the airlines' authority to collect some of those fees in August, most hiked the cost of their tickets by an identical amount and passengers saw no savings.

Alcohol, tobacco and firearms. The government doesn't break down an additional $21 billion collected from "other" excise taxes. But most of that pile of money comes from taxes on alcohol, tobacco products and firearms.

The taxes range from about a nickel on a 12-ounce can of beer to $2.14 for a 750 ml bottle of hard liquor. Smokers pay between $1.01 to $2.11 per pack on cigarettes and small cigars.

Buyers of pistols and revolvers pay an excise tax equal to 10% of the purchase price, while they pay 11% for other firearms and ammunition purchases.

Phone taxes: The Universal Service Fund is funded through taxes on telecom companies that are typically passed onto phone customers. It collects $9 billion a year in order to help those who might otherwise be priced out of service have access to phones and Internet.

It subsidizes rural phone service and makes discounts available to low-income customers. It also helps pay for Internet connections for public schools and rural health clinics.

Other fees and taxes: The government also collects fees and royalties for federal land use for all sorts of things from livestock to gold. Those can range from $1.35 per animal per month for grazing on federal lands, to royalties for oil, gas and precious metals collected on federal lands.

Most of that revenue came from oil, natural gas and coal extraction, which totaled about $7.9 billion in 2010. Other fees added about $3 billion more.

One other major source of income for the federal government isn't exactly a tax, but it would also remain in place under Cain's plan. The Federal Reserve returns any profits it makes to the federal government, much of it coming from interest paid on its massive holdings of U.S. Treasuries.

And because the Fed has purchased trillions in assets in the last three years in an effort to help the economy, those profits have been huge -- last year the Fed returned a record $76 billion to the treasury.

By Chris Isidore @CNNMoney

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

The Eurozone crisis will not go away until banks face reality

European regulators have turned risk assessment into an insider's game where the bankers are calling the shots.

FORTUNE -- The European sovereign debt crisis is slowly driving the global economy back into the ditch. Why is this crisis so unresolvable? The answer comes back once again to excess risk taking and leverage in the banking sector. In late October, Europe's leaders finally persuaded the banks to take a 50% cut on the Greek debt they hold, although this agreement could be jeopardized by Greece's recent call for a referendum on its bailout package. But debt restructuring will get you only so far because Europe's banks do not have sufficient capital to absorb future losses, which the IMF estimates will be $280 billion or higher. And why are Europe's banks so thinly capitalized? That responsibility rests squarely with European banks and their regulators.

When bank regulators assess the adequacy of a bank's capital to handle losses from its loans, investments, and other assets, they take into account the riskiness of those assets. For instance, an investment in U.S. Treasuries carries lower risk (we hope) than an unsecured credit card line. The process, however, is more art than science, and in Europe regulators have given their banks much more leeway in making those determinations than banks have in the U.S. As a result, since the mid-1990s European banks have continually lowered their estimates of likely losses on their assets and now say their assets are twice as safe as those held by U.S. banks.

The problem has been exacerbated by Europe's adoption of a complex Basel II methodology, which essentially lets bank managers use their own judgment in determining the riskiness of their assets. That is naive. It is in a bank manager's interest to say his assets have low risk, because it enables the bank to maximize leverage and return on equity, which in turn can lead to bigger pay and bonuses. Indeed, even during the Great Recession, as delinquencies and defaults increased, most European banks were saying their assets were becoming safer.

The growing wealth gap

The U.S., which has tighter rules governing how FDIC-insured banks determine the riskiness of assets, requires well-capitalized banks to hold capital equal to at least 5% of total assets, regardless of how risky they think the assets are. So for any asset, be it cash, U.S. Treasury securities, or supposedly safe mortgages, banks must hold at least 5% capital against it. European banks do not have this kind of "leverage ratio," and Basel II has allowed them to treat sovereign debt as having zero risk. That is one of the main reasons they have loaded up on nearly $3 trillion of it.

Last year the Basel Committee on Banking Supervision finally approved a still-too-low 3% international leverage ratio. Even at that permissive level, the committee's own research suggests that more than 40% of the world's largest banks would have to raise capital. At the same time, the European Banking Authority (EBA) is raising European banks' common equity capital requirement to 9%, a huge jump from the Basel II standard of 2% and roughly equivalent to the new Basel III standards. But even at 9%, a large number of European banks will continue to operate at extreme levels of leverage because of their rosy views of risk.

European regulators should supplement this requirement with the Basel III 3% leverage ratio -- or even better, the U.S. 5% requirement, adjusting for accounting differences. The EBA should also use realistic loss estimates more in line with those of the IMF and private analysts. If banks have to accept dilution of their stock or temporary nationalization, so be it.

The Basel committee needs to move swiftly to adopt standardized measures of risk set by regulators, not banks, and to consistently apply them across all institutions. U.S. regulators made many mistakes, but because we maintained our leverage ratio and delayed Basel II implementation, FDIC-insured banks have remained much more stable than other financial institutions. Bank capital standards should not be an insider's game. The public deserves better. Bank regulators should do their job, and it is their job, not the job of conflicted bank managers, to set minimum capital levels.

By Sheila Bair, contributor

Stocks rebound after two-day rout

NEW YORK (CNNMoney) -- U.S. stocks opened higher Wednesday, following two days of sharp losses, as investors digested a better-than-expected report on the job market and awaited the Federal Reserve's latest statement on monetary policy.

The Dow Jones industrial average (INDU) spiked 162 points, or 1.4%, S&P 500 (SPX) added 19 points, or 1.6%, and the Nasdaq composite (COMP) gained 31 points, or 1.2%.

Investors were encouraged after payroll processor ADP said private-sector payrolls rose by 110,000 in October.

The Fed is wrapping up its two-day policy meeting. While rates are expected to remain unchanged, investors are increasingly hopeful that Fed chairman Ben Bernanke will hint at new plans to help the struggling economy.

Investors will also continue to watch developments in Greece with a cautious eye.