:: ::  |

| Autor |

Poruka |

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

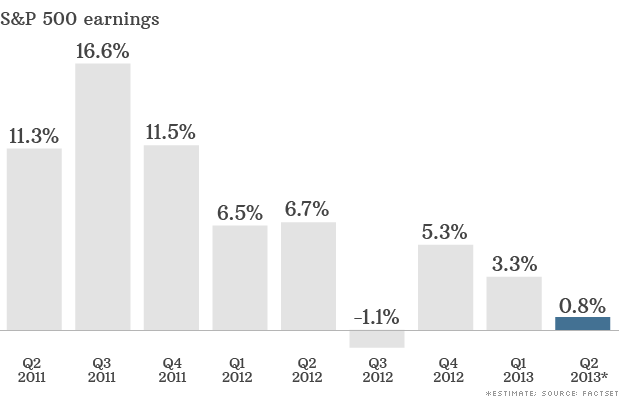

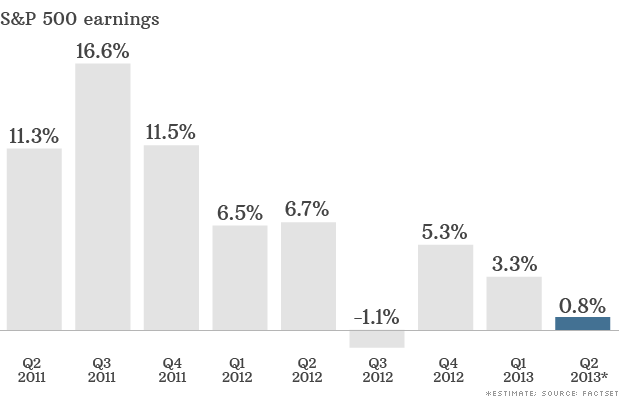

The bull market's profit problem

When companies begin reporting second-quarter results this week, investors will look for signs that profits can keep the bull market going once the Federal Reserve steps aside.

The prognosis is not good. Companies in the S&P 500 are expected to report overall earnings growth of less than 1%, according to FactSet.

Exclude the financial services industry, with projected profit growth of 17%, FactSet is forecasting an overall earnings decline of 2.4%.

In another troubling sign, a record number of companies have already issued negative guidance for the quarter.

Out of the 108 companies that have released forecasts, 87 have projected earnings below consensus estimates, according to FactSet. That's the highest number since the data provider started keeping records in 2006.

Related: Investors dumping bonds

Alcoa (AA, Fortune 500) gets the ball rolling Monday. The aluminum producer is expected to report a profit, but revenue is projected to fall 1%, according to analysts polled by Thomson Reuters.

Revenue growth is expected to be weak for other companies too.

After a tepid 1.1% rise in the first quarter, sales for S&P 500 companies are expected to fall 0.3% in the second quarter, according to S&P Capital IQ.

That would mark the first time revenue fell for the group since the second quarter of 2009, when sales dropped nearly 12%, said Christine Short, a senior manager at the firm.

The expected decline is almost entirely due to a 15% revenue drop for companies in the energy sector. Makers of consumer staples, meanwhile, are expected to report revenue growth of 13%.

The mixed outlook for corporate results adds another layer of complexity for investors as they grapple with ongoing concerns about the Federal Reserve's stimulus policies.

That will make it harder to ignore the weakness in revenue growth, said Quincy Krosby, market strategist at Prudential Financial.

She said investors have been willing to overlook sluggish revenue growth as long as they believed the Fed would continue to support the economy. But that may no longer be the case now that the Fed has signaled it could slow the pace of its $85 billion-per-month bond buying program this year.

"Companies are doing a very good job of managing the bottom line, but investors want to see where future demand is coming from," said Krosby.

Related: Big winners on Wall Street are yesterday's dogs

Ideally, that future demand will come from a stronger U.S. economy, but that's still an open question.

While growth in the first quarter was weaker than previously estimated, investors have been encouraged by more recent reports on durable goods orders, home sales and consumer confidence.

"The market can probably handle some disappointing earnings news as long as macro backdrop is improving," said Brent Schutte, market strategist at BMO Private Bank.

By Ben Rooney @CNNMoneyInvest

Dow posts triple-digit gain

Stocks jumped higher Monday, as investors bet that corporate earnings could help stocks prolong the 2013 market rally.

Second quarter earnings season kicks off after the close of trading with results from aluminum producer Alcoa (AA, Fortune 500) -- a Dow Jones Industrial Average component, whose earnings investors watch as a first-look indicator of how companies fared in the past quarter.

The Dow, the S&P 500 and the Nasdaq moved up between 0.5% and 0.8%. The Dow gained more than 100 points.

Still, analysts aren't as sanguine about the prospects for growth and higher profits in corporate America.

Click here for more on stocks, bonds, currencies and commodities

"Sales have got to start coming through," said fund manager Fiona Harris from J.P. Morgan Asset Management. "We believe the relatively sluggish U.S. sales growth could start to weigh heavily if we don't see improvement soon."

Fed taper puts earnings in focus: Earnings are starting to matter more now to the stock market, as many investors and analysts expect the Fed to taper its bond buying program by year-end.

The Fed's bond buying has been the major catalyst for a stock market rally this year. All three indexes are up between 14% and 16% in 2013.

Earnings bonanza: Results are due later in the week from companies including Yum! Brands (YUM, Fortune 500), JPMorgan (JPM, Fortune 500) and Wells Fargo (WFC, Fortune 500).

Related: Fear & Greed Index shows investors still fearful

In economic news, the Federal Reserve is set to release its monthly report on consumer credit at 3 p.m. ET.

According to Kit Juckes of Societe Generale in London, among the issues standing out for global investors in the week ahead are a speech by Federal Reserve chairman Ben Bernanke's on Wednesday, a possible "Scotch tape solution" to Portugal's economic crisis and concerns about the slowdown in China's economy.

U.S. stocks finished higher Friday following a strong monthly jobs report. Investors seemed to set aside concerns about the Federal Reserve and focused on the improved outlook for economic growth.

European markets made strong advances in afternoon trading., gaining between 1.3% and 2.3%.

Related: Citadel computers run the stock market

But Asian markets ended in the red. The Hang Seng index and the Nikkei in Japan both dropped by more than 1%. The Shanghai Composite index fell even further, down by 2.4%, on continuing concerns about slowing growth in China.

Shares of Asiana Airlines dropped in South Korean markets after a Boeing 777 crashed in San Francisco over the weekend. But the stock price for Boeing (BA, Fortune 500) was little changed.

By Maureen Farrell @CNNMoneyInvest

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

Here's your unemployment check. Now pay it back

Thousands of furloughed federal employees filed for state unemployment benefits during the weeks they were stranded without a paycheck.

But now that Congress has approved back pay for them, the states want that money back.

Data released by the Labor Department early Thursday, show 70,000 federal employees filed for unemployment the first week of the government shutdown.

According to separate data obtained by CNNMoney, federal workers filed a total of 20,000 claims in Maryland, 16,000 claims in Washington D.C., 7,600 claims in Pennsylvania and around 6,000 in Virginia during the entire 16-day shutdown. Even though the shutdown has ended, more claims could still be processed in the next few days.

Related: Furloughed workers face unemployment claim mess

It's unclear just how much money was overpaid.

In Washington DC, 1,700 payments went out, totaling around $500,000. The DC Department of Employment Services had thousands more payments in the pipeline but has since instructed the bank to cancel the transactions.

The agency is also in the process of informing recipients of the repayment process.

"If they have not actually taken any money out, we will then send them a notice and reverse the payment," said Lisa Mallory, director of the agency. "If they have accessed the funds already, we will tell them the amount that needs to be repaid."

Those who already used the benefits will have 60 days to repay the DES, without interest. Workers who are in financial hardship can also apply to be part of a longer repayment plan.

If all else fails, the agency also has the authority to garnish federal workers' wages.

Some states were able to avoid the overpayment problem through sheer luck and good timing.

Pennsylvania usually has a waiting period before it sends out unemployment benefits, and in this case, funds were approved but weren't set to be dispersed until October 25. Now that the shutdown has ended, the state won't pay out the claims to federal workers.

"We think we did it just right. And because the shutdown ended, we have no overpayments due," said Sara Goulet, press secretary for the Pennsylvania Department of Labor and Industry.

The Virginia Employment Commission also said its payouts were minimal due to good timing.

This isn't the first time furloughed workers had to return their unemployment checks. During the government shutdown in 1995 and 1996, state agencies also tried to recoup the overpaid funds.

By Annalyn Kurtz @AnnalynKurtz

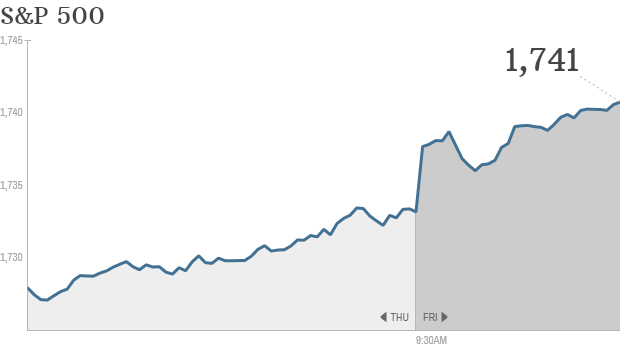

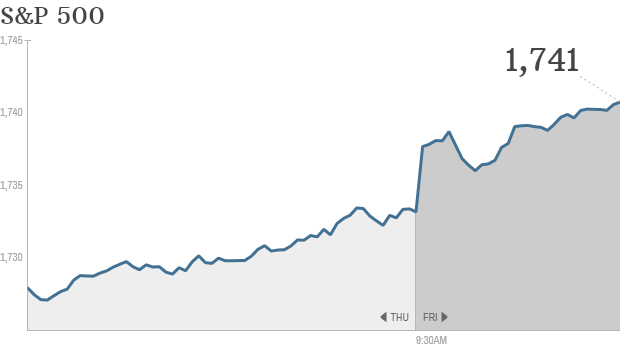

S&P 500 marches on to another new high

The rally continues -- at least for the S&P and Nasdaq.

One day after the S&P 500 hit a new record high, those indexes continued to climb higher. The S&P 500 and the Nasdaq gained between 0.3% and 0.9% in early trading Friday. The Nasdaq was helped by a surge in shares of Google, which topped $1,000 for the first time.

The Dow Jones industrial average dipped slightly.

Now that investors don't have to worry about the United States defaulting on its debt for at least a few months, they're turning their attention to the broader economy and corporate earnings.

Investors mostly like what they see.

Related: World still (reluctantly) loves the dollar

China's economic growth also offered some reason for optimism. China's economy grew 7.8% during the third quarter, the strongest performance since the end of last year.

Economists are becoming less worried that China's growth trajectory will slow down dramatically. The news from China helped send world markets higher, with shares in Hong Kong gaining more than 1%.

Google $1000: Google (GOOG, Fortune 500) shares soared 13% to a record high after the online search giant reported quarterly earnings and sales that beat expectations.

Shares of Mexican fast food chain Chipotle (CMG) also surged to an all-time high thanks to strong earnings.

The last of the big banks to report third quarter earnings, Morgan Stanley (MS, Fortune 500), wowed investors with earnings and revenue that topped forecasts.

General Electric (GE, Fortune 500) shares rose more than 2% after the bank reported better-than-expected earnings.

Related: Fear & Greed Index shifts from fear to neutral

Beyond earnings, British bank HSBC (HBC) said it will appeal after being ordered to pay at least $2.5 billion in damages after losing a U.S. class action case against Household International, a mortgage and credit card company that it bought in 2002.

By CNNMoney Staff @CNNMoneyInvest

|

|

|

| |

|

|

anchi22

•• 20:01 ••

|

Datum registracije: 09 Jul 2008

Poruke: 53463

|

|

Long-term unemployed still face dim job prospects

Friday morning could bring more good news about the economy when the Labor Department releases its latest monthly jobs report.

Economists surveyed by CNNMoney predict the report will show 193,000 jobs were added in December, consistent with a story of solid hiring in the last four months of 2013. The unemployment rate is expected to remain at 7% as some workers rejoin the labor force.

And on Wednesday, payroll processor ADP (ADP) announced that 238,00 jobs were added to the private sector last month. That was more than expected and an increase from November.

In short, economists seem convinced that the jobs recovery has gained momentum, but there's still a major problem. Employers are favoring the newly unemployed, and leaving behind the Americans who have been out of work for longer periods of time.

Take a look at the "typical" unemployed person (if there is such a thing). According to the latest data, it takes this person 17 weeks -- or about 4 months -- to either find a job, or stop looking for one. That's the median duration of unemployment, and it's more than double what it was before the recession began.

http://cnnmoneytalkback.files.wordpress.com/2014/01/chart-weeks-unemployed.png?w=620&h=332

But what about those workers who take much longer than the median?

About 37% of the unemployed have been out of work for 27 weeks or more (that's about 7 months!), and their job prospects look increasingly dim.

According to calculations from the Council of Economic Advisers, a person who has been unemployed for five weeks or less, has a 31% chance of getting a job. Once they've been unemployed between 27 and 52 weeks though, those odds drop to 12%.

What happens once you're unemployed for more than a year? The odds drop to just 9%.

http://cnnmoneytalkback.files.wordpress.com/2014/01/chart-odds-job31.jpg?w=614&h=329

There are 4 million Americans in this unfortunate situation. They've already been unemployed for 27 weeks, and the odds of getting a job just keep dropping. Who are they?

About 34% of them are men considered to be in the prime working ages of 25 to 54, and another 29% are women of that age.

About 18% are young workers under age 25, and 15% are workers on the cusp of the traditional retirement age, between 55 to 64 years old.

The remaining 4% are people who are 65 years or older, but would still like to work.

"I just want everybody to understand – this is not an abstraction. These are not statistics," President Obama said Tuesday, as he pushed for Congress to extend federal unemployment benefits. "These are your neighbors, your friends, your family members. It could at some point be any of us."

http://cnnmoneytalkback.files.wordpress.com/2014/01/chart-long-term-unemployed21.jpg?w=614&h=333

By Annalyn Kurtz

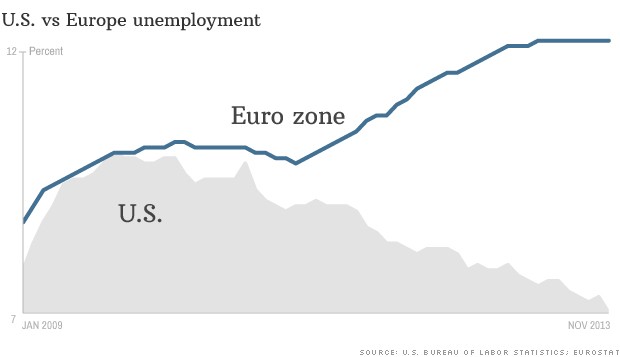

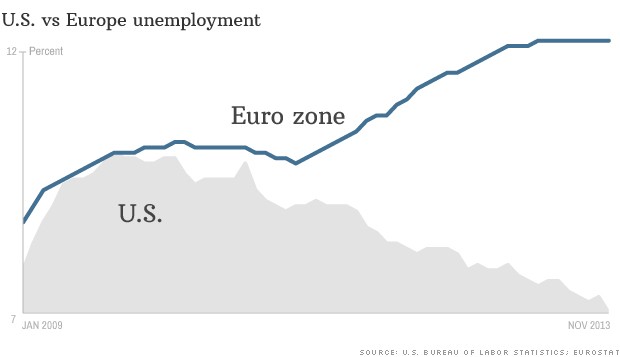

Euro zone unemployment at 12%, while U.S. improving

New reports out of the U.S. and Europe Wednesday show a stark divergence between unemployment trends in America and the euro zone.

Unemployment in the the 17-member euro zone region was stuck at 12.1% in November, according to the latest Eurostat figures -- it hasn't budged from this level since April.

Meanwhile, U.S. unemployment has been slowly and steadily declining, with unemployment at 7% in the same month.

On Wednesday, payroll processor ADP reported the U.S. added 238,000 private-sector jobs in December, a significant jump that points to continued improvement in the nation's job market.

Related: 2013 ended with strong job gains in the U.S.

Europe is still struggling to recover from a financial crisis and sovereign debt debacle that caused unemployment to surge and consumer confidence to plummet.

While the picture is mixed -- with Germany's economy remaining buoyant -- other nations such as France and Spain are still riddled with economic problems.

In Italy, the latest unemployment rate of 12.7% is the highest since record-keeping began in 1977.

Related: Want to keep your job? Rent, don't buy!

But there's growing hope in other European countries that the worst is behind them.

Ireland recently emerged from its bailout program, providing a rare piece of good news for European policymakers.

In the U.K., unemployment is declining and the economy has been rebounding. After teetering on the brink of a triple-dip recession earlier in 2013, a surge in consumer spending and rising house prices led to a dramatic turnaround.

By Alanna Petroff

|

|

|

| |

|

|

|

|

Vi ne možete otvarati nove teme u ovom forumu

Vi ne možete odgovarati na teme u ovom forumu

Vi ne možete menjati Vaše poruke u ovom forumu

Vi ne možete brisati Vaše poruke u ovom forumu

Vi ne možete glasati u anketama u ovom forumu

Vi ne možete postavljati fajlove u ovom forumu

Vi ne možete preuzeti fajlove sa ovog foruma

|

|