:: ::  |

| Autor |

Poruka |

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

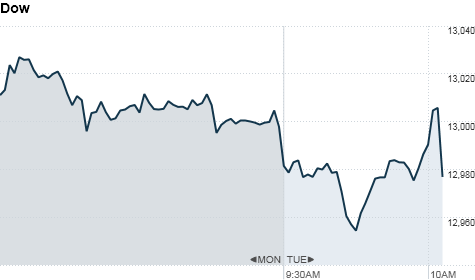

Stocks advance on hopes for Europe

NEW YORK (CNNMoney) -- U.S. stocks moved higher Tuesday, extending gains from the previous day's rally, as investors remain hopeful that leaders are making progress on addressing the eurozone debt crisis.

The Dow Jones industrial average (INDU) rose 59 points, or 0.5%, the S&P 500 (SPX) added 6 points, or 0.5%, and the Nasdaq composite (COMP) gained 1 point, or 0.1%. The day's increase put the Dow back in positive territory for the year, while the S&P 500 and Nasdaq remain in the red.

Financial stocks, which led Monday's advance, were among the losers Tuesday. Bank of America (BAC, Fortune 500) and JPMorgan Chase (JPM, Fortune 500) posted the biggest declines in the Dow. Morgan Stanley (MS, Fortune 500) and Goldman Sachs (GS, Fortune 500) were also down more than 1%.

Nerves were strained after Moody's warned that 87 banks across 15 of the 17 eurozone countries could face downgrades and Italy auctioned €7.5 billion of 3- and 10-year bonds that drew the highest yields in years. Borrowing costs in Italy have been above the uncomfortable 7% mark for days.

But investors are banking on European leaders to step up and agree to a detailed resolution to Europe's debt crisis.

Europe eyes new pact as debt crisis rages

European leaders are working on a new plan to ensure fiscal discipline across the euro area. The proposal is expected to give the European Union greater authority over the budget policies of individual eurozone nations.

"The story continues to be Europe, and signs of anything positive coming out of there in a deeply oversold market are enough to trigger a rally," said Fred Dickson, chief market strategist at D.A. Davidson & Co.

A two-day meeting of eurozone finance ministers gets underway Tuesday, however investors aren't expecting any major announcements until a European Union summit next week.

Optimism about a possible Europe solution, along with strong Black Friday weekend sales, also sent stocks surging on Monday.

But Dickson remains unconvinced that the enthusiasm will last.

"We've had short-term rallies based on frequent bursts of positive news, but those are quickly dampened by reality when nothing comes of these European meetings," he said. "I'm not negative, but I'm skeptical. I'll view these rallies as short-term events until we see signs of a more definitive agreement reached by the eurozone and the European Central Bank."

Economy: Stocks also found support after the Conference Board's Consumer Confidence Index shot up to 56 in November from 39.80 the prior month. Economists were expecting the reading to come in at 42.5.

The S&P/Case Shiller index, a gauge of home prices in 20 major cities, dropped 3.6% in September compared to a year ago, following a 3.8% decline in the previous month. Analysts surveyed by Briefing.com expect prices to have dropped 3.0% versus a year ago.

Companies: Early Tuesday, American Airlines' parent company, AMR Corp. (AMR, Fortune 500), announced that it has filed for Chapter 11 bankruptcy in order to "achieve a cost and debt structure that is industry competitive." The company's stock plunged more than 80%.

Shares of Companies Tiffany & Co (TIF). sank after the luxury jewelry retailer reported earnings that topped forecasts but reeled in its guidance for the fourth quarter.

World markets: European stocks were slightly higher in afternoon trading. Britain's FTSE 100 (UKX) ticked up 0.3%, the DAX (DAX) in Germany rose 0.8% and France's CAC 40 (CAC40) added 0.5%.

Asian markets ended with sharp gains. The Shanghai Composite (SHCOMP) and the Hang Seng (HSI) in Hong Kong climbed 1.2%, and Japan's Nikkei (N225) rallied 2.3%.

Currencies and commodities: The dollar slumped against the euro, the British pound and the Japanese yen.

Oil for January delivery rose 99 cents to $99.20 a barrel.

Gold futures for December delivery rose $1.60 to $1,712.40 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury edged lower, pushing the yield up to 2.04% from 1.96% late Monday.

By Hibah Yousuf @CNNMoneyMarkets

Home prices ease to 8-year lows

NEW YORK (CNNMoney) -- National home prices declined on an annual basis in the third quarter, to levels last seen eight years ago -- but the rate of decline slowed from the prior three months, according to a report issued Tuesday.

Home prices dropped 3.9% year-over-year during the three months ended Sept. 30, according to the S&P/Case-Shiller national home price index. That was an improvement in the annual rate of change; during the second quarter of the year, prices were down 5.8%.

Prices were nearly flat over the summer, gaining just 0.1% compared with three months earlier.

A separate S&P/Case-Shiller index covering 20 major cities fell 3.6% year-over-year. The U.S. average home is selling for about the same price it fetched back in 2003.

"Over the last year, home prices in most cities drifted lower," said David Blitzer, a spokesman for S&P. "Any chance for a sustained recovery will probably need a stronger economy."

The report was a disappointment. The year-over-year drop of 3.6% in the 20-city index was steeper than a consensus of experts from Briefing.com was projecting. They has estimated a 3% decline.

Other housing market metrics had improved lately. New-home sales edged up in October as did existing home sales. Building permits have risen as well.

But, after many months of decline, foreclosures have been on the rise. If they start to flood the market again, they will drive home prices down.

Several cities have struggled mightily over the past 12 months, with prices down 9.8% in Metropolitan Atlanta over that period. Minneapolis prices were down 7.4% and Las Vegas prices dropped 7.3%. Only Detroit, up 3.7%, and Washington, 1% higher, gained over the past 12 months.

By Les Christie @CNNMoney

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

November jobs report: Hiring up, unemployment down

WASHINGTON (CNNMoney) -- Hiring accelerated in November, and the unemployment rate unexpectedly plummeted.

Employers added 120,000 jobs in November, the Labor Department reported Friday, marking a pick-up in hiring from October.

Job growth from the two prior months was also stronger than originally reported. An additional 72,000 jobs were added during September and October combined.

Young workers getting hired again

The government has been bleeding jobs all year, and continued to do so last month, primarily at the state and local level. The public sector cut 20,000 jobs in November

But private businesses have been adding jobs consistently since March 2010. In November, private employers added 140,000 jobs.

The retail sector alone added about 50,000 jobs, more than half of which were at clothing and accessory stores, while the leisure and hospitality industry added 22,000 jobs, mostly at restaurants. Because the Labor Department adjusts its numbers to account for seasonal trends, job growth in those industries is not necessarily because of holiday hiring.

Overall, the labor market still has a long way to go to recover from the financial crisis. Less than a third of all the 8.8 million jobs shed have since been recovered. A whopping 13.3 million people remain unemployed and 43% of those have been out of work for more than six months.

By Annalyn Censky @CNNMoney

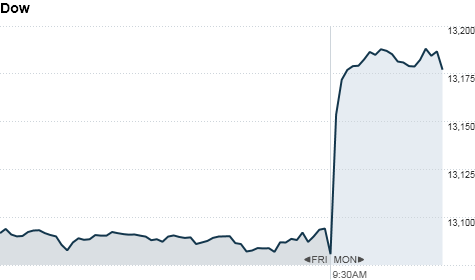

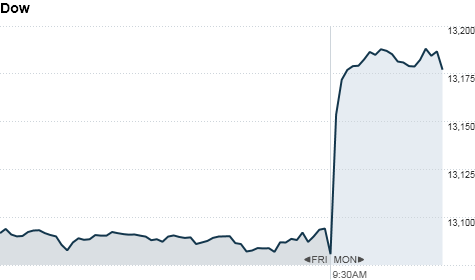

Stocks get a jobs boost

NEW YORK (CNNMoney) -- U.S. stocks opened with big gains Friday, after the government's closely-watched jobs report showed a bigger-than-expected boost in payrolls last month.

The Dow Jones industrial average (INDU) added 86 points, or 0.7%, the S&P 500 (SPX) gained 9 points, or 0.8%, and the Nasdaq (COMP) rose 21 points, or 0.8%.

The U.S. government said employers boosted payrolls by 120,000 jobs in November, from an upwardly revised 100,000 jobs in October. The unemployment rate eased to 8.6%, the lowest level since March 2009.

A CNNMoney survey of 21 economists had predicted that 110,000 jobs were added in November, while the unemployment rate was expected to stay unchanged at 9%.

"We're slowly starting to see improvement in U.S. economic numbers, and if that data comes in better than expected -- markets could really take it positively, and see it as finally drawing a line under unemployment," said Manoj Ladwa, a senior trader at ETX Capital.

Fears about U.S. keep investors in Europe

Investors also remain optimistic that Europe is on the right path.

In a speech to the German parliament Friday, Merkel reaffirmed her support for the euro and called for changes to the European Union treaty. She stated that legally-binding rules need to be put in place to help the region resolve its massive debt crisis.

"This is a positive, because the EU does need to address its original treaty and amend it pretty soon," Ladwa said. "[Merkel] is pushing forward for more integration for the eurozone, which would safeguard the region and hold back on the worse case scenario of the eurozone breaking up."

Ladwa said that the sharp move lower in 10-year sovereign bond yields on Friday could also indicate that the risk of contagion is diminishing, thanks to the plan among a group of central banks -- including the Federal Reserve and the European Central Bank -- to inject liquidity into global markets to make it cheaper for banks to borrow U.S. dollars.

"The feel good effect from the central banks' plan for liquidity stimulation is still there," Ladwa said. "The pressure seems to be coming off some of the [eurozone] nations, so somewhere like Italy might not have to go down the route of seeking more money from the EU."

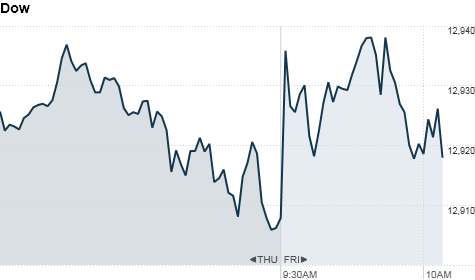

U.S. stocks ended mixed Thursday, after a big rally on Wednesday, as investors were reluctant to push prices higher amid ongoing worries about Europe.

World markets: European stocks climbed in afternoon trading. Britain's FTSE 100 (UKX) jumped 1.4%, the DAX (DAX) in Germany rose 1.4% and France's CAC 40 (CAC40) rallied 1.8%.

Europe debt crisis threatens Obama campaign

Asian markets ended mixed. The Shanghai Composite (SHCOMP) slid 1.1%, while the Hang Seng (HSI) in Hong Kong edged up 0.2% and Japan's Nikkei (N225) rose 0.5%.

Companies: Shares of Research in Motion (RIM) slid nearly 7% after the company said it no longer expects to meet its full-year earnings target.

Shares of Big Lots (BIG, Fortune 500) fell almost 7% after the retailer posted a sharp decline in third-quarter profit.

Currencies and commodities: The dollar slipped against the euro, but gained versus the British pound. It gained ground against the Japanese yen.

Oil for January delivery slipped ticked up 25 cents to $100.45 a barrel.

Gold futures for February delivery gained $16 to $1,755.80 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 2.12% from 2.07% late Thursday.

By CNNMoney staff @CNNMoneyMarkets

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

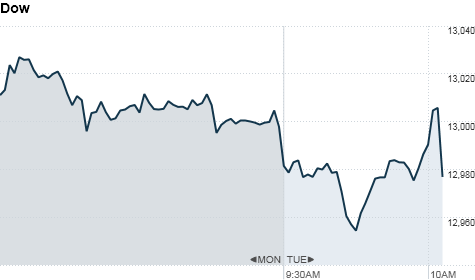

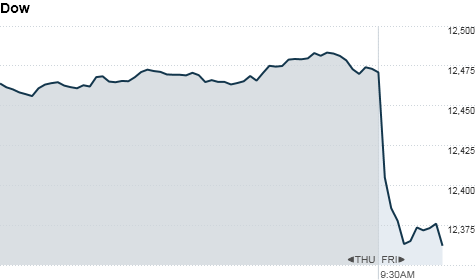

Stocks trim gains on euro jitters

NEW YORK (CNNMoney) -- U.S. stocks pared earlier gains Tuesday following reports that German Chancellor Angela Merkel rejected the idea of increasing Europe's bailout fund.

At midday, the Dow Jones industrial average (INDU) was up just 59 points, or 0.5%, and the S&P 500 (SPX) gained 5 points, or 0.4%. The Nasdaq briefly drifted into the red, but recovered to rise 2 points, or 0.1%. All the major indexes started the day about 1% higher.

The pullback came after a Dow Jones report said that Merkel has rejected suggestions to raise the funding limit for the European Stability Mechanism, or ESM, which currently stands at €500 billion. The fund goes into effect next year and may run alongside the €440 billion European Financial Stability Facility.

U.S. stocks started the day with solid gains thanks to an initial void of bad news out of Europe. Though political leaders have been taking steps toward a resolution for the region's debt problems, the details have yet to be worked out.

"All eyes are still on Europe," said Tim Ralph, portfolio manager at Biltmore Capital. Official meetings and statements will be minimal as the year come's to a close, but Ralph said that the market remains vulnerable to headline risks.

Investors are on watch for possible downgrades on European country credit ratings from Standard and Poor's, which warned last week that it may strip some of Europe's biggest economies, like Germany and France, of their AAA-rating.

Investors are also waiting to hear what the Federal Reserve will say at the end of its policy-making meeting.

U.S. stocks tumbled in a broad sell-off Monday, amid growing investor doubt that Europe's debt crisis will be resolved, and a sales warning from chipmaker Intel.

Europe debt saga far from over

World markets: European stocks finished mixed. Britain's FTSE 100 (UKX) ticked up 1%, while the DAX (DAX) in Germany fell 0.3% and France's CAC 40 (CAC40) edged down 0.8%.

Asian markets ended lower. The Shanghai Composite (SHCOMP) lost 1.9%, the Hang Seng (HSI) in Hong Kong shed 0.7% and Japan's Nikkei (N225) declined 1.2%.

Companies: Former MF Global (MFGLQ) CEO Jon Corzine is back to testify before Congress Tuesday, this time flanked by two former colleagues from the brokerage's parent company, MF Global Holdings: Chief operating officer Bradley Abelow and chief financial officer Henri Steenkamp.

Seeking shelter in FDIC banks

Shares of electronics retailer Best Buy (BBY, Fortune 500) got slammed after the company reported earnings that fell far short of forecasts.

Intel warned that it will badly miss its sales forecast for the current quarter on Monday, because of the worldwide hard drive shortage caused by massive floods in Thailand. Shares of Intel (INTC, Fortune 500) dropped nearly 4% in trading Monday, and continued to slip on Tuesday.

Will Verizon Buy Netlix?

Netflix's (NFLX) continued to rise, on chatter that the company could be acquired by Verizon (VZ, Fortune 500). On Monday, a spokesman for Netflix said the company doesn't comment on speculation.

Economy: Retail sales for the month of November rose 0.2%, which was lower than expected, according to the U.S. Commerce Department. But the disappointing report had little impact.

Sales were expected to have increased by 0.6%, after a 0.5% increase the month prior.

Investors are also awaiting news from the Federal Reserve, which is expected to hold interest rates at 0.25% for the month of December.

Currencies and commodities: The dollar gained ground against the euro and the British pound, but slipped versus the Japanese yen.

Oil for January delivery rose $2.73 to $100.50 a barrel.

Gold futures for February delivery rose $7.50 to $1,675.70 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury dropped, pushing the yield up to 2.04% from 2.01% late Monday.

By Hibah Yousuf @CNNMoneyMarkets

Shoppers slow down

NEW YORK (CNNMoney) -- Consumers slowed the pace of their shopping in November, but that might not bode ill for the entire holiday season.

The Commerce Department reported Tuesday that retail sales were up 0.2% compared to October. The result was well short of the 0.6% increase forecast by economists surveyed by Briefing.com, and the 0.6% gain posted in October.

On an annual basis, sales were up 6.7%, below the 7.5% pace the month before.

The story was similar when auto sales were excluded. Those sales increased by only 0.2%, well off the 0.5% forecast.

While the numbers might have disappointed forecasters, any concern about the holiday season was tempered by the fact that November came on the heels of two months of big sales increases.

With that in mind, Mark Vitner, senior economist at Wells Fargo, says holiday sales are still on track for a strong season.

"The level of sales is still extremely, extremely strong," Vitner said. "The categories that matter most for holiday shopping were all up solidly."

One of those categories -- electronics and appliance store sales -- increased by 2.1% over the previous month. But enthusiasm about the sector was countered by a separate report showed Best Buy (BBY, Fortune 500) earnings declined in the latest quarter.

Clothing retailers saw their sales bump up by 0.5%

"I think we are still on track for a pretty decent holiday shopping season," Vitner said.

Late in the month, Black Friday shoppers showed up in droves and spent a record amount of money over the Thanksgiving weekend -- but that doesn't mean holiday sales momentum will continue through Christmas.

Typically, sales over Black Friday weekend comprise 10% of total holiday sales. That means there is a long way to go before the season can be declared a success -- or failure.

Food and beverage stores were among the worst performers in November, registering a 0.2% decline from October.

By Charles Riley @CNNMoney

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

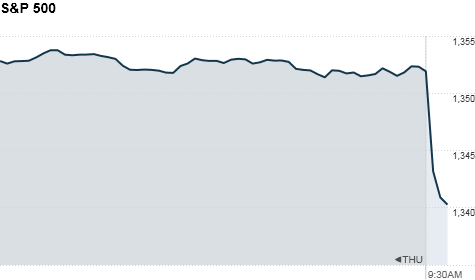

S&P 500 moves back into the black

NEW YORK (CNNMoney) -- U.S. stocks rose Thursday, pushing the S&P 500 back into positive territory for the year, as investors welcomed an upbeat report on the housing market.

The Dow Jones industrial average (INDU) was up 91 points, or 0.8%, in late morning trading. The S&P 500 (SPX) added 9 points, or 0.8%. The Nasdaq (COMP) rose 7 points, or 0.3%.

Thursday's rebound put the S&P 500 back on track for a modest gain in 2011, after the broad market index fell sharply Wednesday.

The National Association of Realtors index of pending home sales, which measures signed sales contracts but not closed sales, rose 4% to a seasonally adjusted annual rate of 4.42 million in November from 4.25 million in October.

Economist had expected the a 0.6% increase in pending home sales.

The report boosted shares of homebuilders, including Pulte (PHM, Fortune 500), Masco (MAS, Fortune 500), Lennar (LEN) and DR Horton (DHI, Fortune 500). Investors also scooped up banking stocks, which have been among the worst performers this year. Bank of America (BAC, Fortune 500), Citigroup (C, Fortune 500) and JPMorgan (JPM, Fortune 500) all rose.

Traders said low volume, typical of the holiday week, has led to more pronounced swings, and some of the moves are coming from year-end portfolio rebalancing rather than convictions over the trajectory of the market or particular stocks.

Are you a markets whiz?

"We expect light trading through today and tomorrow, and any noise can create wild swings," said Doug Cote, chief market strategist at ING Investment Management.

Looking ahead, many investors expect stocks to move higher in the first few months of 2012.

The U.S. economy has shown signs of improvement recently, with economists forecasting a 3.3% increase in gross domestic product in the final three months of 2011. And corporate profits are expected to rise in the fourth quarter, continuing an 11-month streak.

But the outlook for next year remains clouded by the debt crisis in Europe, which continues to weigh on demand for risk assets such as stocks.

On Thursday, an auction of Italian 10-year bonds, which have seen yields continue to flirt with the 7% danger zone, provided muted results. While yields were reported below prior levels, demand was short.

The euro fell to a 17-month low and analysts warn the currency could fall even further in 2012.

"Europe is a powder keg and could explode at any time, and likely will when we are the most complacent," said Keith Springer, president of Springer Financial Advisors in Sacramento.

Economy: Jobless claims rose 15,000 to 381,000 in the latest week, according to the U.S. Labor Department. Analysts surveyed by Briefing.com had expected 368,000 claims.

But the figure remained below 400,000, giving investors hope that the labor market will strengthen in the new year.

Companies: Amazon (AMZN, Fortune 500) fell 3.4% after analysts at Goldman Sachs (GS, Fortune 500) suggested that the online retailer's sales growth for the holiday period may fall short of expectations.

Shares of Yahoo (YHOO, Fortune 500) gained 1% after reports that China's Alibaba Group has hired a lobbying firm to prepare a bid for Yahoo.

BP (BP) edged higher despite reports that employees could face criminal charges in relation to last year's Gulf of Mexico oil spill.

World markets: European stocks closed higher. Britain's FTSE 100 (UKX) added 0.8%, the DAX (DAX) in Germany rose 0.9% and France's CAC 40 (CAC40) rose 1.1%.

Asian markets ended mixed. The Shanghai Composite (SHCOMP) edged up 0.2%, the Hang Seng (HSI) in Hong Kong fell 0.7% and Japan's Nikkei (N225) lost 0.3%.

Betting on the dollar in 2012

Currencies and commodities: The dollar gained strength against the euro and the British pound but fell versus the Japanese yen.

Oil for February delivery rose 31 cents to $99.05 a barrel.

Gold futures for February delivery fell $25.90 to $1,538.20 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury eased, with the yield rising to 1.93% from late Wednesday.

By Ben Rooney @CNNMoneyMarkets

Euro falls to 17-month low

NEW YORK (CNNMoney) -- Selling pressure pushed the euro to its lowest level since mid-2010, and the currency could go even lower early next year.

The euro slid as low as $1.2857 -- a level not seen since July 2010, around the time when the Federal Reserve predicted a weaker recovery and Fed chairman Ben Bernanke said the outlook was "unusually uncertain."

Part of the move was attributed to light volume, which typically leads to more pronounced moves. But one expert said the euro could slide even further come January.

"Investors seem increasingly convinced that the European situation will be stabilized," said Sebastien Galy, senior currency analyst at Societe Generale.

This week's Italian bond auctions signal more confidence in shorter-term debt, with strong demand and sharply lower yields than prior auctions. That suggests banks are willing to take on that shorter-term risk.

Betting on the dollar

If that trend continues, banks may start to buy up longer-dated debt, which turns out to be "risk positive, but euro negative," said Galy.

He said the euro could bounce back to $1.30, but he sees another slide back toward $1.26 in January.

"Lower financing costs are helpful for European stocks and sentiment [but] investors perceive it as a form of quantitative easing by the back door, which means that more euro are printed," Galy explained.

It would mean a boost for the U.S. currency.

A stronger dollar may sound like a good thing, but for companies that do a lot of business outside of the United States, the opposite holds true. That's because companies convert their revenue back into dollars when they report quarterly results. And a stronger dollar can crimp that conversion.

Just last month, Fossil (FOSL), which generates more than 50% of its revenue from outside of the United States, trimmed its fourth-quarter earnings forecast. Other companies, including Royal Caribbean Cruises (RCL), Compuware (CPWR), and Tupperware Brands (TUP), also cited the dollar's strength as a reason for weaker outlooks.

By Catherine Tymkiw @CNNMoneyMarkets

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

Stocks: New Year's rally fizzles

NEW YORK (CNNMoney) -- U.S. stocks dipped early Wednesday as investors refocused on Europe's debt crisis following a brief respite in the previous session.

The Dow Jones industrial average (INDU) was down 9 points, or 0.1%, in morning trading. The S&P 500 (SPX) declined 2 points, or 0.2%. The Nasdaq (COMP) lost 11 points, or 0.4%.

Stocks rallied Tuesday following strong manufacturing reports from China, India and the United States.

But the tone was cautious Wednesday as jitters surrounding Europe's debt crisis resurfaced. Uncertainty about Greece, along with reports that Spain might seek rescue funding, weighed on sentiment.

A spokeswoman for the Spanish government told CNN the reports were "a complete lie" and "radically false" and, separately, Greek officials said Tuesday that progress had been made.

"We're still watching Europe simmering now. We have another summit coming up and the problems are all still there," said Scott Brown, chief economist for Raymond James.

Europe: Still a huge pain for investors

European Union leaders hold their first summit of 2012 on Jan. 30. Political leaders hashed out a fiscal agreement in early December, but investors remain skeptical about how effective it will be.

Concerns about European banks were also in focus after Italy's UniCredit announced a €7.5 billion offering of new shares. UniCredit fell nearly 10% on the Milan stock exchange amid reports that demand for the offering was weak despite a steep discount in price.

Shares of U.S. banks pared Tuesday's gains, with Bank of America (BAC, Fortune 500), Citigroup (C, Fortune 500) and JPMorgan (JPM, Fortune 500) all lower.

World markets: European stocks fell in afternoon trading. Britain's FTSE 100 (UKX) lost 0.2%, while the DAX (DAX) in Germany shed 0.8% and France's CAC 40 (CAC40) slid 1%.

Asian markets finished mixed. The Nikkei (N225) gained 1.2%, while the Shanghai Composite (SHCOMP) fell 1.4% and the Hang Seng (HSI) lost 0.8%.

Economy: The Census Bureau will release data on factory orders for the month of November before the opening bell. Analysts surveyed by Briefing.com expect orders to have risen 2.1% in November, after dropping by 0.4% in October.

In the afternoon, the Commerce Department will release data on auto and truck sales for December. Auto sales stood at a 4.36 million annual rate in November, while truck sales were at a 5.98 million rate.

Companies: Yahoo (YHOO, Fortune 500) named PayPal president Scott Thompson as its new CEO.

Caterpillar (CAT, Fortune 500) shares fell after the construction equipment manufacturer announced it will expand its research and development center in Wuxi, China.

Dunkin' Brands (DNKN) shares climbed after the company announced it plans to double the number of its Dunkin' Donuts restaurants in the United States in the next 20 years. The chain currently operates about 7,000 restaurants nationwide.

Cabot Oil & Gas (COG) announced a 2-for-1 stock split, after its stock rallied 105% over the last year. The company also plans to increase its quarterly dividend 33%.

Currencies and commodities: The dollar rose against the euro and British pound, but fell versus the Japanese yen.

Oil for February delivery rose 18 cents to $103.04 a barrel.

Gold futures for February delivery rose $14.60 to $1,650.10 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 1.97%.

By CNNMoney staff @CNNMoneyMarkets

Europe: Still a huge pain in the neck for investors

NEW YORK (CNNMoney) -- Investing experts may be predicting a modest rise for stocks in 2012, but it will be far from smooth sailing.

The nastiest headwinds continue to blow out of Europe, according to an exclusive CNNMoney survey. In fact, more than two-thirds of the 35 market strategists surveyed agree that Europe's nearly 2-year-old debt crisis will drive investor sentiment and the market's moves in 2012 -- pretty much like it did in the latter half of 2011.

"Europeans have been dancing on the edge of a cliff for some time now, but this could go on for an extended period," said Mark Coffelt, president of Empiric Advisors. "The debt problems there will continue to irritate the market all of next year, and likely well beyond that."

While strategists largely agree that the worst-case scenario -- a break-up of the eurozone -- is an unlikely (and unwanted) outcome, the problems could get worse than they are now, despite the efforts to solve them.

"It's hard to say how bad it's going to get, but you could have a situation where the stronger countries decide to jettison the weaker ones," said Peter Tuz, president at Chase Investment Counsel.

"Or you could see something where Greece decides to go its separate way," Tuz added. "The market could live with that, but once you throw Italy and Spain into the mix, that's much harder to swallow."

CNNMoney survey: Where the markets are headed in 2012

Coffelt also said that investors are more worried about how Europe's sovereign debt problems will impact bank balance sheets, and in turn, global economic growth.

"European banks are loaded up on sovereign debt, so if there is a default by a European country, the whole banking sector could be in deep trouble," said Coffelt.

In an effort to clean up their balance sheets and soften the blow of a sovereign default, European banks are in the process of deleveraging. That means reducing the amount of debt they hold and tightening lending standards, the latter of which typically hinders economic growth.

To slow down and mitigate the effects of that process, the European Central Bank stepped in last month with a €489.19 billion ($643.18 billion) lifeline that will allow European banks to take out 3-year loans at a low rate of 1%.

"Of all the actions we've seen so far, the ECB's loan program is a big step that will help the banks," said Tuz, "But there are still a lot of issues, and there doesn't seem to be a be-all and end-all solution."

European recovery? Wait till 2013 (at least)

Investors are also holding out hope for the central bank to commit to buying an unlimited amount of European sovereign debt to provide an even more secure backstop to Europe's problems.

Tuz said he will be keeping a close eye on European banks as they begin to open the books and report full-year financial results for 2011, which should include how much capital they have.

In addition to Europe's problems, investors are also casting a nervous eye on Washington.

As the November elections near, the political gridlock that frustrated investors last year will remain in the spotlight.

While stocks perform well in election years on a historical basis, the high degree of political uncertainties will make it "difficult for business and individuals to plan and spend money," said Frank Fantozzi, CEO of Planned Financial Services.

"Businesses aren't sure how much to invest, or consider expansion, because there is no clear framework from the government," he added.

By Hibah Yousuf @CNNMoneyMarkets

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

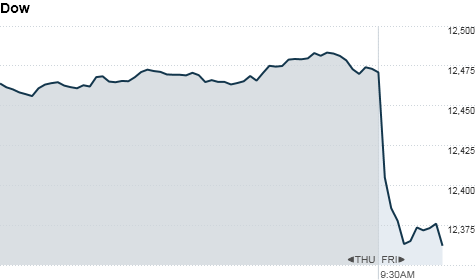

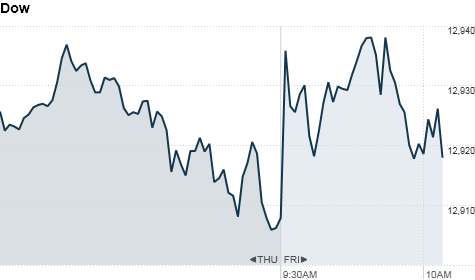

Stocks slide on eurozone downgrade chatter

NEW YORK (CNNMoney) -- U.S. stocks slid early Friday as anxious investors reacted to reports suggesting that Standard and Poor's may downgrade several eurozone countries later in the day.

JPMorgan Chase's disappointing fourth-quarter earnings also weighed on the market.

The Dow Jones industrial average (INDU) dropped 99 points, or 0.8%, the S&P 500 (SPX) fell 10 points, or 0.8%, and the Nasdaq composite (COMP) lost 14 points, or 0.5%.

While solid demand at recent debt auctions in Italy and Spain have calmed some investors, a Reuters report suggesting thatS&P could downgrade several eurozone countries at some point Friday sparked a fresh bout of worries.

Last month, the rating agency put 15 members of the euro currency union, including top-rated Germany and France, on review for a rating cut. The Reuters report, citing a "senior eurozone source," said Germany would not be among the downgraded countries.

S&P did not comment on the report.

Europe on downgrade watch

Meanwhile, investors were also on edge after lackluster earnings from JPMorgan Chase, the first of the big Wall Street banks to deliver fourth-quarter results.

JPMorgan Chase (JPM, Fortune 500) shares fell 3%, after the bank announced it earned 90 cents per share in the fourth quarter, down from $1.12 a year earlier.

In a statement, CEO Jamie Dimon called the results "disappointing," but said JPMorgan sees "see signs of improvement in loan demand and credit quality" going forward.

Investors will be tuning into a slew of bank earnings next week. Wells Fargo (WFC, Fortune 500) and Citigroup (C, Fortune 500) are scheduled to report their earnings on Tuesday. Goldman Sachs (GS, Fortune 500) reports on Wednesday, and Bank of America (BAC, Fortune 500) and Morgan Stanley (MS, Fortune 500) weigh in on Thursday.

Stocks managed to close slightly higher Thursday, despite a choppy day of trading.

Lure to leave the euro may prove irresistible

World markets: European stocks turned lower in afternoon trading, amid downgrade concerns. Britain's FTSE 100 (UKX) fell 0.8%, the DAX (DAX) in Germany dropped 0.8% and France's CAC 40 (CAC40) slipped 0.2%.

Asian markets ended mixed. The Shanghai Composite (SHCOMP) lost 1.3%, while Japan's Nikkei (N225) gained 1.4% and the Hang Seng (HSI) in Hong Kong added 0.6%.

Companies: Novartis (NVS) shares fell after the pharmaceutical company announced it is restructuring its U.S. business -- a move that will result in 1,960 job cuts.

The company said the restructuring will lead to a charge of $160 million in the first quarter of 2012, and an annual savings of approximately $450 million by 2013.

Economy: The government said the nation's trade gap widened in November to $47.75 billion. Analysts surveyed by Briefing.com expected the deficit to stand at $44 billion.

December import prices slid 0.1%, while export prices were down 0.5%.

Later Friday, the University of Michigan will release its Consumer Sentiment Index for the month of January, which is expected to have improved to 71.2 from 69.9 in December.

Currencies and commodities: The dollar gained strength against the euro, British pound and the Japanese yen.

Oil for February delivery fell 75 cents to $98.35 a barrel.

Gold futures for February delivery fell $7.70 to $1,640 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 1.88% from 1.93% late Thursday.

By CNNMoney staff @CNNMoneyMarkets

JPMorgan profit drops 23%

NEW YORK (CNNMoney) -- JPMorgan reported a sharp drop in quarterly earnings Friday morning, hit by big losses from its investment banking and trading divisions.

The nation's largest bank by assets said it earned $3.7 billion, or 90 cents per share, in the final three months of 2011. The results were in line with estimates but down 23% from $4.8 billion, or $1.12 per share, in the same period a year ago.

Shares of JPMorgan (JPM, Fortune 500) fell 3% in early trading.

JPMorgan continued to struggle with declining profits in its investment banking and asset management divisions.

Net income from investment banking fell 52% to $726 million. The drop reflects a $567 million loss related to a narrowing of the spreads between interest rates on certain assets.

Excluding those so-called debit valuation adjustments, or DVA, JPMorgan said its investment banking division would have earned $1.1 billion.

Earlier this year, JPMorgan and other major U.S. banks had benefited from such adjustments.

"As we have consistently said, whether positive or negative, we do not consider DVA reflective of the underlying operations of the company," said JPMorgan CEO Jamie Dimon in a statement.

Meanwhile, net income from JPMorgan's asset management business sank 40% to $302 million in the fourth quarter.

On the bright side, Dimon said the bank is beginning to see signs of improvement in loan demand and credit quality as the economy continues to recover.

JPMorgan said its real estate portfolio lost $11 million in the fourth quarter, compared with a loss of $823 million a year ago.

In addition, the bank set aside $646 million as a provision for losses in its real estate portfolio. That's down from a provision of $2.3 billion in the same period a year ago.

For the full year, JPMorgan reported net income of $19 billion, or $4.48 a share, up from $17.4 billion $3.96 a share, in 2010. Analysts were expecting $4.81 a share. Shares of major U.S. banks, which were among the worst performers last year, have had a nice bounce since the new year started.

Yes, you can dump your bank

Investors have been regaining some appetite for risky investments and bank stocks are considered cheap. But the outlook for the sector remains clouded by the sluggish economy, ongoing problems in the housing market and a host of new government regulations that could hit banks' most profitable business lines.

JPMorgan is the first major U.S. bank to release results in what is expected to be a mixed quarter for the financial services sector. Bank of America (BAC, Fortune 500), Citigroup (C, Fortune 500), Goldman Sachs (GS, Fortune 500), Wells Fargo (WFC, Fortune 500) and Morgan Stanley (MS, Fortune 500) will release quarterly statements in the next few weeks.

By Ben Rooney @CNNMoneyMarkets

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

Stocks: Investors on the sidelines

NEW YORK (CNNMoney) -- U.S. investors were unwilling to place any big bets early Friday, as key Greek debt talks remain unresolved.

The Dow Jones industrial average (INDU) added 36 points, or 0.3%. The S&P 500 (SPX) lost 2 points, or 0.1%. The Nasdaq (COMP) shed 7 points, or 0.2%.

Investors continue to fear repercussions from the European debt crisis, particularly the prospect that Greece may end up defaulting in a disorderly fashion. A deal on restructuring Greek debt remained elusive on Thursday, but talks continue Friday.

The deal is a key condition for Greece to receive additional bailout funds from the European Union and International Monetary Fund. Without additional financial support, Greece may not be able to make a €14 billion payment it owes on bonds that comes due March 20.

Officials from the IMF, EU and European Central bank, known as the troika, are also in Athens reviewing the nation's finances.

Greek debt talks remain elusive

Investors are still weighing quarterly results from some of the nation's biggest tech firms that reported after the bell Thursday. Microsoft (MSFT, Fortune 500), Intel (INTC, Fortune 500) and IBM (IBM, Fortune 500) posted solid fourth-quarter earnings but Google badly missed Wall Street forecasts.

"Google was the biggest disappointment, but I would argue that that's just a temporary phenomenon," said Chip Cobb, senior vice president at Bryn Mawr Trust Asset Management.

Google (GOOG, Fortune 500) shares plunged more than 7% Friday, while IBM and Microsoft both gained more than 2%. Intel shares were up 0.1%.

U.S. stocks advanced Thursday, for a third straight session, thanks to solid gains from financial stocks. Shares of both Bank of America (BAC, Fortune 500) and Morgan Stanley (MS, Fortune 500) gained after the firms released their quarterly results.

World markets: European stocks were mixed in morning trading. Britain's FTSE 100 (UKX) ticked down 0.04%, while the DAX (DAX) in Germany slipped 0.5% and France's CAC 40 (CAC40) fell 0.4%.

Asian markets ended higher. The Shanghai Composite (SHCOMP) climbed 1%, the Hang Seng (HSI) in Hong Kong added 0.8% and Japan's Nikkei (N225) rose 1.5%.

Companies: U.S. markets have more corporate earnings to digest, after Dow component General Electric (GE, Fortune 500) reported its quarterly results Friday morning. The company's earnings just beat forecasts, but GE's shares fell 2.2%, as its revenue fell short of expectations.

100 Best Companies to Work For

Shares of Apple (AAPL, Fortune 500) edged slightly lower, a day after the tech giant's market cap briefly topped $400 billion.

Shares of Carnival Corp. (CCL), which owns the grounded Italian cruise liner Costa Concordia, remain under pressure. Carnival's stock has shed 7% since the Jan. 13 accident. Shares were down another 2% Friday.

Economy: Investors received an auspicious report on existing home sales from the National Association of Realtors Friday morning. Sales rose by 5% in December, faster than an expected 2.9%, according to a survey of analysts by Briefing.com.

Homes sold at an annual rate of 4.6 million, up from a rate of 4.42 million in November. The realtor group cited early signs of 'sustained recovery.'

Currencies and commodities: The dollar rose against the euro, the British pound and the Japanese yen.

Oil for February delivery slipped 61 cents to $99.78 a barrel. Oil for March deliver, which becomes the active contract at the close of trade Friday,lost $1.44 to $99.98.

Gold futures for February delivery fell $1.50 to $1,653.0 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 1.98%.

By Maureen Farrell @CNNMoneyMarkets

Bank investors better get used to low returns

Reduced risk has translated into a return on shareholder's equity that's more akin to a sleepy regulated utility than a top investment firm.

FORTUNE -- Wall Street's cash printing machine may be finally out of ink. One by one, the big U.S. banks reported dismal quarterly earnings this week, blaming the poor results on everything from the European debt crisis to court settlements.

Morgan Stanley and Bank of America were the latest disappointments Thursday morning, with profits for the fourth quarter at both firms down around 130%, compared with the same time last year, after stripping out a onetime $5.3 billion gain at Bank of America. Despite the poor results, the two banks managed to beat low expectations and saw their shares rise.

While tough market conditions did play a role in ruining Wall Street's annual money dance, it was hardly the main reason for its poor performance. The traditional investment banking and lending businesses have been gutted after new regulations forced the banks to decrease risk. Safer investing on behalf of the banks this quarter has translated into a return on shareholder's equity that's more akin to a sleepy regulated utility as opposed to an aggressive investment firm.

So should bank investors get used to such lackluster and weak returns on their capital? While not every firm has the exact same problems, there is a common theme running throughout their earnings. Trading revenues at all major banks were down significantly from the heydays before the credit crisis. As a result, the firms' return on common shareholder equity, or ROE, which measures the efficiency of a company's earnings power, has collapsed.

Let's look at some numbers. Given the lumpiness of bank earnings, it is best to look at full-year results as opposed to quarterly results. Goldman Sachs's (GS) annual ROE came in at a shockingly low 3.7% for 2011, down significantly from 11.9% the previous year. Before the financial crisis hit, Goldman's ROE was an industry-leading 32% in 2007 and 2006. But it wasn't just Goldman who sputtered. Morgan Stanley's (MS) ROE came in at 6% for the year, down from 7% in 2010. Morgan had a 9% ROE in 2007 and averaged an annual 20% ROE from 2000 to 2006. JP Morgan (JPM) fared a bit better with an ROE of 10.2% for the year, up slightly from the 9.7% it hit in 2010. But the firm is still below its pre-crisis ROE of around 13% in 2007.

Star dims for Goldman's youngest partner

All this means nothing unless it is put in context. For the level of risk and amount of capital these firms hold, single digit returns on equity is pretty lousy -- and the banks know it. Goldman promised earlier in the year that it would hit a respectable 20% ROE in 2011. But its executives quietly dropped that goal in May after it became clear that its trading division was having some troubles.

To be sure, ROE isn't the be-all-end-all metric that Wall Street lives by. There are dozens of other performance metrics that banking chieftains target, which are specific to the banking model. Nevertheless, ROE, while it has its flaws, is still a metric that investors and analysts like to see as it flattens out the sector, allowing them to compare it with other asset classes.

There were two major structural changes that took place in the industry in the aftermath of the crisis that shook the trading world. The first was that several of the major players in the space ceased to exist. The second was the string of regulatory changes that forced the banks to cut risk and maintain larger capital buffers. Goldman and Morgan became bank holding companies like rivals JP Morgan and Bank of America (BAC) and were therefore forced to scale back on their risk taking. Higher capital requirements meant less money to use for trading. Lower leverage levels meant lower returns on investments.

Despite the structural changes, the banks still maintain that they will be able to boost their returns on equity back up to double-digits, close to where they were before the crisis. Investors and analysts have been giving the banks the benefit of the doubt, but have since been sorely disappointed. The common view is that the employees at these firms are so smart, innovative and connected that they will find some way to get out of the mess they created, dodge the new regulatory constraints and eventually return to minting money.

But it's now looking as if that will never happen. Sure, the banks will make a profit, but gone are the days where it could make ROE's north of 30%. Stripping out the risky proprietary trading and ancillary investing silos, the banks' broker-dealer and retail banking businesses are pretty low margin.

What's the point of private equity?

For now, the banks are focusing on cutting spending to boost their ROE. They have largely been successful in cutting waste, but there is only so much they can cut without jeopardizing their business models. Going forward, the banks will need to either force their clients to pay more for the services they offer or cut employee compensation dramatically if they are serious about upping their ROE.

Getting customers to pay more for services seems to have been a bust so far on both the brokerage and retail banking ends. Compensation is the one area that the banks have direct control over. While the amount the banks pay their employees has fallen in real terms, it has not budged relative to the firm's overall revenues and in some cases, it's actually gone up. Goldman actually increased its compensation ratio this year to 42% from 39%, even though revenues at the firm were down by 26%.

Not to be upstaged, Morgan Stanley had the highest compensation ratio of the big banks at 51%, which is roughly where it was last year. Meanwhile, JP Morgan's investment bank had a compensation ratio that was significantly lower than that of Goldman or Morgan Stanley at just 34%. That might explain in part why JP Morgan's ROE was higher than that of both Goldman and Morgan Stanley, combined.

This year will be a critical turning point for the banks. They will need more than just a return to normal business conditions to boost their ROE -- they will need to raise fees and cut compensation aggressively. At the same time, investors and analysts need to rethink what it means to be a bank in the 21st century and be more realistic about the industry's ability to make money.

But it isn't all doom and gloom. While the banks probably won't report an ROE above 30% in the near future, they can still post some pretty strong profits if they roll with the times.

By Cyrus Sanati, contributor

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

Stocks get early boost from manufacturing data

NEW YORK (CNNMoney) -- U.S. stocks opened higher Wednesday, as investors welcomed stronger manufacturing data around the world.

The Dow Jones industrial average (INDU) was up 79 points, or 0.6%, shortly after the opening bell. The S&P 500 (SPX) gained 10 points, or 0.7%. The Nasdaq rose 19 points, or 0.7%.

Manufacturing activity picked up in China, Germany, France and the United Kingdom in January, according to separate reports. Investors will also closely watch a reading on U.S. manufacturing, the ISM Manufacturing Index, due later in the morning.

Meanwhile, the other big news Wednesday looks likely to be Facebook's long-awaited IPO filing. According to reports from outlets including the New York Times and CNBC, Facebook is seeking to raise up to $5 billion in its offering.

If that number is correct, Facebook would by far be the largest global IPO by an Internet-focused company, according to data from Dealogic. Some experts have suggested that the social network could be valued between $75 billion and $100 billion once it starts trading, which will likely happen a few months after its initial filing.

Europe: 4 things you need to know

Meanwhile, anxieties over Greece and its struggle to broker a debt-reduction deal with private-sector creditors continue to underpin sentiment.

U.S. stocks traded in a narrow range Tuesday, after worse-than-expected U.S. housing and manufacturing data tempered the modest enthusiasm over Europe's progress on a new pact aimed at promoting fiscal discipline.

World markets: European stocks posted solid gains in mid-day trading. Britain's FTSE 100 (UKX) added 1.3%, the DAX (DAX) in Germany gained 2% and France's CAC 40 (CAC40) rose 1.5%.

Asian markets ended most lower. The Shanghai Composite (SHCOMP) fell 1.1%, the Hang Seng (HSI) in Hong Kong dropped 0.3% and Japan's Nikkei (N225) was flat.

Economy: A report from payroll processor ADP showed that the private sector added 170,000 jobs in January. The report was expected to show that 200,000 jobs were added last month, according to a survey of analysts by Briefing.com, down from the revised gains of 292,000 the month prior.

The ISM Manufacturing Index for January is expected to stand at 54.5, up from 53.9 in December. Meanwhile, a report on December construction spending is expected to show an increase in 0.4%, versus the month prior.

Companies: NYSE Euronext (NYX, Fortune 500) announced early Wednesday that it will terminate its merger agreement with Deutsche Boerse. The proposed $10 billion takeover of the operator of the New York Stock Exchange would have created the world's largest exchange, but was quashed by European officials.

Pfizer (PFE, Fortune 500) is recalling 1 million packs of birth control pills, after the pharmaceutical giant discovered that some blister packs may contain an inexact count of inert or active ingredient tablets, and that the tablets may be out of sequence. Birth control pills typically have to be taken in sequence to be effective.

Is JC Penney the future of retail?

Shares of Tupperware (TUP) fell after the company reported earnings per share that fell 3 cents short of forecasts. Hershey's (HSY, Fortune 500) shares edged lower after the chocolate maker reported earnings and sales in line with estimates.

Whirlpool (WHR, Fortune 500) shares rose after the company beat Wall Street expectations on both earnings and revenue.

Broadcom's (BRCM, Fortune 500) stock also got a boost after the seminconductor firm reported slightly better results and issued a brighter outlook.

Two years after its bankruptcy and U.S. bailout, Chrysler Group posted 2011 net income of $183 million, its first annual profit since 2005. Although the company is no longer publicly traded, its results boosted shares of its competitors, General Motors (GM, Fortune 500) and Ford (F, Fortune 500).

Shares of online retailer Amazon (AMZN, Fortune 500) plunged after the company reported quarterly revenue late Tuesday that missed analysts' estimates. But the company beat profit expectations.

Currencies and commodities: The dollar fell against the euro, the Japanese yen and the British pound.

Oil for March delivery gained 24 cents to $98.72 a barrel.

Gold futures for April delivery rose $9.40 to $1,749.80 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 1.83% from 1.80% late Tuesday.

By CNNMoney staff @CNNMoneyMarkets

Europe's debt crisis: Where things stand

NEW YORK (CNNMoney) -- After wreaking havoc in global financial markets last year, the debt crisis in Europe has entered a complicated new phase in 2012.

There have been signs of progress in Italy and Spain, thanks to the efforts of new governments in both countries and aggressive moves by the European Central Bank.

But the outlook for Greece remains uncertain, with key issues surrounding additional bailout funds and a writedown of the nation's debts still unresolved.

And Portugal has come under pressure amid speculation that the bailed-out nation could be next on the default watch list if Greece negotiates a restructuring.

Greece's deep debt problem

Europe's debt problems started in Greece more than two years ago, and the situation there has yet to be fully resolved.

Greece is close to finalizing a deal with private sector creditors to write down a portion of the nation's overwhelming debt load, Prime Minister Lucas Papademos said Tuesday.

The agreement, which has been held up for weeks amid disagreements over how much of a loss investors will voluntarily accept, is a key condition for Greece to receive more bailout money.

Beyond the private sector talks, Greece is also negotiating the terms of a second bailout package with the EU, IMF and ECB. EU leaders agreed in October to a €130 billion rescue, but there are signs Greece may need up to €145 billion given its deteriorating economy.

Greece has struggled to meet the conditions of its bailout loans in the past and some euro area nations remain reluctant to provide more funds without assurances.

Germany, the richest eurozone economy, has proposed giving EU authorities veto power over Greek budget policies as a condition of more bailout money. Greece rejected the proposal as an infringement of national sovereignty, and other EU officials have ruled it out.

The risk is that Greece will miss a €14.5 billion bond redemption in March without more bailout money. That could lead to a disorderly default, a development that would have severe and unknowable consequences for the global financial system.

The lack of clarity on the debt reduction and bailout talks have raised calls for Greece's creditors in the "official sector" to provide some relief. The ECB, which holds an estimated €30 billion to €45 billion in Greek debt, is under pressure to forego profits on those bonds, as are individual euro area central banks.

Europe to S&P, Fitch: Who cares?

EU leaders on Monday called for a resolution to these issues "in the coming days" so that the private sector deal can be implemented by mid-February.

Meanwhile, investors have been growing worried that Portugal could be the next to face a default. Portugal's borrowing costs have spiked to record highs since the government's credit rating was cut to speculative grade by Standard & Poor's on Jan. 13.

New EU budget rules

EU leaders representing 25 members of the 27-nation group have agreed to sign a pact designed to increase fiscal discipline and strengthen political ties.

The terms of the pact include, among other things, a legally-binding balanced budget requirement with an "automatic correction mechanism," and a provision to make fiscal policies of individual governments subject to EU authority "ex ante," or before the fact.

Euro: Putting lipstick on the PIIGS

The 25 leaders hope to sign the pact at the next EU summit in March. But analysts say finalizing the new rules, which will require parliamentary approval in many cases, could take months if not years.

The goal is to help prevent a future crisis by ensuring that governments do not spend beyond their means and rack up unsustainable debts.

The pact represents a step toward a so-called fiscal union, which economists say is necessary for the long-term stability of the euro currency. But critics say the agreement does not address the immediate challenges in the eurozone.

A stronger bailout firewall

To deal with the immediate challenges, EU leaders backed a plan this week to implement the European Stability Mechanism in July.

The €500 billion ESM, which was originally set to come into force next year, is a permanent bailout fund for euro area governments. It will replace the temporary European Financial Stability Facility, which is effectively maxed out and set to be phased out next year.

EU leaders expect finance ministers to make the plan official at the next Eurogroup meeting in February.

The aim is to restore confidence in global financial markets about the financing of troubled member states such as Italy and Spain.

Borrowing costs for Italy and Spain have come down and both nations have enjoyed solid demand for short-term bonds this year. The improvement in Italian and Spanish bond markets coincided with aggressive moves by the European Central Bank, which poured nearly €500 billion into the banking system in December.

Can 'Super Mario' save Europe and America?

The ECB has also relaxed its collateral requirements and is set to offer more long-term loans in February, when banks are expected to borrow up to €1 trillion.

The unprecedented lending program is designed to prevent a deeper credit crunch in the banking system. Many European banks have struggled to secure funding from private sources amid concerns about their exposure to bad sovereign debt.

But analysts say the ECB's lending program may also be supporting demand for government bonds.

Europe's shaky economy

The latest phase of the debt crisis is playing out against a backdrop of declining economic activity across the eurozone.

The IMF expects the 17-nation region to suffer a mild recession this year as government cutbacks take a toll on growth. The dour outlook sets up a difficult balancing act for officials as they struggle to revive growth and reduce debt at the same time.

After Davos: Making the case for global optimism

EU officials have proposed measures to boost employment, support spending on infrastructure projects and help small businesses grow. But most governments have little room in their budgets to stimulate economic activity.

Economists say the weak economic backdrop raises the risk that a policy "accident" could drive another bout of volatility in financial markets.

The unemployment rate among young people in the eurozone stands at 22% in December, according to data published Tuesday by EU statisticians.

In crisis-hit Greece, youth unemployment is a whopping 47%, while nearly 49% of young people in Spain are out of work.

The exceptionally high levels of youth unemployment have raised concerns that additional austerity measures could give rise to social unrest.

By Ben Rooney @CNNMoneyMarkets

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

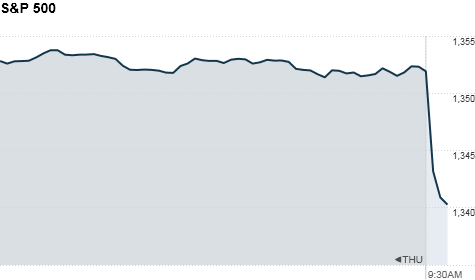

Stocks slide on new Greek worries

NEW YORK (CNN Money) -- U.S. stocks dropped Friday, as investors grew concerned about the latest obstacle in Greece's ongoing debt saga.

The Dow Jones industrial average (INDU) moved down 100 points, or 0.8%. The S&P 500 (SPX) fell 11 points, or 0.8%. The Nasdaq (COMP) shed 20 points, or 0.7%.

"There's an increase in the level of agita in the markets, because the Greek deal isn't done," said Guy LeBas, chief fixed income strategist at Janney Capital Markets. "The tone of the market has turned fairly negative."

The fresh bout of worries over Greece came after eurozone finance ministers called the new Greek austerity deal into question, saying it does not go far enough.

The finance ministers said they would need to see more spending cuts before signing off on a new €130 billion bailout, which is key to the debt-laden country making its payment on a €14.5 billion bond redemption next month and avoiding default.

"Despite the important progress achieved over the last days, we did not yet have all necessary elements on the table to take decisions today," said Jean-Claude Juncker, the prime minister of Luxembourg and head of the Eurogroup.

Specifically, Juncker said the reform package needs to be approved by the Greek parliament this weekend, and Greece's leaders need to pledge they'll continue to implement the measures after elections in April. He also said that Greece must cut an additional €325 million from its "structural expenditures" in 2012.

Greece: One step forward, two steps back

If Greece meets those conditions, a bailout package could be signed as early as next week, when eurozone finance ministers are due to meet again.

Meanwhile, Greece is also working to finalize a deal with its private-sector creditors to write down a portion of its debt.

U.S. stocks posted slim gains Thursday, as investors breathed a sigh of relief after Greek political parties struck a deal on the austerity measures.

World markets: European stocks were lower in afternoon trading. Britain's FTSE 100 (UKX) slipped 0.8%, the DAX (DAX) in Germany dropped 1.8% and France's CAC 40 (CAC40) fell 1.2%.

Asian markets ended mixed. The Shanghai Composite (SHCOMP) added 0.1%, while the Hang Seng (HSI) in Hong Kong shed 1.1% and Japan's Nikkei (N225) fell 0.6%.

China's trade surplus expanded in January as imports slumped 15%, sparking questions over the sustainability of China's rapid economic growth.

Economy: The December trade deficit for the U.S. expanded to $48.8 billion, from $47.1 billion the prior month.

A report on consumer sentiment is due later in the morning. In the afternoon, the Treasury Department's budget report for January will be released.

The February edition of the Michigan Consumer Sentiment Index is expected to come in at 74, down from 75 last month, while the January Treasury budget report is expected to show a deficit of $40 billion.

Companies: Alcatel-Lucent (ALU) shares spiked 14%, after the telecom equipment maker posted an annual profit for 2011 -- its first since Alcatel and Lucent merged in 2006.

LinkedIn (LNKD) shares jumped almost 9% Friday, a day after the professional networking site's fourth-quarter profit surged 30% and revenue more than doubled.

Barclays (BCS) shares moved up nearly 3%. The London-based bank posted an unexpected loss for the fourth quarter, but it also cut its its bonus pool by 25%. For employees at the investment bank, Barclays Capital, bonuses fell by almost a third and are capped at £65,000.

Shares of Activision Blizzard (ATVI), maker of World of Warcraft and Call of Duty, slipped 0.5% even after the game maker beat fourth-quarter profit and sales estimates.

Currencies and commodities: The dollar rose against the euro, the British pound and the Japanese yen.

Oil for March delivery slipped $1.94 to $97.90 a barrel.

Gold futures for April delivery fell $26.70 to $1,712.30 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 1.98% from 2.05% late Thursday.

By CNN Money staff @CNNMoneyMarkets

-- CNN's Elinda Labropoulou and Per Nyberg contributed to this report.

Broken budget process hurts Wall Street reform

NEW YORK (CNNMoney) -- President Obama is likely to propose a substantial funding increase for Wall Street regulators in his forthcoming budget.

But there won't be any cheering in the boardrooms and hallways of the Securities and Exchange Commission and the Commodity Futures Trading Commission.

That's because Congress will probably bypass the president's recommendation and instead set funding for the CFTC and SEC at a much lower level.

The agencies have been caught in an epic struggle over the implementation of the Dodd-Frank Wall Street reform bill, a conflict that has pitted the White House and congressional Democrats against Republican opponents.

Asked by Congress to increase regulation of Wall Street firms and the murky, multi-trillion dollar derivatives market after the financial crisis of 2008, the agencies say they need additional funding to beef up their staffs, technology and expertise.

But House Republicans have consistently voted to deny the SEC and CFTC that funding.

"It is a backdoor way of trying to starve the agency on the line," said Bart Chilton, a Democrat and one of five CFTC commissioners. "The people who don't want to fund us are the same sort of people who voted against Dodd-Frank to begin with."

The blending of political and budgeting priorities has made effective regulation near-impossible, and the bitter fight has become emblematic of a herky-jerky budgeting process that has defined appropriations during the Obama era.

Opponents say the SEC doesn't deserve any additional funding without significant reform, and point to a series of failures, including the Bernie Madoff Ponzi scheme, as evidence. They also say the agency does not pay enough attention to the cost of the regulations and rules it produces.

"Before we even think about giving this agency yet another funding increase, at minimum, the agency will need to show major progress in implementing recommended reforms," Republican Rep. Scott Garrett, who chairs the subcommittee that oversees the agency, said at a recent hearing.

Politics is also a factor. The Wall Street reform law is one of Obama's signature policy victories, and Republicans have not exactly been coy about their desire to slow down its implementation.

"You have the SEC begging for more money, a lot more money, and only receiving a little more," said Bruce Carton, a former attorney with the SEC's Division of Enforcement who now edits a website called Securities Docket. "This is where they find themselves every year."

There is a lot on the line.

"If the SEC does not receive additional resources, many of the issues highlighted by the financial crisis and which the Dodd-Frank Act seeks to fix will not be adequately addressed," SEC Chairman Mary Schapiro said in a December plea for more funds.

Because the agency's budget is funded by transaction fees levied on the firms it regulates, increasing its budget would come at no cost to taxpayers.

Dodd-Frank, the law the agency is struggling to implement, suggested funding levels for the SEC of $1.3 billion in 2011 and $1.5 billion in 2012. But the agency was actually funded at around $1.1 billion in 2011. In December it received a bump to $1.3 billion for 2012 from Congress.

Washington's budget follies

Meanwhile, the SEC says trading volume in the securities markets has more than doubled over the past decade, and the agency has just about the same number of "cops on the beat" as it did in 2005, despite "enormous growth in the size and complexity of the securities markets since then."

James Cox, a professor of corporate and securities law at Duke University, said the games being played with the SEC budget amount to a "kind of kabuki dance."

"These are complex enterprises, and you have to pay for experience," Cox said. "It's pretty simple. If you don't pay for much regulation, you don't get much regulation."

The story is much the same at the CFTC, where budgets have increased from $168 million in 2010 to $202 million in 2011. Late last year, the agency's funding for 2012 was finalized at $205 million, far below the Obama administration's request of $308 million.

"This means we won't do things," CFTC chairman Gary Gensler told Congress. "We won't have the people to oversee the market."

The CFTC is working to finish a regulatory framework that will allow it to police the massive over-the-counter derivatives market, which some experts estimate has ballooned to $700 trillion in size.

The 2012 tax and spending wars

"We can put the rules in place," Chilton said. "The question is can we oversee what we've put in place, and the answer to that is emphatically no."

The fight over funding at agencies tasked with regulating financial markets has played out against a backdrop of seemingly endless short-term budget measures called continuing resolutions.

In 2011, lawmakers passed seven continuing resolutions, a tactic that resulted in more than one close call with potential government shutdowns. The debate over funding levels also became entangled with the debt ceiling drama and subsequent super committee disaster.

The budget punt strategy has implications for effective governance. Continuing resolutions generally freeze spending at the prior year's levels. That forces federal agencies into a head snapping game of stop-and-go. Hiring is delayed, work is repeated, and agencies struggle to implement new legislation.

So try as the White House might, Monday's budget release won't mean too much. Ultimately, Congress has the responsibility to appropriate funds for the government to spend.

"The president's budget is one of the loudest policy announcements he can make," said Craig Jennings, a budget expert at the progressive think tank OMB Watch. "But he doesn't always get everything he wants."

By Charles Riley @CNNMoney

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

Stocks inch higher after consumer confidence

NEW YORK (CNNMoney) -- U.S. stocks inched higher early Tuesday, as investors weighed a small pullback in oil prices and improving consumer confidence against a worse-than-expected drop in durable goods orders.

After starting out mixed, the Dow Jones industrial average (INDU) added 11 points, or 0.1%, and the S&P 500 (SPX) added 2 points, or 0.2%. The Nasdaq (COMP) rose 14 points, or 0.5%.

Investors have been keeping a close watch on the oil market, where crude futures rose almost 9% in seven consecutive days, settling at a nine-month high above $109 a barrel Friday, amid concerns about increased tensions between Iran and Western powers.

The rise in oil prices has translated into higher gas prices, with the national average rising 21 straight days.

But crude futures eased for a second straight day Tuesday, easing worries that higher gas prices could cause the economic recovery to stall if consumers change their spending habits.

Investors were also impressed by a big spike in consumer sentiment in February, with the index now at a 1-year high.

However, the gains were limited as investors were disappointed by a 4% plunge in durable goods orders, the biggest drop in three years.

"Unquestionably, it (the durables orders) looks bad, but the context is important," noted Ian Shepherdson, chief U.S. economist at High Frequency Economics. "We see no evidence of underlying slowing in the industrial economy, so we look for a rebound in February and the re-emergence of the upward trend over the next couple of months."

On Monday, U.S. stocks ended little changed, as investors weighed an upbeat housing report against worries about the debt crisis in Europe and rising gas prices.

World markets: European stocks turned lower in afternoon trading. Britain's FTSE 100 (UKX) ticked down 0.2%, the DAX (DAX) in Germany fell 0.5% and France's CAC 40 (CAC40) dropped 0.3%.

Investors will also continue to watch for developments out of Europe, amid ongoing nervousness about the region's debt crisis.

On Monday, the German Parliament approved the nation's contribution to a second bailout for Greece. Later in the day, S&P downgraded Greece's credit rating to "selective default" after the government took legal steps to impose losses on all holders of Greek government bonds.

Investors are growing optimistic ahead of the European Central Bank's second so-called long-term refinancing operation (LTRO) on Wednesday. The central bank will hold its second auction to allow banks to take three-year loans at low interest rates, bolstering their balance sheets.

In its first auction in December, banks borrowed €489 billion from the ECB. The "flood of money" sparked a rally in stock markets, noted Global Forex Trading's Kathy Lien, and she says this round of stimulus could also be a boon for stocks.

Most analysts are expecting the size of the ECB's refinancing stimulus to be even larger on Wednesday, with a high estimate of €1 trillion.

Asian markets ended with solid gains. The Shanghai Composite (SHCOMP) closed up 0.2%, the Hang Seng (HSI) in Hong Kong spiked 1.7% and Japan's Nikkei (N225) increased 0.9%.

Economy: Durable goods orders tumbled 4% in January, following a 3.2% increase the month before. Analysts were expecting that orders slipped 1.3% during the month.

The Conference Board's consumer confidence index rose in February to the highest level in a year. The index climbed to 70.8 from 61.5 in January. Economists were expecting the index to rise slightly to 63.5.

National home prices fell 4% in the fourth quarter of 2011, putting them back at levels last seen in mid-2002, according to the S&P/Case-Shiller national home price index. That's the fifth consecutive annual loss and the biggest decline since 2008, when markets were in freefall and prices plummeted more than 18%.

Why JPMorgan Chase has become a Wall Street laggard

Companies: Shares of AutoZone (AZO, Fortune 500) rose Tuesday, after the auto parts retailer's fourth-quarter earnings and sales figures rose and topped analyst expectations. Same-store sales at Autozone improved almost 6% during the last quarter of 2011.

Shares of Apollo Group (APOL, Fortune 500) tumbled after the operator of for-profit University of Phoenix issued a downbeat outlook for 2012, forecasting sluggish growth in new degree enrollment during the second quarter. Shares of fellow for-profit college DeVry (DV) also fell.

Cablevision (CVC, Fortune 500) posted earning that were a penny shy of expectations, but sales that were a bit higher than estimates. Shares of the cable provider were flat.

Priceline.com (PCLN) shares spiked after the online travel company beat earnings and revenue expectations late Monday, thanks to strong growth in international hotel bookings.

Dreamworks Animation (DWA) is slated to report corporate results after the bell Tuesday. Dreamworks is expected to post earnings of 32 cents per share.

Currencies and commodities: The dollar fell against the euro, the British pound and the Japanese yen.

Gas prices steady climb

Oil for April delivery slipped 43 cents to $108.13 a barrel.

Gold futures for April delivery rose $7.70 to $1,782.60 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 1.91% from 1.92% late Monday.

By CNNMoney staff @CNNMoneyMarkets

Gas prices climb for 21st day

NEW YORK (CNNMoney) -- Gas prices continued to climb on Tuesday, inching closer to $4 a gallon as they rose for the 21st day in a row.

The nationwide average rose to $3.72 a gallon, up 2 cents from a day earlier, according to the motorist group AAA.

Only a month ago, the nationwide average was $3.42 a gallon.

Gas prices are up 13.3% so far in 2012. The average price is down 40 cents, or about 9.7%, from the record high of $4.11 reported on July 17, 2008.

Average prices for regular gasoline are more than $4 a gallon in California, Alaska and Hawaii. Gas prices are just shy of the $4 mark in New York, Connecticut, and Washington, D.C., according to AAA. The lowest average gas prices are in Wyoming and Colorado, where a gallon is going for less than $3.20.

Gas prices have been rising on the back of soaring oil prices, which have surged 10% over the past month amid fears that tensions with Iran will lead to an all-out war that causes a disruption in oil supplies.

Signs of an improving economy have also been boosting oil prices, along with the stock market, which has seen the S&P 500 (SPX) rise by more than 8% in 2012.

On Monday, TransCanada (TRP) announced that it will move forward with parts of the Keystone XL pipeline, which will boost the flow of crude oil from the oil sands of Canada to the Gulf Coast. While the White House denied a more controversial proposal earlier this year, this portion does not require federal approval and is expected to be operational in 2013.

As gas prices soar, Republican candidates are looking to tie Obama's policies to the increase.

On Monday, Rick Santorum blamed the president for blocking the expansion of domestic energy production. Santorum also argued that high gas prices were to blame for the 2008 housing meltdown and ensuing economic slump.

By CNNMoney staff @CNNMoneyMarkets

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

Stocks rise after strong jobs report

NEW YORK (CNNMoney) -- A slightly better-than-expected jobs report and positive news out of Greece lifted stocks for a third straight day on Friday.

The Dow Jones industrial average (INDU) added 31 points, or 0.2%, the S&P 500 (SPX) gained 4 points, or 0.3%, and the Nasdaq (COMP) increased 8 points, or 0.3%.

The jobs report showed that the U.S. economy added 227,000 jobs in February, and the unemployment rate remained unchanged at 8.3%. That's down from January, when employers added 243,000 jobs.

A CNNMoney survey of 19 economists had predicted that the economy added 210,000 jobs in February, with an 8.3% unemployment rate.