:: ::  |

| Autor |

Poruka |

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

Stocks turn mixed after strong start

NEW YORK (CNNMoney) -- U.S. stocks were mixed Monday, as investors focused on retail sales, corporate earnings and renewed anxieties about Europe.

The Dow Jones industrial average (INDU) was up 64 points, or 0.5%, in morning trading. But the S&P 500 (SPX) eased 3 points, or 0.2%, and the Nasdaq (COMP) tumbled 31 points, or 1%.

The Commerce Department reported Monday that retail sales rose 0.8% in March, ahead of analyst expectations of 0.3%, after climbing a revised 1% in February.

"Consumers appear to have spent more than anticipated in March even after we control for the effects of higher prices for gasoline and autos," said Steven Ricchiuto, chief economist at Mizuho Securities.

The retail sales data helped offset concerns about Spain, where bond yields rose above 6% earlier Monday -- the highest level in several months.

Investors will be watching auctions of Spanish government bills on Tuesday and bonds on Thursday. Spain has been struggling with rising borrowing costs, amid fears that it may need to be bailed out.

"Investors are clearly questioning the sustainability of the fiscal situation in Spain for the near term," said Nick Stamenkovic, a fixed income strategist at RIA Capital Markets Ltd.

Stocks are coming off of their worst week of the year. Last week, the Dow tumbled 1.6%, the S&P 500 sank 2% and the Nasdaq lost 2.3%.

New World Bank pick expected Monday

World markets: European stocks were higher in midday trading. Britain's FTSE 100 (UKX) was up 0.5%, the DAX (DAX) in Germany rose 0.5% and France's CAC 40 (CAC40) added 0.8%.

Asian markets ended lower. The Shanghai Composite (SHCOMP) slid 0.1%, while the Hang Seng (HSI) in Hong Kong shed 0.4% and Japan's Nikkei (N225) dropped 1.7%.

Economy: A report on business inventories in February is due out after the market opens.

Companies: Citigroup (C, Fortune 500) shares rose after the bank said it earned 95 cents per share in the first quarter. Excluding certain items, Citi said it earned $1.11 per share. Analysts had been anticipating earnings of $1 per share.

So far, bank earnings are off to a solid start, after both Wells Fargo (WFC, Fortune 500) and JPMorgan Chase (JPM, Fortune 500) topped estimates when they released reports Friday. Bank of America (BAC, Fortune 500), Goldman Sachs (GS, Fortune 500) and Morgan Stanley (MS, Fortune 500) will all report earnings later in the week.

Mattel (MAT, Fortune 500) shares fell after the company reported quarterly earnings before the bell that missed expectations.

Nokia (NOK) shares were down after the company was downgraded by credit rating agency Moody's.

Private equity kicks off best year since 2007

Currencies and commodities: The dollar gained against the euro and the British pound, but fell versus the Japanese yen.

Oil for May delivery fell 77 cents to $102.03 a barrel.

Gold futures for April delivery fell $10.50 to $1,648.40 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 1.99%.

By CNNMoney staff @CNNMoneyMarkets

Spanish bond yields soar again

NEW YORK (CNNMoney) -- Spanish bond yields soared on Monday to above 6%, their highest point since November, raising concerns that Europe's debt crisis may again be rearing its head after a period of relative calm.

"Spain has replaced Greece and Portugal as the chief source of market anxiety," wrote Brown Brother Harriman analyst Marc Chandler in a market report.

The yield for 10-year Spanish bonds hovered around 6.06% on Monday. Nick Stamenkovic, fixed income strategist at RIA Capital Markets in Edinburgh, Scotland, said that's the highest point since yields peaked at 6.7% in November.

"Investors are clearly questioning the sustainability of the fiscal situation in Spain for the near term," he said. "If yields continue to move higher, Spain might eventually get external help."

Stamenkovic said this reflects wider problems in the Spanish economy, such as the youth unemployment rate -- approaching 50% -- and could lead to political problems as the government plans to cut billions of euros in health and education funding.

Spain is unlikely to achieve its 2012 bond yield target of 5.3%, just as the country missed its target last year, he said. Investors will be keeping this in mind on Thursday, when Spain has scheduled an auction for 10-year bonds and two-year notes.

The rise in interest rates follows a period of calm in eurozone sovereign debt markets, helped by aggressive moves by the European Central Bank, which has funneled some €1 trillion into the banking system since December.

But the lull appears to be coming to an end as investors question whether eurozone governments will really address deeper economic and fiscal problems.

"There are a lot of policy options from the ECB and the [European Union], but at the moment there are no signs that they are intervening," Stamenkovic said.

European markets still managed to make mild gains during midday trading Monday. The FTSE 100 (UKX), DAX (DAX) and CAC40 (CAC40) all rose just less than 1% as investors turn their attention to Wall Street and retail data.

The U.S. Commerce Department reported Monday that retail sales rose 0.8% in March, ahead of analyst expectations of 0.3%, after climbing a revised 1% in February.

But Stamenkovic said the market gains are too mild to be cause for celebration.

Investing in Europe? Look north

"This is only a modicum of stability," he said, comparing the modest gains with last week's market declines.

Chandler of BBH outlined the challenges that Spain faces going forward.

"It is not clear what investors are more concerned about: That [Spain] reaches its deficit targets or that it doesn't," he wrote. "Perhaps the worst combination is that it tries and fails. Trying means more austerity despite the contracting economy, falling house prices and rising unemployment."

Meanwhile, German bonds, which are considered the gold standard of stability, headed in the opposite direction, fell Monday 1.71%.

By Aaron Smith @CNNMoneyMarkets

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

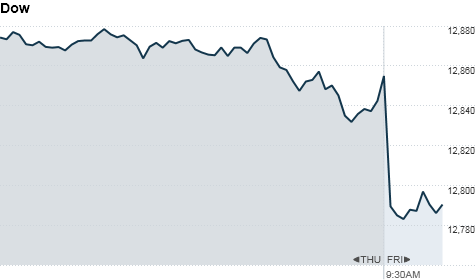

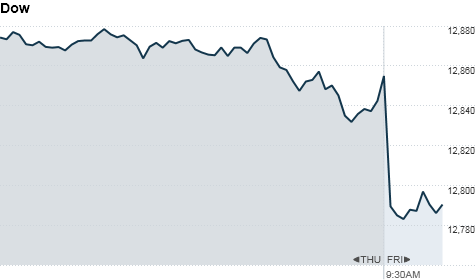

JPMorgan loss rattles stocks

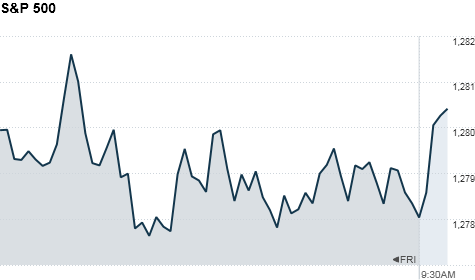

NEW YORK (CNNMoney) -- A sell-off in financial shares rattled the broader U.S. stock market Friday after banking giant JPMorgan said it would suffer a $2 billion trading loss.

The Dow Jones industrial average (INDU) was down 40 points, or 0.3%, in early trading. The S&P 500 (SPX) fell 3 points, or 0.2%, while the Nasdaq (COMP) bucked the trend, rising 6 points, or 0.2%.

Bank stocks weighed on the market. Shares of Citigroup (C, Fortune 500), Morgan Stanley (MS, Fortune 500), Bank of America (BAC, Fortune 500), Goldman Sachs (GS, Fortune 500) and Wells Fargo (WFC, Fortune 500) fell between 1.5% and 4%.

The technology sector was supported by shares of chip maker Nividia (NVDA), which rose 9% on better-than-expected quarterly results.

JPMorgan Chase (JPM, Fortune 500) reported the $2 billion loss after the market closed Thursday. CEO Jamie Dimon cited "errors" and "bad judgment" in trades meant to hedge risk. The bank's shares fell more 9% early Friday.

The loss not only damaged the reputation of JPMorgan, which had come through the financial crisis of 2008 in relatively good shape compared to its Wall Street rivals, but it also raised worries whether conditions since April would cause more unreported losses at other big banks.

Arguments in favor of proposed regulations that limit the trading that banks can do with their own money, known as the Volcker Rule, were also fueled by the big bank's loss. Dimon has been one of the most vocal critics of the Volcker Rule.

In addition to JPMorgan, investors will continue to focus on the political uncertainty in Europe.

Europe's rising risks from Greece

Greek politicians are still struggling to form a coalition government, which makes the future of austerity measures and a European bailout of its debt unclear.

Spain announced a new round of bank reforms Friday, including independent audits of all Spanish banking assets, and requirements for more reserves to protect against real estate loan losses, in an effort to assure investors about the banks' viability. The rules come two days after Spain partially nationalized one of its largest banks.

The yield on the Spanish 10-year bond edged back above the 6% benchmark that raises alarms with investors.

Meanwhile, further worries about weaker-than-expected economic growth in China could weigh on markets. A report from China Friday showed an unexpected drop in the rate of industrial production growth, which could feed fears of a so-called hard landing for the world's No. 2 economy.

U.S. stocks ended mixed Thursday, as investors welcomed a small drop in jobless claims.

World markets: European stocks were lower in midday trading. Britain's FTSE 100 (UKX) fell 0.6%, the DAX (DAX) in Germany slipped 0.7%, and France's CAC 40 (CAC40) shed 1.6%.

Asian markets ended in the red. The Shanghai Composite (SHCOMP) closed down 0.6%, as did Japan's Nikkei (N225), while the Hang Seng (HSI) in Hong Kong lost 1.3%.

Economy: Lower energy prices took wholesale prices down 0.2% in April, according to the Labor Department's producer price index. Economists surveyed by Briefing.com had expected prices to be unchanged from March. But stripping out volatile food and energy prices left core wholesale prices up 0.2%, which matched forecasts.

Bye bye unemployment benefits

At 9:55 a.m. ET, the University of Michigan releases its consumer sentiment index. Economists surveyed by Briefing.com predict the index to come in at 75, lower than last month's revised tally of 76.4.

Companies: Shares of upscale retailer Nordstrom (JWN, Fortune 500) fell after it reported earnings of 70 cents a share, which fell 5 cents short of forecasts, despite revenue that was roughly in line with forecasts.

U.S. shares of Sony (SNE) fell further in early trading after it sank 6.5% in Tokyo to a multi-decade low for the stock in its home market. Sony reported lower earnings after the close of the market in Tokyo on Thursday, which hit before the New York exchange open.

Currencies and commodities: The dollar fell against the euro, but rose versus the Japanese yen and British pound.

Oil for June delivery lost $1.40 to $95.68 a barrel.

Gold futures for June delivery tumbled $14.10 to $1,581.40 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury was little changed, leaving the yield near the 1.88% level.

By CNNMoney staff @CNNMoneyInvest

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

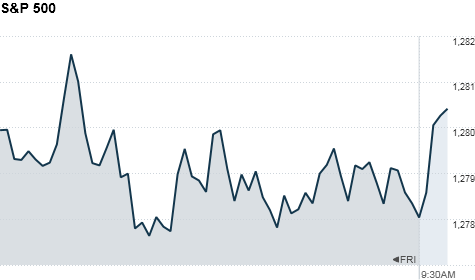

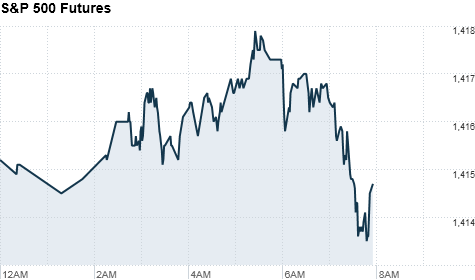

Stocks ease in choppy trading

NEW YORK (CNNMoney) -- Stocks eased in early Monday trading, as worries about a global growth slowdown and uncertainty surrounding Europe's debt crisis persisted.

With little on the economic or corporate calendar Monday, investors are taking most of their cues from any comments out of Europe.

"Europe is front and center, back, left and right," said Dan Greenhaus, chief global strategist at BTIG.

And after markets were brutalized last week, investors have some reason to believe that European leaders might be willing to make tough choices to stave off larger problems in the region.

"There's a belief that with their backs against the wall. European leaders will at least come up with a short-term resolution to at least help the Spanish banking system," said Peter Boockvar, equity strategist at Miller Tabak.

Anxieties over the health of the Spanish banking system and the possibility that Greece could soon exit the euro remain high.

"Last week was so terribly negative that even the absence of negative news gives some support to the market," added Greenhaus.

Still it's impossible to ignore the fear factor still gripping the markets as 10-year Treasury yields remain near all-time record lows. That shows that global investors are willing to forego returns simply for the safety of holding debt backed by the U.S. government.

There are also worries about slowing growth in emerging markets such as China and India. Recent reports out of China last week showed the manufacturing sector contracted more than expected in May.

The S&P 500 (SPX) lost 3 points, or 0.1%. The Nasdaq (COMP) moved down 3 points, or 0.1%. The Dow Jones industrial average (INDU) dropped 24 points, or 0.2%.

Investors head into the week reeling from a dismal monthly jobs report on Friday, and as worries about the European debt crisis grow. .

U.S. stocks tumbled more than 2% Friday in the worst trading day of the year. The Dow erased all its gains for 2012, and the S&P 500 and Nasdaq moved into correction territory -- down more than 10% from the year's highs.

Fear and Greed Index

CNNMoney's Fear and Greed Index fell more sharply into extreme fear territory in trading Friday. And that fear fed into the flight to safety, driving up bond prices and pushing the yield on the benchmark 10-year Treasury down to a record low close of 1.47%.

Bond prices retreated slightly in Monday trading, allowing the yield on the 10-year note to rise back to just under 1.50%.

World markets: European stocks were mixed in afternoon trading. The DAX (DAX) in Germany fell 0.4%, while France's CAC 40 (CAC40) rose 0.9%. British markets are closed for a bank holiday.

Asian markets ended lower in their first day of trading since the U.S. jobs report. The Shanghai Composite (SHCOMP) tumbled 2.7%, and the Hang Seng (HSI) in Hong Kong fell 2%. The Nikkei (N225) in Tokyo fell 1.7%.

Economy: Factory orders declined 0.6% in April, the government reported Monday. The report was weaker than the 0.1% increase expected by economists surveyed by Briefing.com. The March decline was revised to a deeper 2.1% drop.

Facebook IPO aftermath

Companies: Shares of Facebook (FB), which have gotten hammered since the company's IPO, edged slightly lower.

Groupon (GRPN) shares added 0.6% after dropping sharply Friday. The online discount service, which has been dogged with questions about its accounting practices since its initial public offering in November, ended its lock-up period Friday, meaning that insiders who own shares are now able to sell them.

Shares of AutoNation (AN, Fortune 500), the largest U.S. car dealership, jumped after it reported that its May new car sales rose 45%. That was almost twice as good as the 26% rise in industry wide U.S. car sales reported by major automakers Friday. But the industry wide sales pace was generally less than forecast as it came in at the weakest pace of 2012.

Currencies and commodities: The dollar rose against the euro and Japanese yen, but fell versus the British pound.

Oil for July delivery lost 23 cents to $83.47 a barrel.

Gold futures for August delivery lost $2.60 to $1,614.60 an ounce.

By Maureen Farrell @CNNMoneyInvest

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

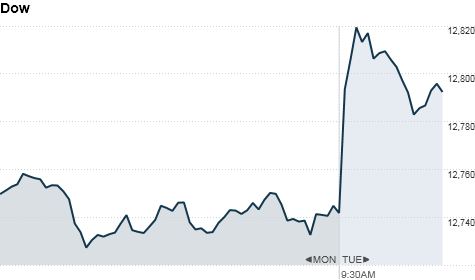

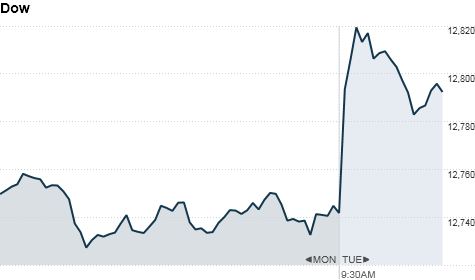

Stocks edge higher at the open

NEW YORK (CNNMoney) -- U.S. stocks opened modestly higher Tuesday as investors continue to keep eyes on Europe, along with earnings and economic readings on the domestic front.

The Dow Jones industrial average (INDU) rose 82 points, or 0.7%, the S&P 500 (SPX) gained 11 points, or 0.8%, and the Nasdaq (COMP) added 27 points, or 0.9%.

Sunday's election in Greece yielded a victory for the pro-bailout party and eased fears that the country will soon exit the euro. The winning New Democracy party could announce a coalition government as soon as Tuesday.

As fears of an imminent Greek exit from the euro recede, banking and debt worries in Spain have moved into greater focus. Spain's 10-year yield remained above 7% Tuesday, heightening worries about that country staving off the need for a bailout

Leaders of the Group of 20 nations conclude a meeting in Mexico on Tuesday. Europe is at the top of the agenda, though analysts aren't expecting any significant policy announcements.

Anticipation is higher about the Federal Reserve's two-day meeting, which ends Wednesday. Some observers believe the Fed may announce another round of bond buying or plans to continue its so-called Operation Twist, which extends the maturities of debt held by Treasury.

U.S. stocks ended mixed Monday after a day of choppy trading following the election in Greece. But CNNMoney's Fear & Greed index showed investors' level of fear continued to lessen.

Fear & Greed Index

Economy: In May, home builders filed for the greatest number of building permits since September 2008, the government reported Tuesday. Permits came in at a seasonally-adjusted annual rate of 780,000, easily topping forecasts of 725,000 from economists surveyed by Briefing.com. Housing starts, which are more affected by weather than are permits, fell slightly to an annual rate of 708,000, a bit short of forecasts.

Companies: Shares of retailer JC Penney (JCP, Fortune 500) tumbled after it announced late Monday that its president had left the company, effective immediately. Michael Francis was hired away from rival Target (TGT, Fortune 500) with great hopes in November to lead Penney's marketing efforts, but in May the company announced disappointing sales that sent its share price sharply lower.

Business software maker Oracle (ORCL, Fortune 500) made a surprise earnings announcement after the close Monday, lifting its shares. the company made an unscheduled earnings release late Monday that showed an operating profit of 82 cents a share and announced a $10 billion buyback.

Drugstore chain Walgreens (WAG, Fortune 500) announced Tuesday it was buying a 45% equity ownership stake in Alliance Boots, the Switzerland-based drug wholesaler that is a major global drugstore chain. Walgreens will pay $4 billion in cash and an additional $2.7 billion in stock for the stake, and have the right to purchase the remaining 55% of the company within three years.

JPMorgan Chase (JPM, Fortune 500) CEO Jamie Dimon returns to Capitol Hill on Tuesday, this time to testify before the House Financial Services Committee on the bank's $2 billion trading loss. In testimony before the Senate Banking Committee last week, Dimon said he couldn't defend the trades that led to the bank's massive loss and said executives could subject to clawbacks.

FedEx (FDX, Fortune 500) reported earnings of $1.99 a share in its fiscal fourth quarter, excluding special items, topping forecasts of a $1.92 a share profit. But its guidance for fiscal first quarter earnings was below current forecasts and the upper end of its full-year earnings guidance only met the current forecast.

Financial services firm Jefferies (JEF) reported earnings of 31 cents a share, excluding special items, down from 36 cents a year earlie but topping forecasts.

Book retailer Barnes & Noble (BKS, Fortune 500) reported a quarterly loss of $1.08 a share, up from the loss of $1.04 a share a year earlier. But the recent quarter included a 10 cents-a-share charge.

Microsoft (MSFT, Fortune 500) shares edged higher after the software maker unveiled a Windows tablet computer of its own design late Monday.

Shares of Pandora (P) fell Tuesday after Spotify announced it was launching a free mobile radio app for Apple's iPhone, iPad and iPod touch.

AutoTrader: Dividends for us, not for you

World markets: European stocks were higher in afternoon trading. Britain's FTSE 100 (UKX) gained 1.2%, while the DAX (DAX) in Germany rose 0.9%, and France's CAC 40 (CAC40) bounced back from earlier losses to be up 0.6%.

Asian markets closed slightly lower, with the Shanghai Composite (SHCOMP) losing 0.7%, the Hang Seng (HSI) in Hong Kong slipping 0.1% and Japan's Nikkei (N225) off 0.8%.

Currencies and commodities: The dollar was slightly lower against the euro, the Japanese yen as well as the British pound.

Oil for July delivery added 77 cents to $84.04 a barrel.

Gold futures for August delivery lost 20 cents to $1,626.60 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, sending yield up to 1.61% from 1.58% on Monday.

By CNNMoney staff @CNNMoneyInvest

Gas prices fall below $3.50

NEW YORK (CNNMoney) -- Gas prices fell below $3.50 per gallon on Tuesday for the first time in more than four months, according to AAA, thanks to the free flow of oil in the U.S. and the Middle East.

"In general, we've got a very well supplied oil market," said Dan Dicker, oil trader and author of "Oil's Endless Bid: Taming the Unreliable Price of Oil to Secure Our Economy."

The average nationwide price of unleaded gasoline was $3.497 on Tuesday, the motorist group said.

Gas prices have declined for seven consecutive days, according to AAA. More important, it's the first time the average gas price fell below $3.50 per gallon since Feb. 10. Tuesday's price matches the nationwide average from February: $3.497 for a gallon of unleaded gasoline.

Dicker said that gas prices are being held down by steady oil supplies from Saudi Arabia, which is churning out 10.2 million barrels per day "partly to screw the Iranians, who want to keep the market very tight."

He also said there's consistent supply coming out of Iraq, as well as from within the U.S.

Check gas prices in your state

"U.S. domestic crude production is rising at a pace some of us haven't seen in our lifetime," said Tom Kloza, the chief oil analyst for Oil Price Inflation Service.

Oil was trading at $84.23 per barrel on Tuesday, up 96 cents from the day before.

By Aaron Smith @CNNMoney

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

Stocks dip but remain near 4-year highs

NEW YORK (CNNMoney) -- Stocks traded down slightly Monday on what looks to be another quiet trading day. Still, all three indexes remain near their highest levels in more than four years.

The Dow Jones industrial average, the S&P 500 and the Nasdaq shed 0.2%.

Trading volume has been low over the past few days, with many investors on vacation and little news out of Europe.

Even as fewer shares change hands, the Federal Reserve will once again take center stage this week when it releases minutes from its July meeting on Tuesday. While the Fed didn't announce any further stimulus measures at the meeting, investors will look for clues about whether quantitative easing could be coming when chairman Ben Bernanke speaks at a Jackson Hole, Wyo., symposium at the end of the month.

Investors will also keep an eye on news out of Europe, as Greek prime minister Antonis Samaras meets with top eurozone officials throughout the week. Samaras is expected to push for a two-year extension of Greece's bailout program, which would give the government more time to implement difficult reforms.

Fear and Greed Index

U.S. stocks ended higher Friday, capping off a sixth straight week of gains. Stocks have been trading near the highest levels since May 2008.

World Markets: European stocks were mixed in midday trading. Britain's FTSE 100 edged lower by 0.4 % and France's CAC 40 fell 0.2%, while the DAX in Germany was flat.

Asian markets ended mixed. The Shanghai Composite fell 0.4% and the Hang Seng in Hong Kong shaved off 0.1%, while Japan's Nikkei ended up 0.1%.

Companies: Lowe's (LOW, Fortune 500) second-quarter earnings missed expectations, falling 10% over the same period a year ago, the home improvement retailer reported Monday. Shares were down over 4% on the news.

Aetna (AET, Fortune 500) is buying Coventry Health Care (CVH, Fortune 500) for $5.7 billion in cash and stock. The deal would make Aetna one of the largest providers of government-financed health care. Shares of both companies moved up.

Apple (AAPL, Fortune 500) shares set another all-time high Friday on growing expectations for an upcoming wave of new gadgets. Shares of Apple continued to move higher Monday.

Currencies and commodities: The dollar rose against the euro and the British pound, but slid against the Japanese yen.

Oil for September delivery fell 26 cents to $95.74 a barrel.

Gold futures for December delivery fell $3.30 cents to $1,616.20 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury was unchanged, with the yield holding at 1.82% from late Friday.

By CNNMoney Staff @CNNMoneyInvest

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

Stocks: Earnings and housing data in focus

NEW YORK (CNNMoney) -- U.S. stocks opened lower Wednesday but quickly turned mixed, as investors took in new housing market data and another batch of corporate earnings.

The Dow Jones Industrial Average bounced along the breakeven line, while the Nasdaq and the S&P 500 were up between 0,2% and 0.4%.

Housing starts, which tally the number of new homes under construction, climbed 15% to an annual rate of 872,000 in September, according to the Census Bureau. That's the highest level in more than four years and much higher than what economists had expected. Building permits for future construction also rose to the highest level in more than four years.

On the earnings front, Bank of America (BAC, Fortune 500) reported third-quarter earnings that topped expectations, citing improved lending and deposits. Shares of the bank rose slightly in early trading.

PepsiCo (PEP, Fortune 500) logged earnings that topped forecasts, but revenue slipped more than 5% from a year ago. Earnings from Abbott Laboratories (ABT, Fortune 500) also beat expectations.

After the market close Tuesday, chip maker Intel (INTC, Fortune 500) reported earnings that beat Wall Street's expectations, but fell from a year earlier. Investors were also disappointed by the company's outlook. Shares of the company are down 2% on the news.

IBM (IBM, Fortune 500) posted earnings that topped forecasts by a penny a share, but revenue fell short of expectations, sending shares nearly 4% lower.

Results from American Express (AXP, Fortune 500)are due after the close.

U.S. stocks ended higher Tuesday, as investors welcomed strong corporate earnings and digested the latest inflation data.

Fear & Greed Index

World Markets: European stocks were higher in afternoon trading. Britain's FTSE 100 gained 0.5%, the DAX in Germany rose 0.1% and France's CAC 40 added 0.1%. Meanwhile, Spanish bonds climbed after Moody's Investors Service affirmed Spain's investment grade credit rating.

Asian markets closed higher. The Shanghai Composite gained 0.3%, the Hang Seng in Hong Kong climbed 1%, and Japan's Nikkei jumped 1.2%.

Related: Can presidents change gas prices?

Currencies and commodities: The dollar slipped against the euro, the British pound and the Japanese yen.

Oil for November delivery rose 77 cents to $92.77 a barrel.

Gold futures for December delivery gained $2.7 to $1,748.90 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 1.77% from 1.72% late Tuesday.

By CNNMoney Staff @CNNMoneyInvest

Home building surges to 4-year high

NEW YORK (CNNMoney) -- The housing recovery blossomed in September, as the pace of home building surged to a four-year high, according to a government report issued Wednesday.

Builders started work at an annual pace of 872,000 homes last month, up 15% from the pace in August. They also filed for permits to build homes at an annual rate of 894,000, up 11.6% from the previous month. Both readings were the best since the summer of 2008, before the meltdown in financial markets that caused home lending and building to freeze up.

But mortgage rates are now near record lows, and the Federal Reserve's decision to buy $40 billion in mortgages every month is likely to keep rates low for the foreseeable future. The low mortgage rates, coupled with affordable housing prices and a drop in unemployment have helped to restart home sales.

Foreclosures have fallen to a five-year low, reducing the supply of distressed homes available on the market. And four years of depressed levels of home building have cut the supply of new homes on the market to nearly record lows, according to a separate government report.

All these factors have helped to lift home prices and get builders back building again. And while there had been signs of improvement in the housing market in readings leading up to Wednesday's report, the improvement in these latest numbers were far greater than expected.

"We've been seeing consistent improvement in housing for some time, but this is a big jump though," said Anika Khan, senior economist with Wells Fargo Securities.

Related: The return of the housing boom

Economists surveyed by Briefing.com had forecast that starts would rise to a 768,000 rate, while permits would edge up to an 815,000 rate.

Khan said that part of the increase was driven by a 25% jump in the start of apartment buildings of five or more units. That number can be fairly volatile and there could be a retreat in that reading next month, she said.

But the 11% rise in starts for single-family homes is more impressive, and is a sign of an improvement in the underlying housing market, Khan said.

"We're clearly seeing overall improvement in sales," she said. "I don't necessarily think this report is a one-month jump."

On Tuesday, the National Association of Home Builders said its October survey of members found confidence among builders at the highest level since 2006. However, their enthusiasm looks good mostly in comparison to the past four years -- only 20% of the builders surveyed characterized current business conditions as good and 39% said conditions were still poor.

The news helped lift the stocks of most of the publicly traded builders. PulteGroup (PHM), Lennar (LEN), DR Horton (DHI) and KB Home (KBH) were all up between 2% and 4% in early trading Wednesday. Prices of builders' stocks have more than doubled on average already this year.

By Chris Isidore @CNNMoney

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

Stocks fall on fiscal cliff concerns

NEW YORK (CNNMoney) -- U.S. stocks declined Monday as investors returned to work with one eye on the results from the first weekend of the holiday shopping season, and the other on upcoming economic negotiations in Washington and Europe.

In the first full trading day since last Wednesday, the Dow Jones industrial average dropped 95 points, or 0.7%. The S&P 500 slipped 0.7% and the Nasdaq composite lost 0.4%.

No major economic or corporate reports are expected, so investors were looking for signs of an economic recovery in retail sales. On Sunday, the National Retail Federation reported that the Black Friday weekend brought in a record $59.1 billion in sales, up 13% from last year.

Abercrombie & Fitch (ANF) shares rose more than 1%, making it one of the top performers in the S&P 500, on reports that the retailer had a solid sales weekend.

On Friday, U.S. stocks rallied in a holiday-shortened trading day, led by gains in retail stocks.

Fear & Greed Index

Investors were also looking again at the fiscal cliff. Congress is back in session, and lawmakers will be under pressure to reach a deal with the White House before the end of the year.

Following the first post-election meeting between the White House and Congressional leaders almost two weeks ago, lawmakers seemed optimistic that they would strike a deal ahead of the New Year. But market experts are doubtful that a quick agreement can be reached.

"We were always skeptical and the weekend talk shows support our view that there has been little progress from initial positions," said Marc Chandler, global head of currency strategy at Brown Brothers Harriman. "It is in the interest of both sides to take this to the wire, or a little more. Both sides have to make concessions and to do so before the last possible minute is understood as a sign of weakness to one's own base."

Meanwhile, eurozone finance ministers are meeting for the third time to discuss the latest release of bailout funds for Greece. European stocks were all lower in afternoon trading, with London's FTSE off 0.6%, the CAC 40 in Paris down 0.6%, and the German DAX slipping 0.2%

"There are no assurances that today's meeting will succeed where the previous two have failed," said Chandler.

If there is no final decision at the conclusion of the day's meeting, attention will turn to the next regular Eurogroup meeting scheduled for December 3.

Also in Europe, the Bank of England named the Canadian central bank chief Mark Carney its next Governor, taking the reins from outgoing Governor Mervyn King. That was a surprise move.

In another leadership change, Securities and Exchange Commission chairman Mary Schapiro announced she would be stepping down from her position, as expected, in mid-December.

Asian markets ended mixed. The Shanghai Composite lost 0.5% and the Hang Seng in Hong Kong slid 0.2%, while Japan's Nikkei added 0.2%.

Companies: Shares of Knight Capital (KCG) jumped after a report late Friday in the Wall Street Journal said the trading firm is weighing the sale of its market-making business, the unit whose trading glitch in August that cost the company more than $400 million.

Research in Motion (RIMM) shares gained ground, as investors are hopeful the BlackBerry 10, debuting Jan. 30, will signal a turnaround for the company. A bullish analyst report triggered a rally Friday, with the stock rising 14%.

Facebook (FB) shares spiked after an analyst upgraded the stock to outperform. Yahoo (YHOO, Fortune 500) shares also rose after an upgrade from Goldman Sachs.

Shares of McGraw-Hill (MHP, Fortune 500) increased after the company, which owns Standard and Poor's, announced that is selling its education arm, McGraw-Hill Education, to private equity firm Apollo Global Management for $2.5 billion.

Currencies and commodities: The dollar gained on the euro and the British pound but lost ground versus the Japanese yen.

Oil for January delivery slipped 80 cents to $87.48 a barrel.

Gold futures for December delivery lost $3 to $1,747.40 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury edged higher, pushing the yield down to 1.64% from 1.69% Friday.

By Hibah Yousuf @CNNMoneyInvest

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

Smaller paychecks coming - bosses say, don't blame us

Everyone's paycheck is about to take a hit, and it's not the boss' fault. But some business owners say it's a tough talk to have.

The rate of workers' payroll taxes, which fund Social Security, has been 4.2% for the past two years. As of Jan. 1, it's back to 6.2%, on the first $113,700 in wages.

That forced Mike Brey, who owns four Hobby Works shops near Washington, D.C., to notify his store managers about the upcoming change during a conference call Monday. He called the experience uncomfortable. "These are the people who can least afford it," Brey said.

Brey said he can't raise compensation to ease the pain. Enduring the recession meant cutting his own salary, firing workers, taking on half a million dollars in debt and raiding his own 401(k).

"Any business that survived the recession did so by digging a big hole," Brey said. "We can't dig any deeper."

Related: How the rich will pay more in 2013

Payroll taxes are key for financing Social Security, and the break of the past two years has forced the government to replenish the funds with borrowed money. The tax break was always meant to be temporary.

Workers earning the national average salary of $41,000 will receive $32 less on every biweekly paycheck. The higher the salary (up to $113,700), the bigger the bite, but business owners say their lower wage employees will feel it most.

Deborah Koenigsberger, who owns the Noir et Blanc fashion store in Manhattan, has yet to have the talk with her only part-time employee, a college student.

"It's going to hurt me to tell her this. She can't afford a decrease," Koenigsberger said. What unnerves her is the feeling that she's lost control as a business owner watching out for her employees.

Keval Mehta, CEO of In-R-Food, a smartphone app developer in Durham, N.C., worried the tax increase will threaten morale. "They don't get paid enough for what they do," Mehta said.

Related: Fiscal cliff's new definition of 'rich'

The 1-year-old company has yet to make a profit, having just launched software that scans grocery products and lists ingredients and nutritional values. His four employees could make upwards of $80,000 a year elsewhere, but three of them earn less than half that. They put in long hours, must work from laptops while on vacation, and no, there isn't a health insurance plan.

All that made it even more difficult to warn them during the holidays about the oncoming pay cut. Mehta promised them he'd make up the lost pay if the company's finances improve next year.

"Currently, they're working on passion. But that can only drive you so much," Mehta said. "I don't like that I don't have control over this. It wasn't a decision I made. But as a CEO, you take responsibility for everything. You're automatically at fault, because you're the captain of the ship."

By Jose Pagliery @CNNMoney

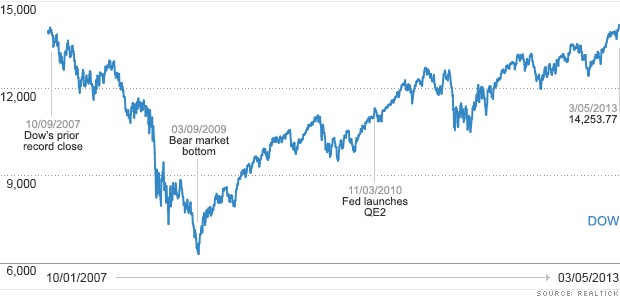

Stocks rally into 2013

U.S. stocks surged into the New Year after U.S. lawmakers reached a last minute deal to avert the fiscal cliff.

The Dow Jones Industrial Average rallied more than 260 points, or 2%, early Wednesday. Gains were broad, with all 30 Dow stocks showing solid gains.

The S&P 500 rose 2%, while the Nasdaq spiked 2.5%.

Financial shares were among the strongest gainers, with Bank of America (BAC, Fortune 500), JPMorgan Chase (JPM, Fortune 500) and Citigroup (C, Fortune 500) rising between 2% and 4%. Credit card companies Visa (V, Fortune 500) and MasterCard (MA, Fortune 500) both hit all-time highs. Tech stocks were also faring well, with Apple (AAPL, Fortune 500) and Hewlett-Packard (HPQ, Fortune 500) logging big increases.

Oil and gold prices also posted sharp gains, while the dollar was mixed, gaining against the yen but weakening against the euro and Bristish pound.

As investors shifted into riskier assets, safe havens, such as U.S. Treasuries sold off, with the yield on the 10-year note rising to 1.84% - a level not seen since mid-October.

Investors cheered the late night deal reached by the House that keeps the Bush tax cuts in place for most Americans, but raises the tax rate on individuals earning more than $400,000 and married couples earning over $450,000.

Lawmakers allowed the payroll tax cut to expire but extended federal emergency unemployment insurance benefits for another year.

Related: 3 more fiscal cliffs loom

Investors ignored any downsides to the deal, including Congress's failure to tackle automatic spending cuts, which are now set to go into effect March 1. Additional -- and perhaps more intractable -- challenges remain. Congress must soon raise the debt ceiling, and figure out plans for the postponed spending cuts and the federal budget.

"Congress has done the easy part," said Lewis Alexander, chief U.S. economist for Nomura, in a research note. "Now a new Congress will have to tackle the hard part -- reduce long-term spending, raise additional revenue and increase the debt limit."

Fear & Greed Index

Major global markets were closed Tuesday for the New Year's holiday -- but many overseas markets posted strong gains Wednesday after news of the deal broke.

European markets were broadly higher in early trading, posting gains of more than 2%. Asian markets ended higher. Australia's ASX All Ordinaries index added 1.3%. South Korea's KOSPI gained 1.7% and the Hang Seng in Hong Kong advanced 1.9%.

Japan's Nikkei and the Shanghai Composite remain closed in an extended New Year's holiday.

Related: Stocks in 2013: Get defensive

Aside from weighing the deal's impact, investors also got some good news on the economic front. The Institute for Supply Management's monthly manufacturing index showed activity rebounded in December. Investors shrugged off the Census Bureau's data on construction spending, which showed a decrease in of 0.3% in November. Analysts had predicted a 0.5% increase.

In company news, Avis Budget Group (CAR, Fortune 500) announced it will acquire Zipcar for $12.25 a share -- a 49% premium over its closing price on Monday. Zipcar (ZIP) shares rose nearly 50%.

By CNNMoney Staff @CNNMoneyInvest

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

Dow drops 100 points

U.S. stocks declined sharply Thursday as investors digested mixed economic news and a slew of earnings results.

The Dow Jones industrial average dropped 100 points, or 0.7%. The S&P 500 and Nasdaq also fell 0.7%.

Stocks have stalled this week after a strong start to the year. The Dow and S&P 500 are both up more than 5% in 2013, and near their all-time highs. The Nasdaq is up more than 4% for the year.

On the economic front, weekly initial jobless claims came in at 366,000, down 5,000 from the previous week but above forecasts.

Meanwhile, the nation's business productivity dropped 2% in 2012's fourth quarter, according to the Bureau of Labor Statistics, which was more than economists were expecting.

In the afternoon, the Federal Reserve will release data on consumer credit for December.

Related: Insiders bailing on Dow 14,000

In corporate news, Akamai Technologies (AKAM), which provides Internet content delivery, delivered weak fourth-quarter results and a disappointing revenue forecast. The lackluster news sent the company's stock plunging 16%, making it the biggest loser in the S&P 500 and Nasdaq 100.

News Corp (NWSA, Fortune 500) was also a big laggard after the media giant issued a downbeat earnings forecast for the year.

And Green Mountain Coffee Roasters (GMCR)shares tumbled on the company's weak outlook for sales growth.

Sprint Nextel (S, Fortune 500) shares edged lower after the cell phone carrier reported a fourth-quarter loss in line with expectations.

Shares of Sony (SNE) dropped after the electronics manufacturer reported a surprising third-quarter loss.

Alcatel Lucent (ALU) posted another quarterly loss, yet shares rose on news that CEO Ben Verwaayen is resigning from his post.

On the positive side, shares of Devry (DV) rallied after reporting better-than-expected earnings and revenue, and getting upgraded by JPMorgan Chase.

Retailers were also big movers as they reported sales figures for January.

Macy's (M, Fortune 500) rose after reporting a 11.7% rise in same-store sales for last month, topping forecasts. Gap (GPS, Fortune 500), Costco (COST, Fortune 500), Target (TGT, Fortune 500) and Limited Brands (LTD, Fortune 500) also posted better-than-expected January sales figures.

Shares of Blackberry (BBRY) gained ground after the smartphone maker said the Canadian launch of its new Z10 smartphone was its best launch ever.

Apple (AAPL, Fortune 500) shares were in the spotlight after activist investor David Einhorn publicly called for the electronics maker to give some of its $137 billion cash hoard to back to shareholders in the form of preferred stock.

Related: Fear & Greed Index still in extreme greed but ticked lower

LinkedIn (LNKD) headlines the group of companies reporting after markets close.

U.S. stocks finished little changed Wednesday, as investors weighed concerns about Europe against the latest corporate results.

European markets were mostly lower after the European Central Bank and the Bank of England kept interest rates unchanged. During a news conference, ECB president Mario Draghi said the eurozone economy, which is set to contract for a second year running in 2013, could gradually recover during the second half of the year. But he warned that the risks to the outlook were still tilted to the downside.

Asian markets ended in the red. The Shanghai Composite dropped 0.7%, the Nikkei declined 0.9% and the Hang Seng lost 0.3%.

By CNNMoney Staff @CNNMoneyInvest

Europe's central banks stand firm on rates

Europe's central banks resisted pressure to do more to support growth, keeping interest rates at record low levels Thursday as evidence emerged that the region's economy may be on the mend.

The European Central Bank left its key interest rate at 0.75%, and the Bank of England held its at 0.5%.

The eurozone economy is set to contract for a second year running in 2013, as recession grips southern Europe while much of the rest of the region is in stagnation. But Europe's biggest economy, Germany, saw a sharp rebound in industrial orders in December, and the purchasing managers' index for the eurozone rose for a third straight month in January.

"We see a gradual recovery in the second part of this year," ECB President Mario Draghi told reporters, adding the risks to the outlook were still tilted to the downside.

Another sign of a return to more normal financial conditions came last week, when eurozone banks repaid €137 billion in emergency 3-year loans issued by the ECB a year ago in the middle of the credit crisis.

Related: 'Jury still out' on eurozone - Draghi

The shrinking of the ECB's balance sheet and refusal to relax policy further to help lift the eurozone economy out of recession have combined with a return of investor confidence to push the euro to 14-month highs against the dollar.

The strong euro has prompted some European politicians to voice concerns about the impact on exports and to call for an exchange rate policy. France has promised to raise its concerns at a meeting of G-20 nations later this month.

Draghi said he did not believe recent sharp moves in currency markets were the result of deliberate competitive devaluations, but the ECB would monitor their impact closely.

"They are more the effect of macro policies that are meant to revamp the economies.... such as very low interest rates or the adoption of an inflation target which is distant from current inflation rates," he said. "We will certainly want to see if the appreciation, if sustained, alters our risk assessment as far as price stability is concerned."

Draghi rejected suggestions he had failed when head of the Bank of Italy to oversee Monte dei Paschi di Siena, the bank at the center of a political scandal that could affect the outcome of crucial Italian elections later this month.

"You should certainly discount much of what you hear and read... as part of the regular noise that elections produce," he said.

The Bank of England also resisted pressure to extend its government bond-buying program, leaving the volume at £375 billion, but said it was ready to provide further monetary stimulus if needed.

The U.K. economy contracted by 0.3% in the fourth quarter of 2012, bringing to the brink of a third recession in five years.

"The [bank] continues to judge that the U.K. economy is set for a slow but sustained recovery," it said in a statement. "But the risks are weighted to the downside, not least because of the challenges facing the euro area."

Related: Europe: No retreat from austerity

U.K. manufacturing output bounced back in December -- rising 1.6% after a decline of 0.3% in November -- reducing the risk of a second consecutive negative quarter for gross domestic product.

Still, given the government's determination to push ahead with its austerity program, some analysts say the bank might need to pump more cash into the economy.

"Overall, in the current economic situation, further expansion of the asset purchase program would be warranted if the economy stays weak," the OECD said this week.

The weaker economy is already throwing the government's fiscal plans off course. The Institute for Fiscal Studies said Wednesday the U.K. would borrow £64 billion more than planned in 2014-2015 unless further spending cuts or tax rises were implemented.

By Mark Thompson @CNNMoney

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

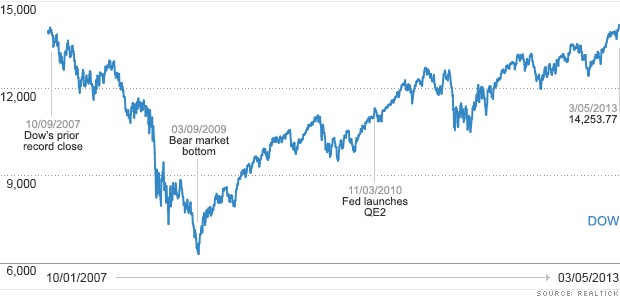

Dow hits new record high

The Dow hit a new record high within the first few minutes of trading Tuesday.

The Dow Jones industrial average gained nearly 100 points, rising as high as 14,226.20. That topped both the Dow's intraday and closing records that were set in October 2007.

The S&P 500 added 10 points, and is within 2% of its record closing high of 1,565.15, also reached in October 2007. The Nasdaq rose 27 points, or 0.9%.

Stocks have had a strong start to 2013. Even with a largely uneventful, February, all three indexes are still up between 6% and 9% so far this year.

Investors will also be looking for any signs of progress in talks to end the budget impasse in Washington, known as sequester. The Obama administration has started making $85 billion of cuts and some federal workers have started getting furlough notices.

U.S. stocks shrugged off the budget fight to end higher Monday.

Related: Fear & Greed index firmly in greed

Aside from Washington's antics, investors will keep tabs on other economic news.

The Institute for Supply Management will release its monthly index on service sector business activity at 10 a.m. ET. Economists are forecasting a slight improvement in that measure of the majority of the nation's economic activity.

Investors are also looking ahead to central bank meetings later this week in Europe, Japan and the U.K., all of which are expected to end with more promises of support the for world's major economies. The week ends with the U.S. jobs report which is forecast to show a pick up in hiring in February.

After the market close, gun maker Smith & Wesson Holding Co (SWHC) is expected to report strong quarterly results. Gun sales have surged in recent months amid speculation about new gun control laws.

JC Penney's (JCP, Fortune 500) shares tumbled, as the struggling retailer is in the third week of a court battle with Macy's (M, Fortune 500) claims that Martha Stewart Living Omnimedia (MSO) violated a previous agreement with Macy's in entering into a new partnership with J.C. Penney.

Genworth Financial Inc. (GNW, Fortune 500) shares rose on rumors that the company is planning a sale.

Investors will likely continue to watch Apple (AAPL, Fortune 500), which hit a new 52-week low on Monday. The stock is down 20% this year. Meanwhile, Google (GOOG, Fortune 500) continues to hit new highs.

European markets were firmer in afternoon trading, while Asian markets ended higher after Chinese Premier Wen Jiabao announced the government will carry a larger deficit in 2013 to help the world's No. 2 economy reach its goal of 7.5% growth this year. The Shanghai Composite added 2.3%, while the Hang Seng increased 0.1% and Japan's Nikkei rose 0.3%.

The dollar fell against the euro, the British pound and the Japanese yen.

Oil and gold prices edged higher.

The price on the 10-year Treasury declined, pushing the yield up to 1.90% from 1.88% late Monday.

By CNNMoney Staff @CNNMoneyInvest

Colleges offer four-year graduation guarantees

Now that the average college freshman takes more than five and a half years to graduate, a growing number of colleges are trying to entice students with guarantees that they will finish in four years -- or the extra tuition will be free.

But most of these four-year guarantees come with fine print that can disqualify many applicants, such as requiring students who sign up for the program freshman year to declare and stick to a major all four years, take inconvenient classes or forgo study abroad. In addition, even the most generous of the guarantees only offer to cover tuition after the fourth year -- students still have to pay for dorm and living costs.

To qualify for a guarantee program, students are typically required to complete at least 30 credits each academic year, meet regularly with advisors, and take required courses.

In return, the colleges typically promise to help students finish in four years by eliminating roadblocks to graduation, such as reducing overcrowding, lowering the number of credits required to graduate, and creating standard four-year plans that can easily be followed. If school-caused delays prevent a student who signs up for a guarantee from finishing in four years, the college promises to pay for any extra courses they need.

Last year, for example, the University at Buffalo launched its "Finish in 4" free-tuition guarantee, and added 30,000 extra seats in bottleneck courses to help ensure students could meet their requirements.

The moves attracted hundreds of new applicants, says vice provost Scott Weber. "We had one of our largest freshmen enrollments this fall," he said.

But some colleges offering these guarantees aren't making the reforms needed to help students finish on time.

Related: Community college grads out-earning bachelor's degree holders

"I would be shocked if [these guarantees were] anything more than a marketing strategy" at schools where a majority of the students take longer than four years to graduate, said Tom Sugar, vice president of Complete College America, a nonprofit that works with states to raise graduation rates.

Some colleges are setting requirements so high that they are discouraging or disqualifying students from taking advantage of the guarantees.

At the California State University, San Bernardino, where only 13% of freshmen finish in four years, priority enrollment and free tuition after four years is only given to students who have committed to a major and the guarantee program before the start of their freshman year.

Officials at the University of Maine at Farmington blamed a low signup rate for its four-year guarantee (only 75 of the school's approximately 480 freshmen signed on last fall) on a contract that was "two-page, dense, and filled with legalese" says associate provost Robert Lively.

Last fall, the school drafted a shorter and simpler contract that it is now promoting to applicants.

Whether or not four-year graduation guarantees actually help students graduate on time, the promises still sound so attractive to applicants that more than 40 colleges offer some sort of pledge or incentive. Among them are many small private colleges, such as DePauw, Juniata College and Washington & Jefferson, as well as many large universities, such as the University of Minnesota, the University of Nebraska and Pace University in New York.

Related: How much will college really cost?

Some other colleges, such as Ball State University and Indiana University, offer "incentives" rather than guarantees. Ball State this winter started paying $500 to students who graduate on time. Indiana University last year announced it would freeze tuition for upperclassmen on track to finish in four years.

To tell whether any of these promises will actually help you graduate on time, experts say applicants should follow these steps:

Read the fine print. Every program is different, so make sure you understand what the college requires from you and what it offers in return. Will you be able to complete the number of required credits? Is your schedule flexible enough to enroll in early morning or night courses if those are the only ones available? How soon will you feel ready to commit to a major? What are you getting in return?

Avoid crowds. One of the most common causes of delayed graduation is overcrowding in required courses, says Michael Lovenheim, a Cornell economist who has researched the issue. So if you have a choice, avoid colleges where students have to scramble to get into the courses they need.

Choose deeds over words. Opt for colleges that are making changes proven to help students graduate on time, whether or not they offer guarantees. Seek out colleges that offer enough classes and set graduation requirements at no more than 120 credit hours, said Complete College America's Sugar.

Accept help. Research shows that students are more likely to stay on track when colleges offer "intrusive advising," or advisors who step in at early signs of trouble such as dropped courses, Sugar adds.

Check the record. Before choosing a college, check its four-year graduation rate -- and find similar colleges with better records - by entering the name of any college you're considering attending into Collegeresults.org.

Focus on the bigger goal. Don't sacrifice your health, grades or important internship opportunities just to finish quickly, advises Dan Black, Americas director of campus recruiting for Ernst & Young. The standard course program for certified public accountants takes five years, for example, but "I don't care how long it takes them," (within reason, anyway) he says of the approximately 9,200 entry-level new graduates he plans to hire this year. Instead, Black gives an edge to students with top grades and internships.

By Kim Clark @CNNMoney

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

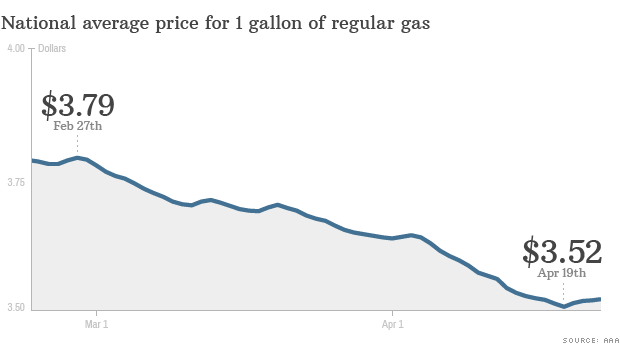

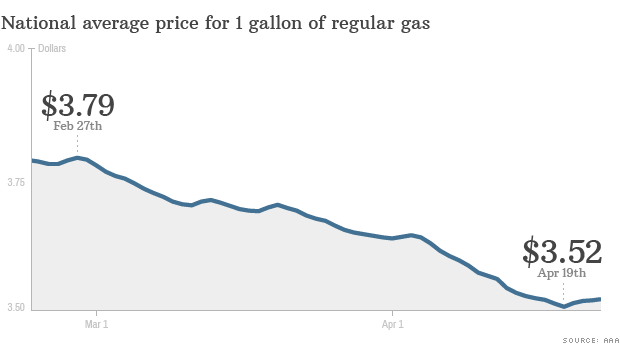

Falling gas prices could boost economy

The sharp drop in gas prices over the last month or so could provide America's economy with a much-needed jolt, putting money into consumers' pockets just as the impact of federal spending cuts reverberates through the economy.

In fact, some economists believe they could balance each other out nearly dollar for dollar.

Gasoline prices have fallen some 30 cents a gallon since hitting a high of nearly $3.80 a gallon earlier this year. The drop is mostly due to declining oil prices.

If the gas price drop continues -- and many expect it will -- prices could slip below $3.40 a gallon by summer, according to the research firm Capital Economics.

If prices stay that low, the savings for drivers over the course of a year could top $80 billion. That's $80 billion to spend on other things like clothes, electronics or entertainment.

Related: Check gas prices in your state

"To put that into context, it is roughly the same size as the sequestration spending cuts that took effect at the start of last month," researchers at Capital Economics wrote in a recent note. As a result, economic growth "might not be as bad as we had initially feared."

Not that the economy's on fire. Most economists are expecting first-quarter growth to come in at a relatively strong 3% or so when the numbers are released later this week.

But it's the second quarter that's got people concerned, partly because of the federal spending cuts and related tax hikes that are sapping consumer spending. Any additional money being pumped into the economy -- from, say, falling gas prices -- could help growth in the second quarter.

"Gasoline prices have been declining this spring, and the national average price is lower today than it was at the same time last year," Gary Thayer, an economist at Wells Fargo, wrote in a note last week. "Consequently, consumer sentiment and consumer spending are likely to improve in the months ahead."

By Steve Hargreaves @CNNMoney

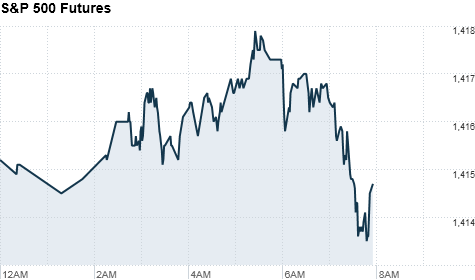

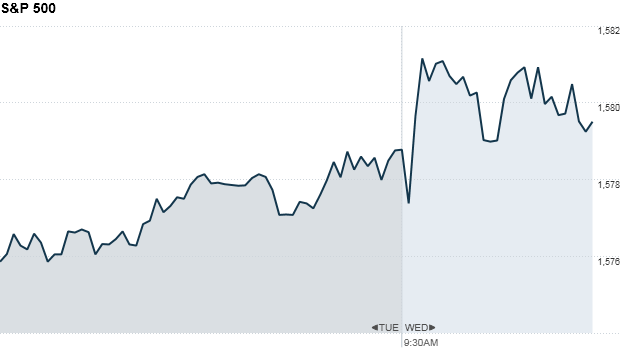

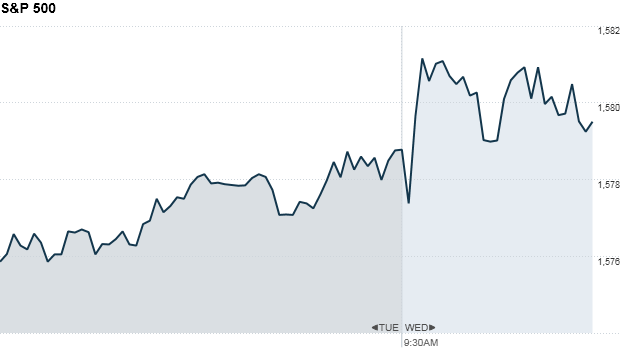

Stocks falter in early trading

Stocks dropped slightly Tuesday, a day after an erroneous tweet wreaked havoc on markets.

The Dow Jones Industrial Average, the S&P 500 and the Nasdaq dropped between 0.2% and 0.4%.

Investors were spooked by a report on durable goods orders that showed orders fell by 5.7% in March -- much worse than analysts had predicted.

Another batch of earnings also gave investors pause.

Boeing (BA, Fortune 500) was the biggest gainer on the Dow, after it reported an increase in profits, even as revenue was dinged by its grounded Dreamliners.

But AT&T (T, Fortune 500) and Procter & Gamble (PG, Fortune 500) offset those gains. AT&T's sales came up short, while Procter & Gamble cut its guidance.

Apple (AAPL, Fortune 500) beat expectations and announced it would raise its quarterly dividend and boost its stock buyback program. But the company still struggled with lower profits on the iPhone and iMac.

Ford (F, Fortune 500) also reported a jump in earnings, helped by sales in North America.

Related: High speed trading fueled Twitter crash

Shares of Juniper Networks' (JNPR) fell more than 7% after the company projected "continued weakness" in its earnings outlook late Tuesday.

Shares of Yum Brands (YUM, Fortune 500) jumped more than 6% after the fast-good restaurant operator reported earnings that topped Wall Street's low expectations.

Related: Fear & Greed Index, Drifting into neutral

Even with the errant tweet, U.S. stocks finished higher Tuesday.

European markets rose in afternoon trading, supported by continuing talk of a ECB rate cut following weak eurozone data. The Ifo German business climate index for April was weaker than expected.

Asian markets ended higher, with Japan's Nikkei adding 2.3%. Hong Kong's Hang Seng added 1.7% and the Shanghai Composite increased 1.6%.

The dollar rose against the euro and the Japanese yen, but fell against the British pound.

Oil and gold prices jumped.

The yield on the 10-year Treasury stayed flat at 1.70%.

By CNNMoney Staff @CNNMoneyInvest

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

The 4 worst tax breaks

If you live in California, you'll probably hate this story. So will anyone who gets health benefits at work or stands to inherit stocks. And if you're one of those guys who manages billions of dollars? Let's just say you'll be less than delighted.

CNNMoney asked several tax experts to identify some of the worst tax breaks for individuals that lawmakers should reform or eliminate.

"It's hard to rank stupid tax provisions because there are so many candidates," said Len Burman, the incoming director of the Tax Policy Center.

"Worst" can mean a provision that disproportionately benefits some more than others, doesn't serve its intended purpose or otherwise provides an unjustified windfall.

Here are just four that experts flagged:

Carried interest: Managers of private equity, venture capital and hedge funds don't pay ordinary income tax rates on a portion of their income.

That portion, known as carried interest, represents a share of profits from the funds they manage. They are paid that share even if they were not required to invest their own money in the funds.

Carried interest is taxed at the long-term capital gains rate of 20% -- well below the top two income tax rates of 35% and 39.6%.

Proponents of the special rate contend that managers assume some risk because they provide hands-on management, connections and their reputations to the companies their funds buy, often for long periods. And there's no guarantee the investments will turn a profit.

Critics of the lower rate contend, among other things, that the managers are really performing a service for a fee -- and therefore should be paying regular income tax rates.

Related: Top 1% get big bang from tax breaks

"Fund managers claim risk-based compensation, which require no financial investment on their part," said Martin Sullivan, chief economist of Tax Analysts.

President Obama has repeatedly proposed taxing carried interest as ordinary income. Such a change could raise $17.4 billion over 10 years, according to estimates from the Joint Committee on Taxation.

Tax exclusion for health insurance: Besides a steady paycheck, one of the biggest workplace benefits for 160 million Americans is the employer subsidized health insurance they receive.

Yes, workers pay for some of the cost of their insurance. But their employers pick up the lion's share, and that share is treated as tax-free income to the worker. It's not subject to income or payroll taxes.

That "health exclusion" also accounts for the lion's share of the cost of federal tax breaks to the government. The Joint Committee on Taxation estimates it will cost $760.4 billion over the next five years, just counting the exclusion from income tax. If the payroll tax exclusion were also counted, the cost would jump by tens of billions of dollars a year.

"Health care benefits represent a large and growing share of compensation, and the exclusion exacerbates the problems of excessive spending on health care, the high cost of health care, and the lack of mobility of health insurance," said Will McBride, chief economist of the Tax Foundation.

State and local tax deduction: Only about one-third of tax filers itemize deductions. Those who do may deduct their state and local taxes (income or sales tax, plus property taxes).

The deduction is a form of federal subsidy to state and local governments. "Theory would suggest that taxpayers are willing to accept higher state and local tax rates and greater state and local public spending because of lower federal income taxes arising from the deduction," according to the nonpartisan Congressional Research Service.

As with other itemized deductions, the state and local deduction disproportionately benefits higher income filers. And it disproportionately benefits those who live in high-tax states and cities. The deduction has become even more valuable to high-income residents in California, where top state income tax rates recently rose to as high as 13.3%.

For this reason, Burman thinks lawmakers should rethink this break.

"The subsidy is most valuable in states with lots of high-income people, which are the places that least need fiscal assistance because they have a robust tax base," Burman said.

If the federal government wants to offer states a hand, he'd rather it give straight grants to states most in need of aid.

The JCT estimates the state and local deduction will cost federal coffers about $278 billion over five years.

Exclusion of capital gains at death: This provision is known among tax wonks as a "step-up in basis."

Essentially, if someone bequeaths to you an investment that has appreciated in value since the day it was first purchased, you won't have to pay any tax on the capital gains that accrued before you inherited it. You would only owe tax on the capital gains that accrue from the day you get it -- and only if you choose to sell the asset.

"Holding stock until death exempts it from capital gains tax. This is a huge and largely unnoticed tax benefit for the super-rich," Sullivan said.

The provision will cost federal coffers an estimated $258 billion over five years.

By Jeanne Sahadi @CNNMoney

Dow keeps winning streak alive

Can U.S. markets keep up the momentum through June?

The Dow Jones Industrial Average was keeping its winning streak going early Monday, while the S&P 500 and Nasdaq flipped between small gains and losses.

It's been a stellar year for stocks so far. All three indexes are up between 14% and 16%.

However, the move higher has come with a dose of volatility over the past few weeks, as investors worry about when the Federal Reserve might pull back on its bond buying program.

Underwhelming readings on manufacturing and construction spending didn't appear to rattle investors' confidence Monday.

Manufacturing contracted for the first time since November, while construction spending didn't rise as much as economists had expected.

Investors are waiting for the one big number this week: the government's monthly jobs report due out on Friday.

Related: Investors flee SAC Capital

America's love affair with automobiles reignited: Ford (F, Fortune 500), General Motors (GM, Fortune 500), and Toyota (TM) all reported stronger-than-expected U.S. auto sales for May.

Merck leads rally in drug stocks: Shares of Merck (MRK, Fortune 500) rose sharply, after the pharmaceutical firm announced a positive study for a skin cancer treatment.

The news boosted shares of GlaxoSmithKline (GSK) and Pfizer (PFE, Fortune 500).

Related: Best deals in investing

Troubles in Turkey: Stocks in Turkey got hammered as protests against Prime Minister Recep Tayyip Erdogan spread across the country.

But other European markets didn't show a sharp reaction to the violence there.

European stocks were mixed in afternoon trading, recovering from earlier losses. London's FTSE 100 remained slightly in the red, while benchmark indexes in Germany and France turned higher.

Related: Fear & Greed Index, idling in neutral

Asian markets ended with losses, led by a 3.7% tumble for Tokyo's Nikkei. The index has lost nearly 12% since its peak in May.

By Maureen Farrell @Maureenmfarrell

|

|

|

| |

|

|

|

|

Vi ne možete otvarati nove teme u ovom forumu

Vi ne možete odgovarati na teme u ovom forumu

Vi ne možete menjati Vaše poruke u ovom forumu

Vi ne možete brisati Vaše poruke u ovom forumu

Vi ne možete glasati u anketama u ovom forumu

Vi ne možete postavljati fajlove u ovom forumu

Vi ne možete preuzeti fajlove sa ovog foruma

|

|